-

Planning to tweet a few papers from the FRA conference in Las Vegas, starting now. #FRA2019

-

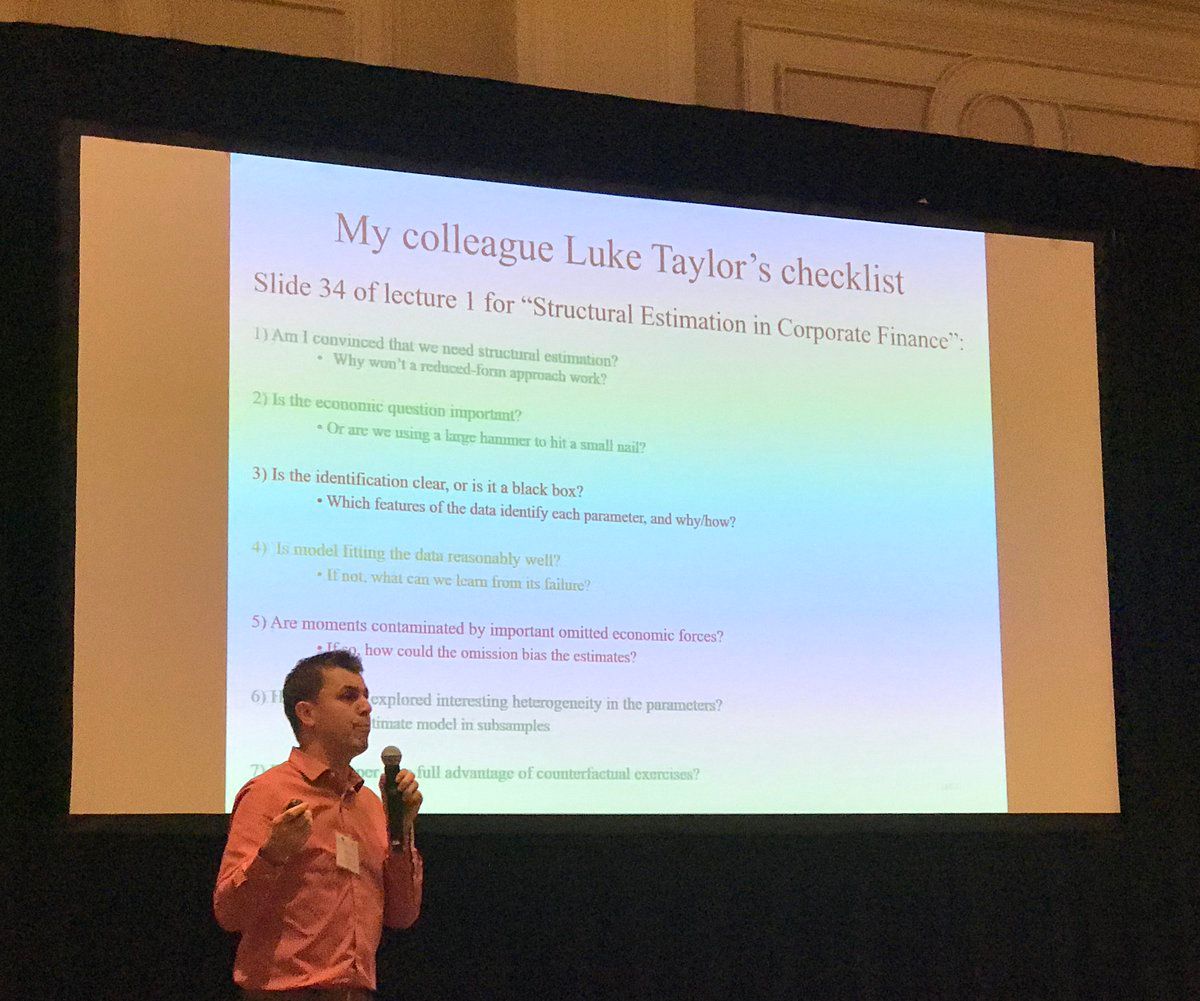

First up: Vincent Glode discussing “Venture Capital Contracts” by Ewens @startupecon, Gorbenko, and Korteweg. Structural model of search and matching between investors and entrepreneurs, negotiating endogeneous contracts. Calibrate w new, big(gest) VC contract dataset. #FRA2019

-

Func. form assumptions on firm value (incl. multiplicative separability between value driven by [1] investor and entrepreneur characteristics and [2] contract terms). Estimation focused on VC equity share, participation rights, pay-to-play provisions, and board seats. #FRA2019

-

BTW, may want to mute me for ~36 hours if financial economics conference livetweeting isn’t your jam. Sorry! #FRA2019

-

Estimated parameters imply contract that maximizes firm value features: - 16% equity share for VC - no participation rights - a pay-to-play provision - no board representation ※ Typical contract doesn’t really look quite like this. 🤔 #FRA2019

-

Gorobenko (author): [my paraphrase] ~ ”We don’t think of this as full-blown structural model, more like a fancy Heckman-like selection model.” Directed search partly captured by a correlation coefficient in model (?). Working on some other suggested extensions. #FRA2019

-

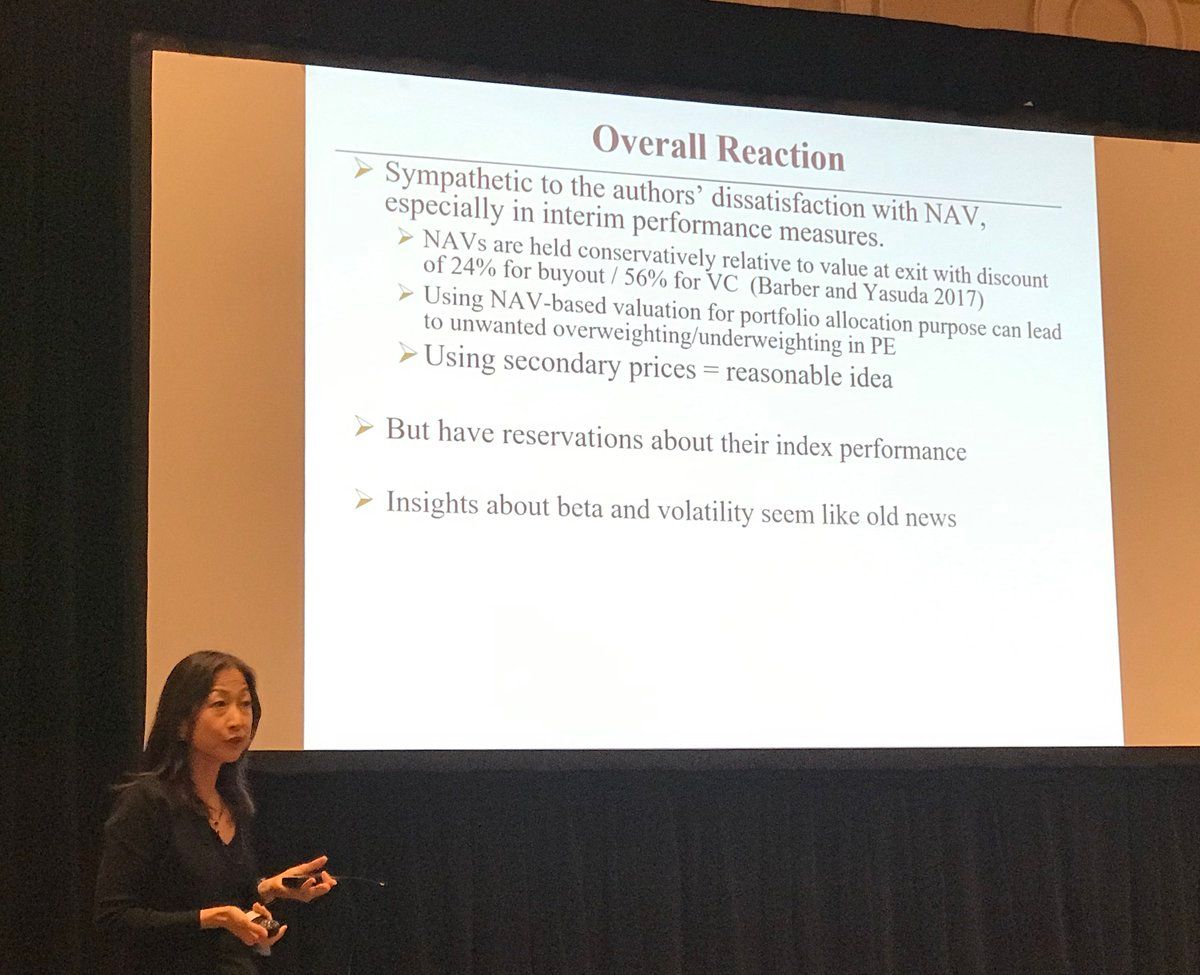

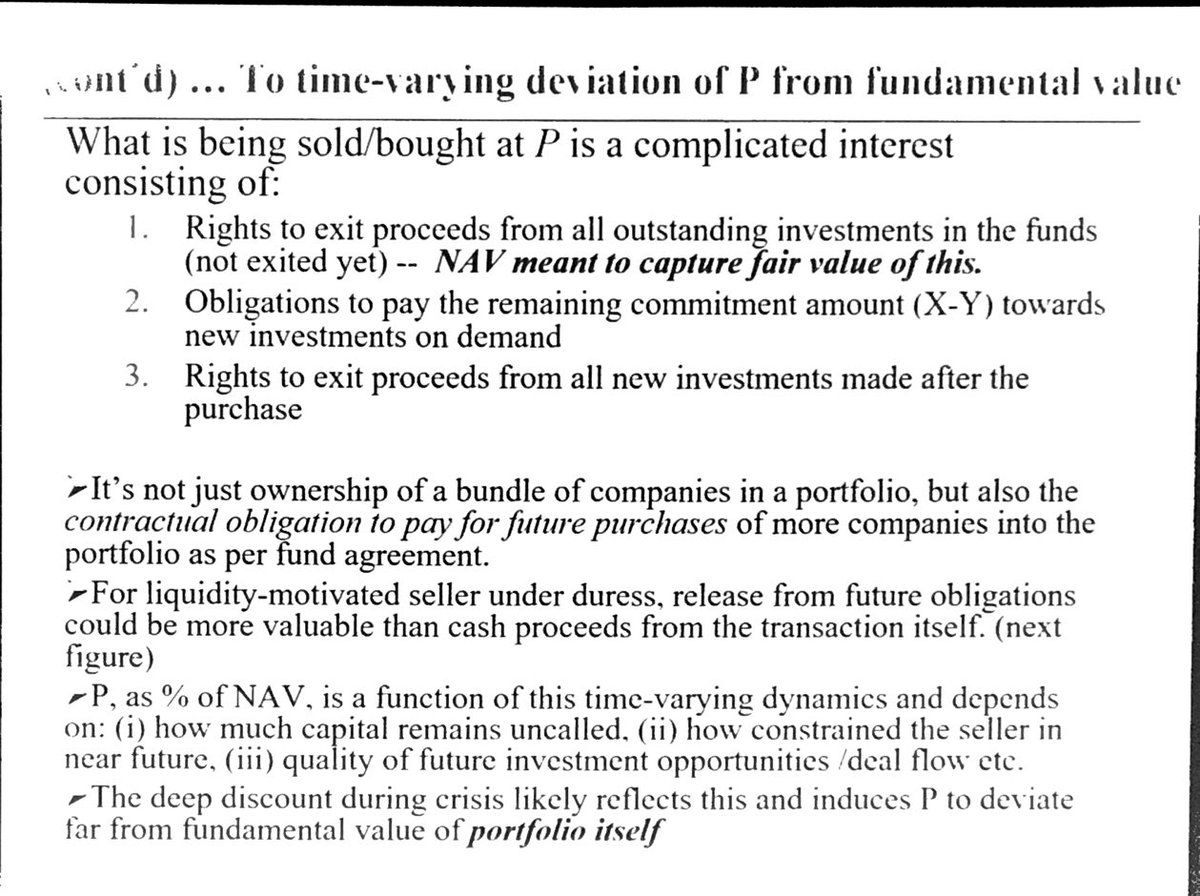

Next up: Ayako Yasuda on “Private Equity Indices Based on Secondary Market Transactions” (Boyer, Ndauld, Vorkink, Weisbach) Secondary PE part of broader phenomenon incl. - Fewer IPOs - Companies going private - MF/HF putting more money into PE #FRA2019

-

Authors build PE return index using observed secondary market prices of PE interests 2006–2017. Extrapolates price of not-for-sale stakes usig Heckman selection “hedonic” model with economy and fund chars as controls. [N.B. 2nd mention of Heckman selection this hour!] #FRA2019

-

Heckman instrument here is percentage of pension funds in fund. Intuition is pensions have long horizons. Yasuda raises concerns about validity of exclusion restriction: pension holding rates don’t affect prices directly. #FRA2019

-

Brian Boyer (author) response, noting that main advantage of their PE index is they are using *actual secondary-market transaction prices* that LPs are paying, so reflect liquidity discounts and other frictions. #FRA2019

-

Quick note for anyone interested and following my #FRA2019 conference live-tweet: At this conference, authors don’t present their own papers; discussants present the paper as part of their discussion. Authors get to do a short response and Q&A.

-

Success of the #FRA2019’s unique approach (discussants present the papers; authors only get to do a short response) makes me wonder why more econ/finance conferences don’t try alternative formats. For example, what the @ClioSociety does at their annual conf. looks very cool.

-

Alex Chinco asks a nice question about the Boyer et al. Private Equity index: Is it right to think (as we often do) of there being some “true” price of which we only get noisy/selected observations? [Price may be noisy signal of *value,* but the price is the price.] #FRA2019

-

Why is it that using a price-based index results in a higher estimate of PE beta? (asks @startupecon) Boyer suggests that measurement error in other indices may be biasing towards zero. Also, “unique features” relative to buy-and-hold market. #FRA2019

-

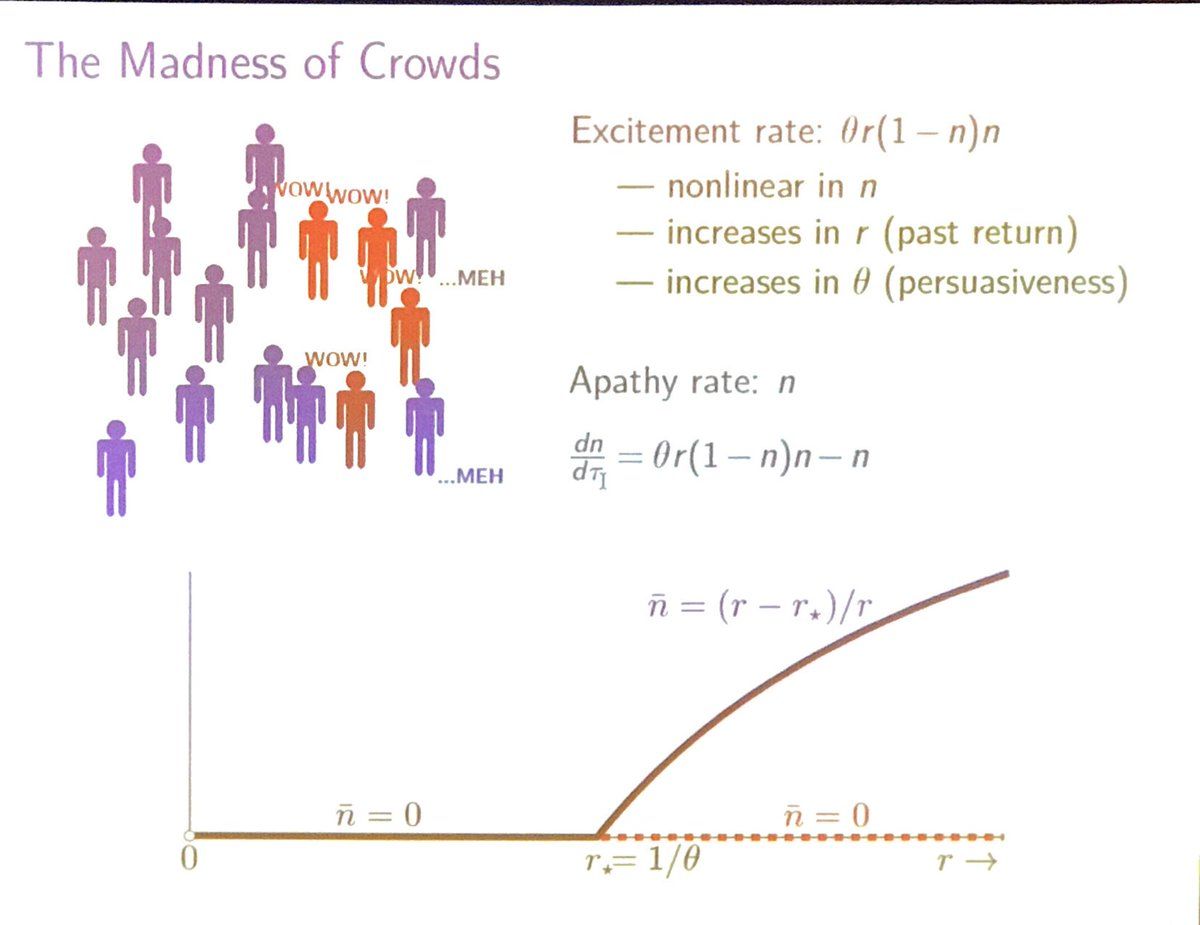

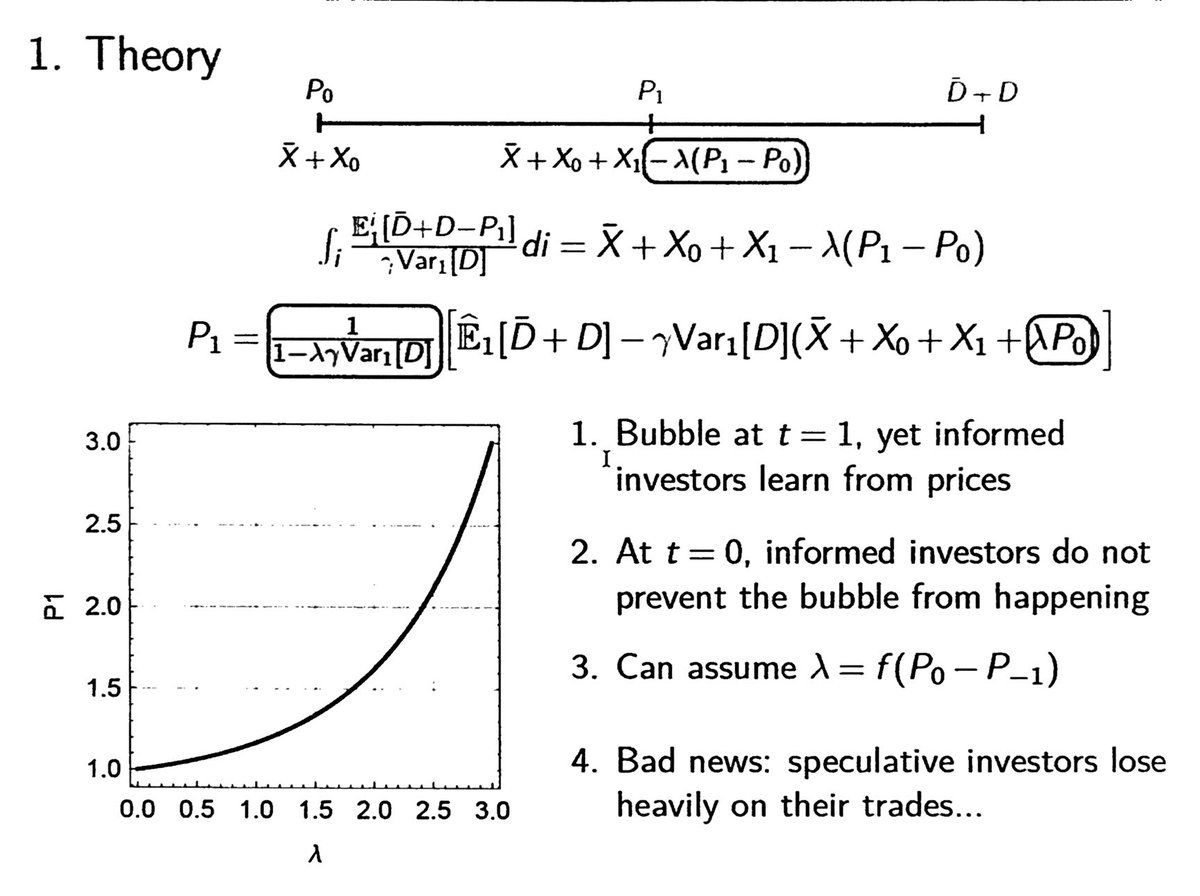

Equilibrium bubbles (price ≠ value) arise when returns exceed threshold determined by persuasiveness: r* = 1/𝜃. Empirics: Regress bubble (explosive growth followed by immediate crash) on persuasiveness (covariance between media coverage and previous month’s return) #FRA2019

-

Andrei’s (big) “wow”: Theoretical link between social interaction and bubbles, supported by data (cf Bitcoin) Andrei’s (Small) “meh”s: - Model not necessary to make point? - Fails in equilibrium: speculators keep losing - Embedded asymmetry: bubbles but not panics #FRA2019

-

Chinco: For bubbles you need (1) Dumb people (2) Reasons that arbitrageurs can’t fix the problem Thirty years of behavioral finance is making long lists of prospective causes (1) and (2). This paper is about turning (1)+(2) on and off. #FRA2019

-

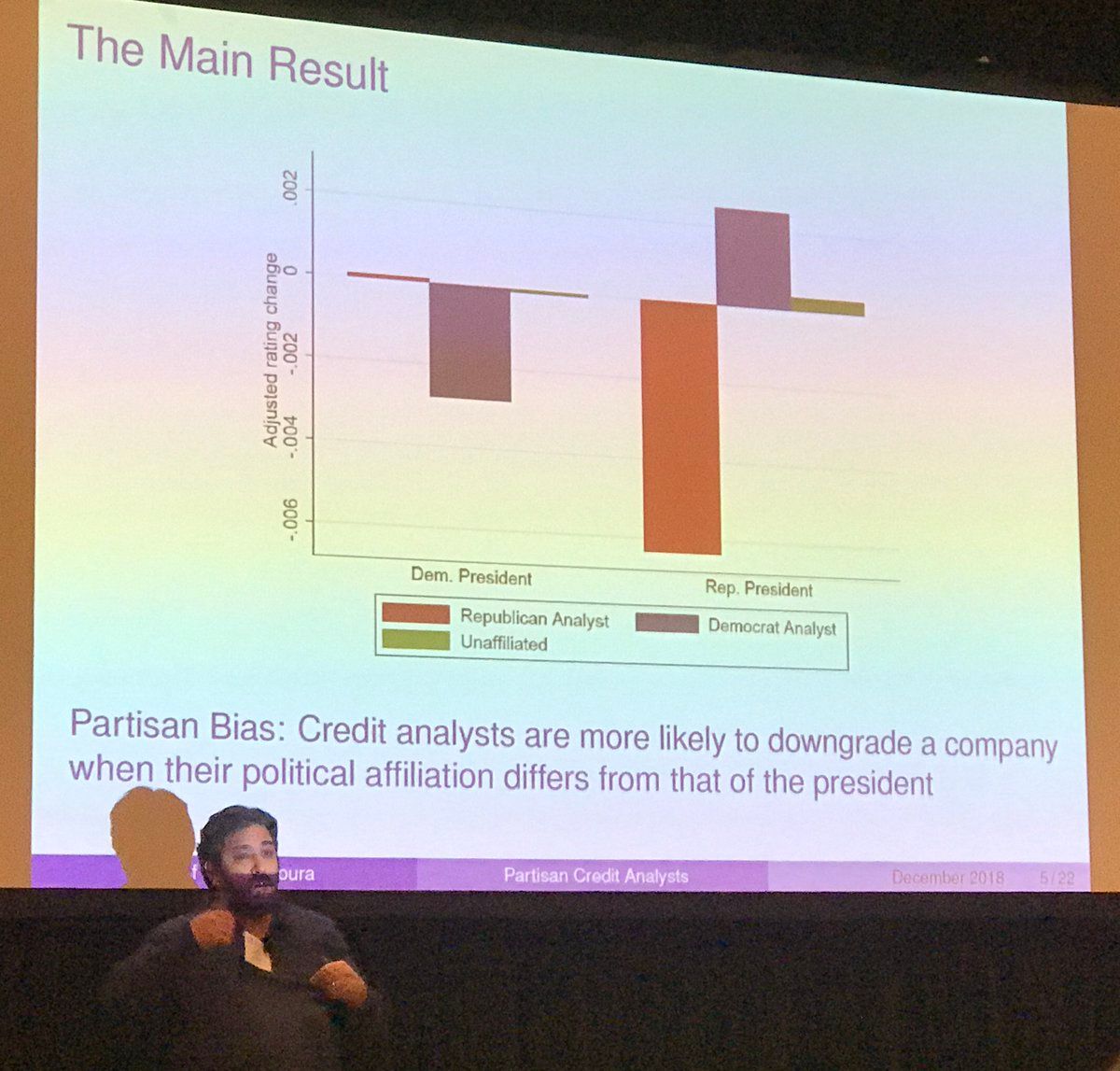

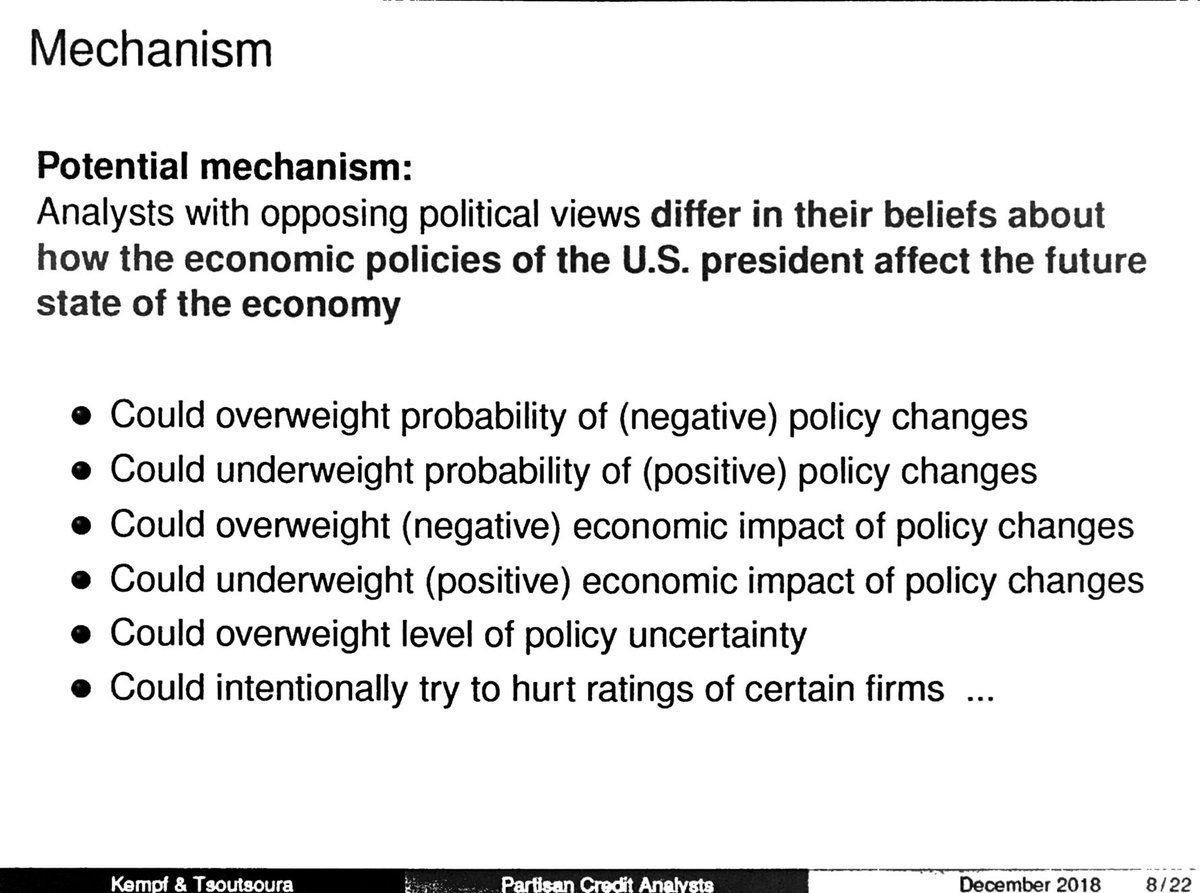

Next paper: Stefan Lewellen presents/discusses Elizabeth Kempf and Margarita Tsoutsoura, “Partisan Professionals: Evidence From Credit Ratings Analysts.” Paper assesses whether individual partisan beliefs affect professional credit analysts’ ratings. ※ YES #FRA2019

-

By the way, S&P hires the most democrats (vs. Moody’s and Fitch). #FRA2019

-

Lewellen recommends an alternative pitch, since we already know that professionals suffer from biases. What’s more interesting is pushing on the mechanism. Try to test some! Heterogeneous effects? Textual analysis? Consequences for analysts? #FRA2019

-

Lewellen asks about identification: Is this partisan bias? Or could unobservable factors drive both assessment of economy and of companys’ risks? #FRA2019

-

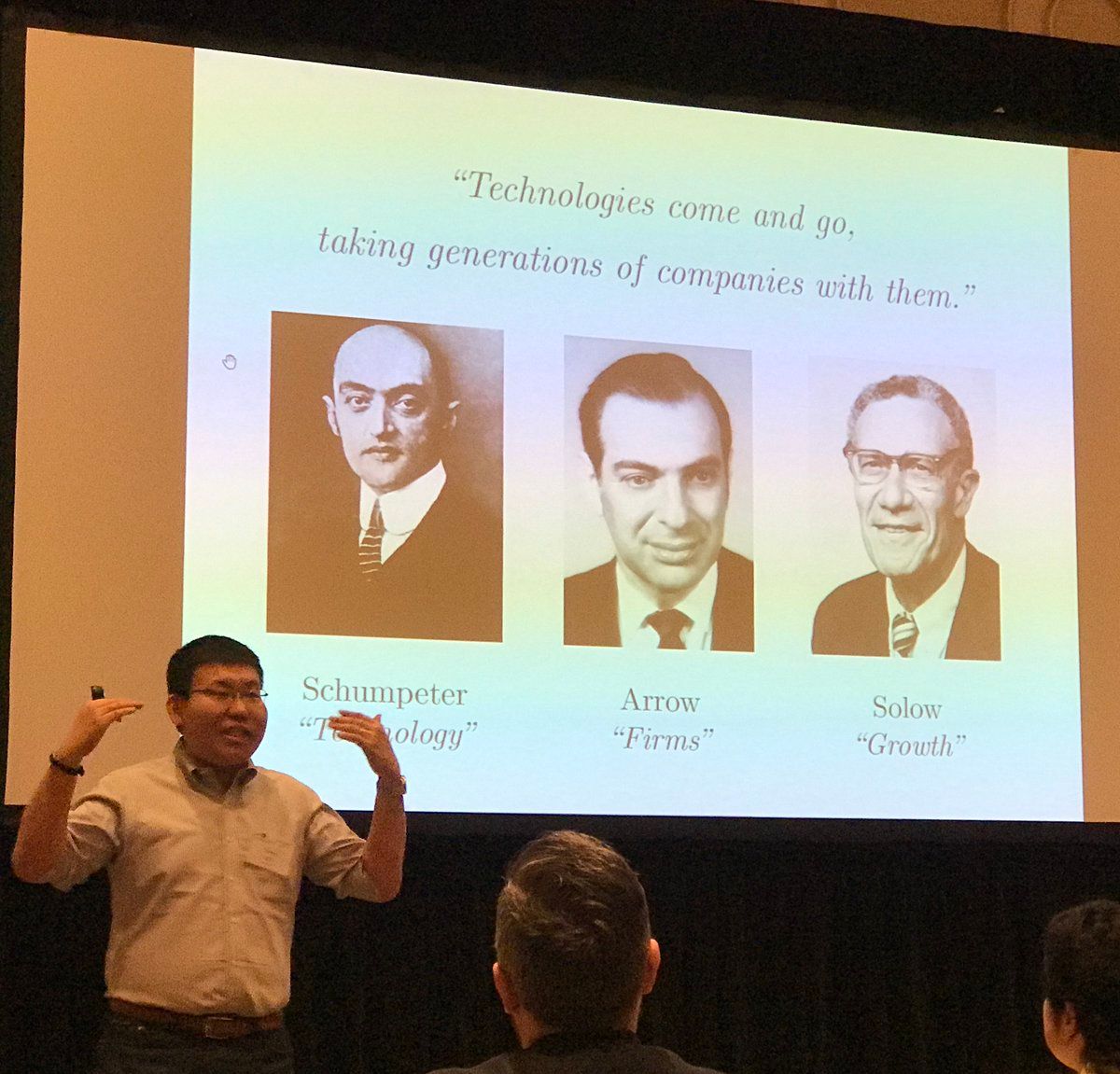

Next up: @ProfSongMa presents/discusses “Technological Disruptiveness and the Evolution of IPOs and Sell-Outs” by Bowen, Frésard, and Hoberg. #FRA2019

-

Paper connects 1. Technology (new text-based measure of technology disruptiveness) 2. Firms/IO (new mechanism suggesting firms with more disruptive tech more likely to IPO) 3. Growth (interaction of trends in tech and capital markets) #FRA2019

-

BFH use textual analysis of patents to identify “tech disruptiveness” ≈ use of ‘hot’ words @ProfSongMa notes: - Surging in use means crowded area with lots of competition - Hot words may be catering to market over-valuation #FRA2019

-

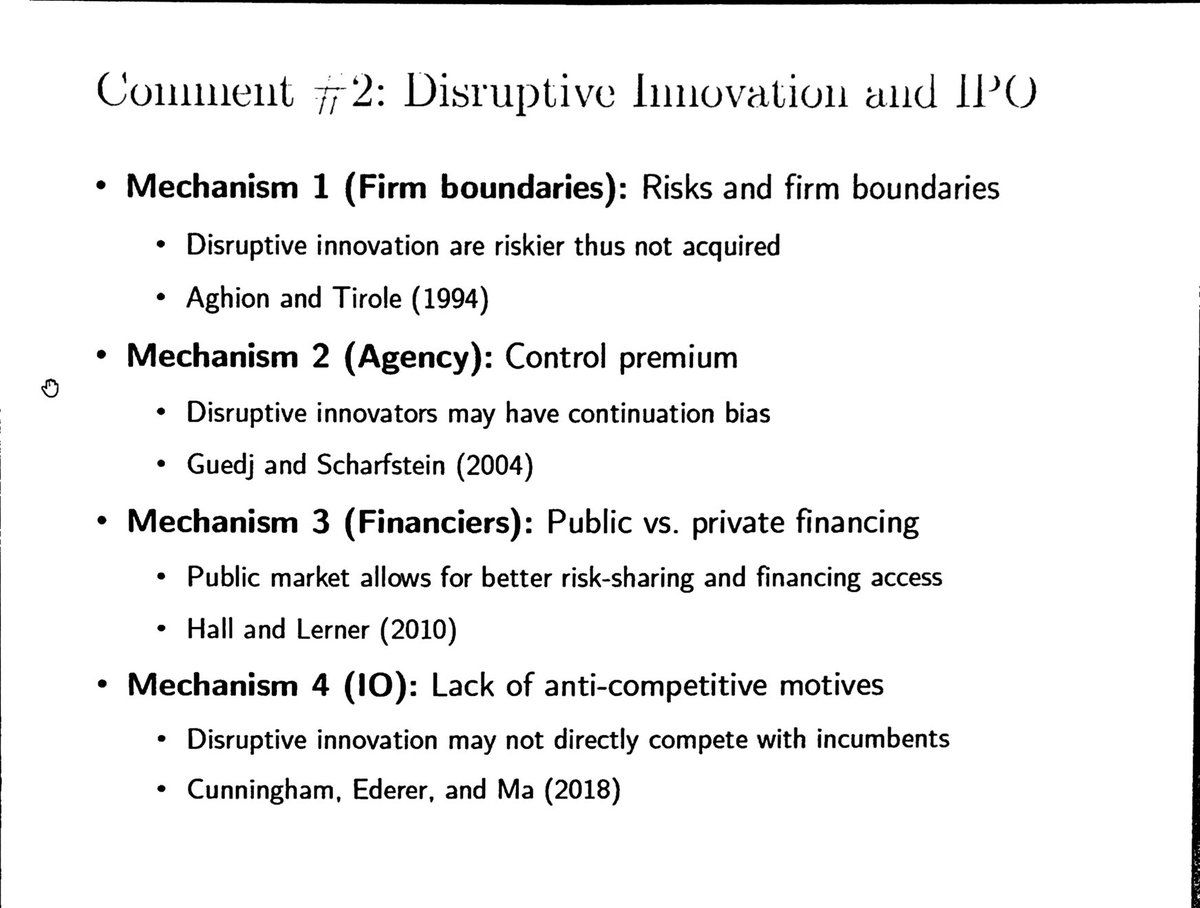

BFH estimate competing risk hazard model (and OLS) to predict IPO and sell-out using the patent-based “tech disruptiveness” measure. ※ More disruptive tech. correlates with IPOs @ProfSongMa notes: Lots of potential mechanisms! (See pic) #FRA2019

-

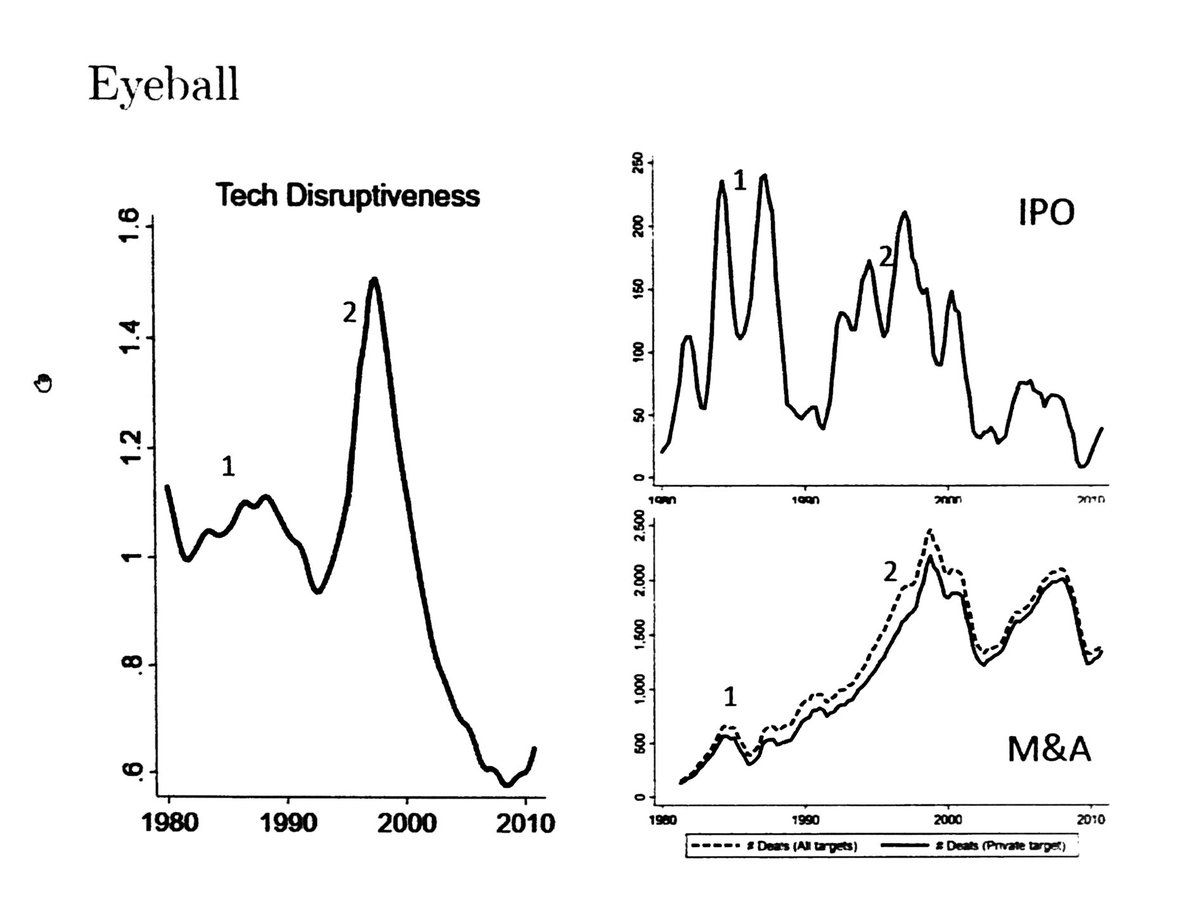

BFH relate aggregate tech. disruptiveness and IPO trends. @ProfSongMa isn’t sure about intra-ocular time-series regression result🧐. Also, causality?? #FRA2019

-

Bowen makes a few important points in response to @ProfSongMa: - There are (obviously) better tech disruptiveness measures, but it’s important that they’ve constrained to using those available ex ante (i.e., no lookahead) - BFH are *not* claiming causality #FRA2019

-

Last paper of the afternoon: Ran Duchin presents/discusses “Public Ownership and the Local Economy” by Jess Cornaggia, Matt Gustafson, @JasonKotter, and Kevin Pisciotta. Big question: What are effects of stock market on the real economy? #FRA2019

-

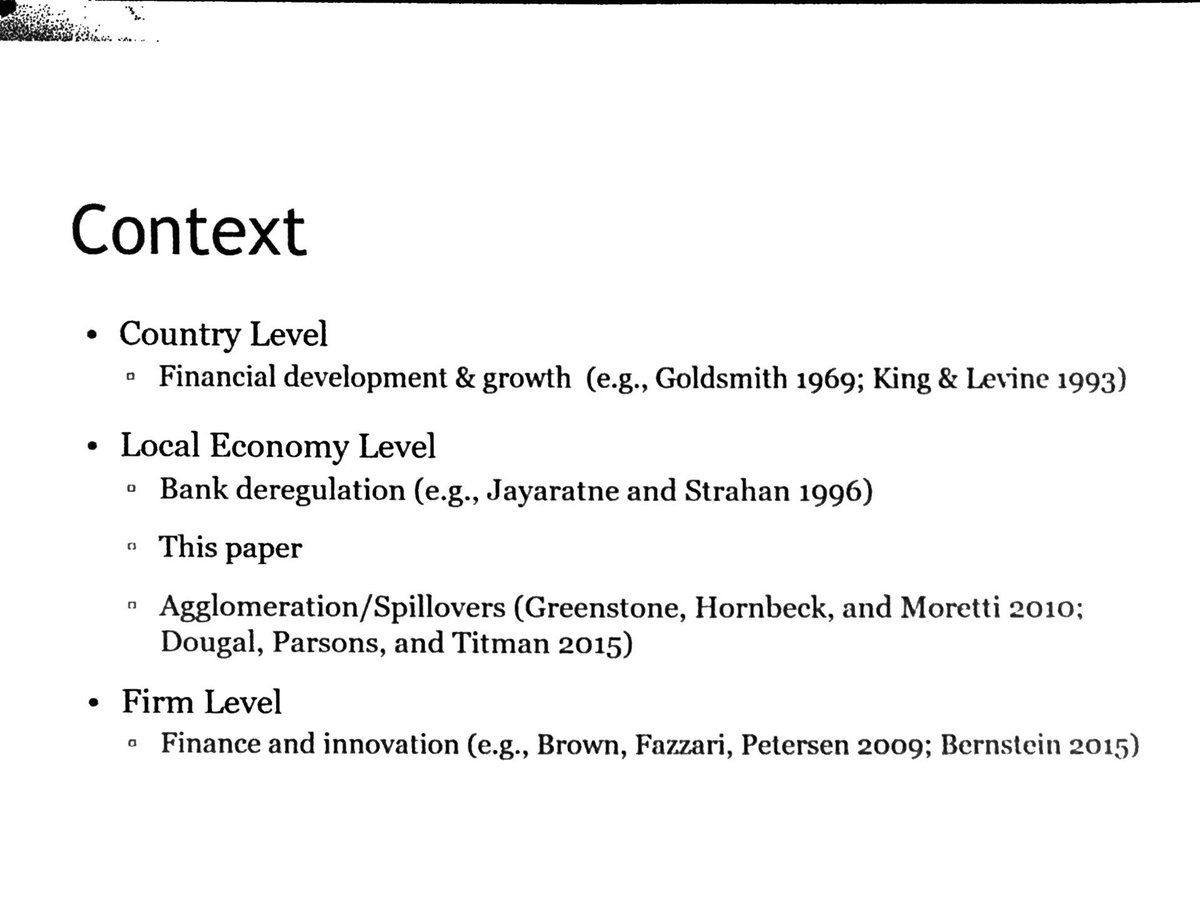

Scumpeter (1969): Finance *causes* growth Robinson (1952): Finance *follows* growth (John Adams?): Finance *harms* growth CGKP engages, specifically around public equity markets. cc: @JasonKotter #FRA2019

-

CGKP framework: IPO improves firm visibility in market place → lower info asymmetry between firm and suppliers → changes in bargaining power and relative prices of local vs. non-local inputs. cc: @JasonKotter #FRA2019

-

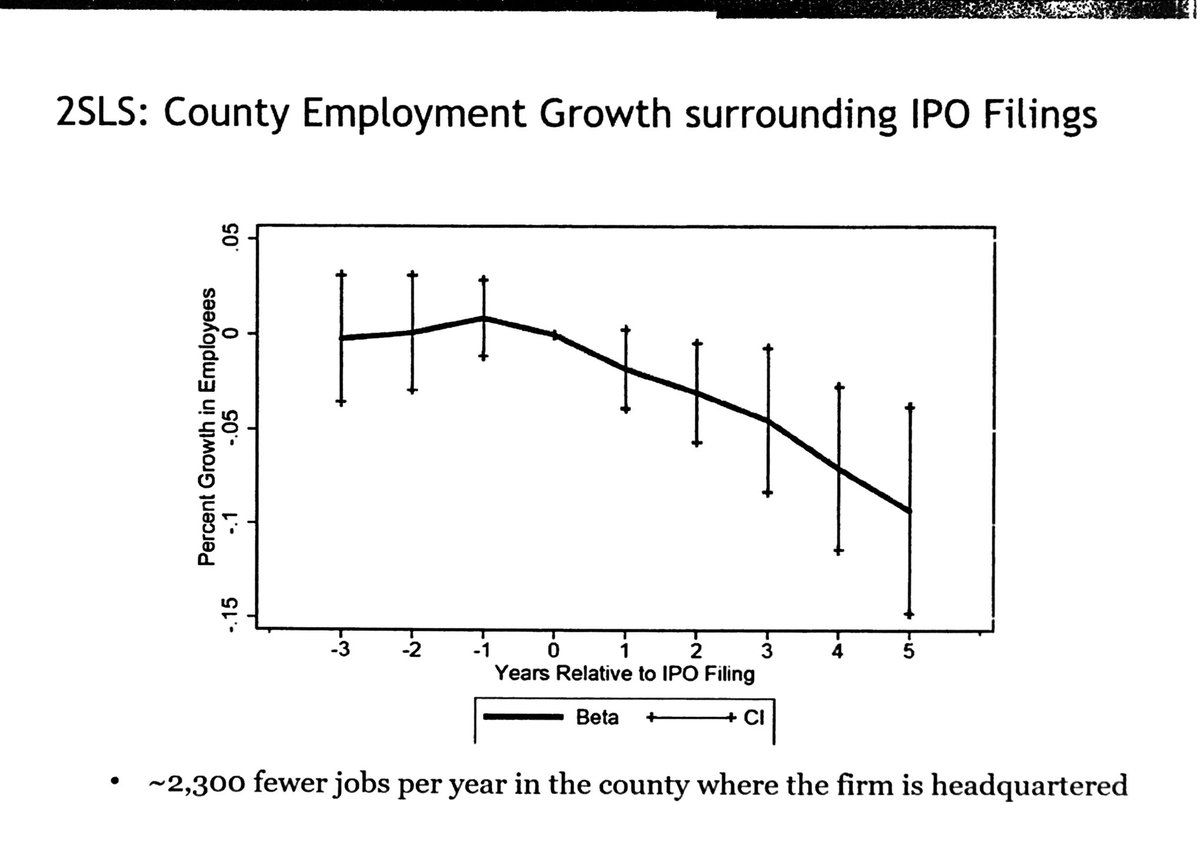

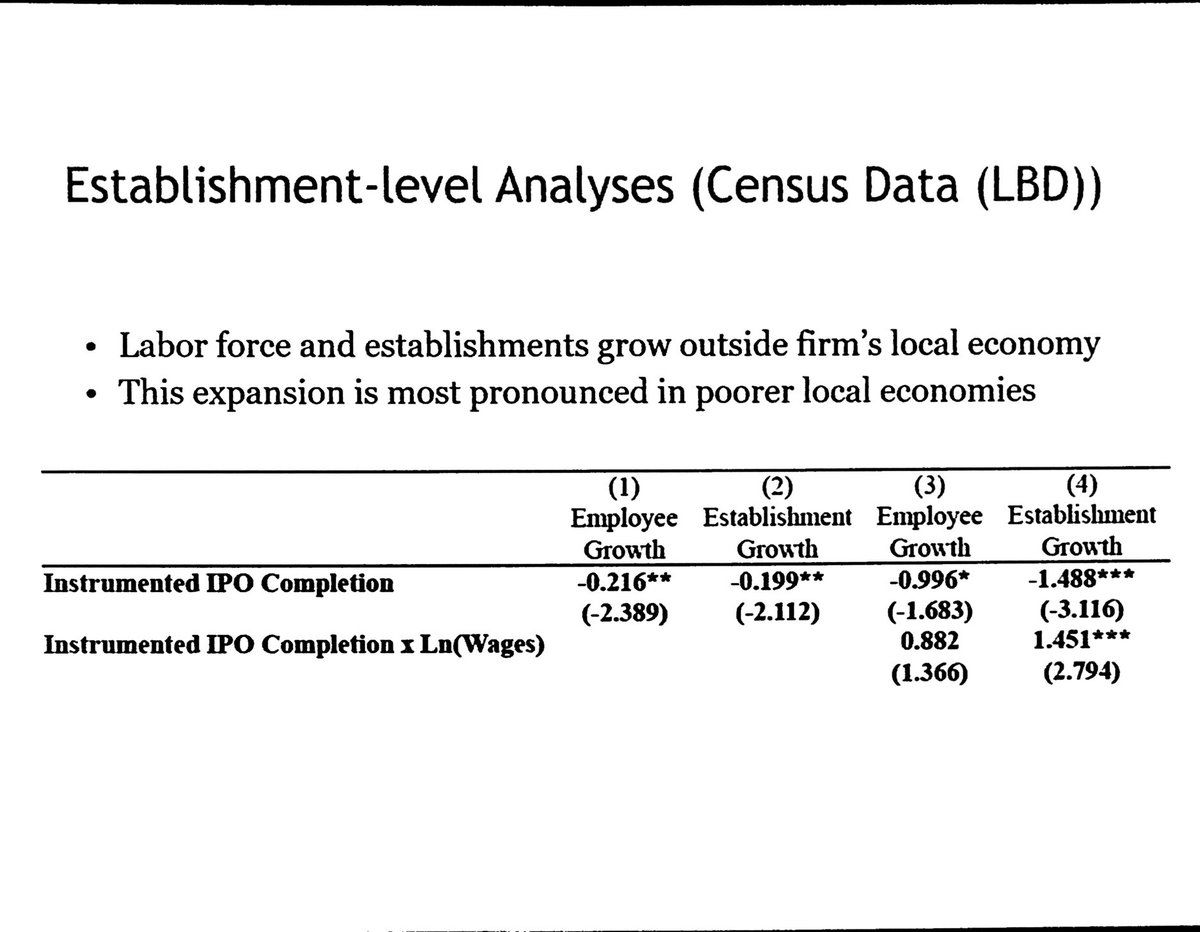

Empirics: Using sample of county-years with ≥1 IPO filing, compare completed and withdrawn IPOs (using Shai Bernstein instrument for IPO success). CGKP find: IPOs have *negative* impact on headquarters county employment, population, and wage growth. cc: @JasonKotter #FRA2019

-

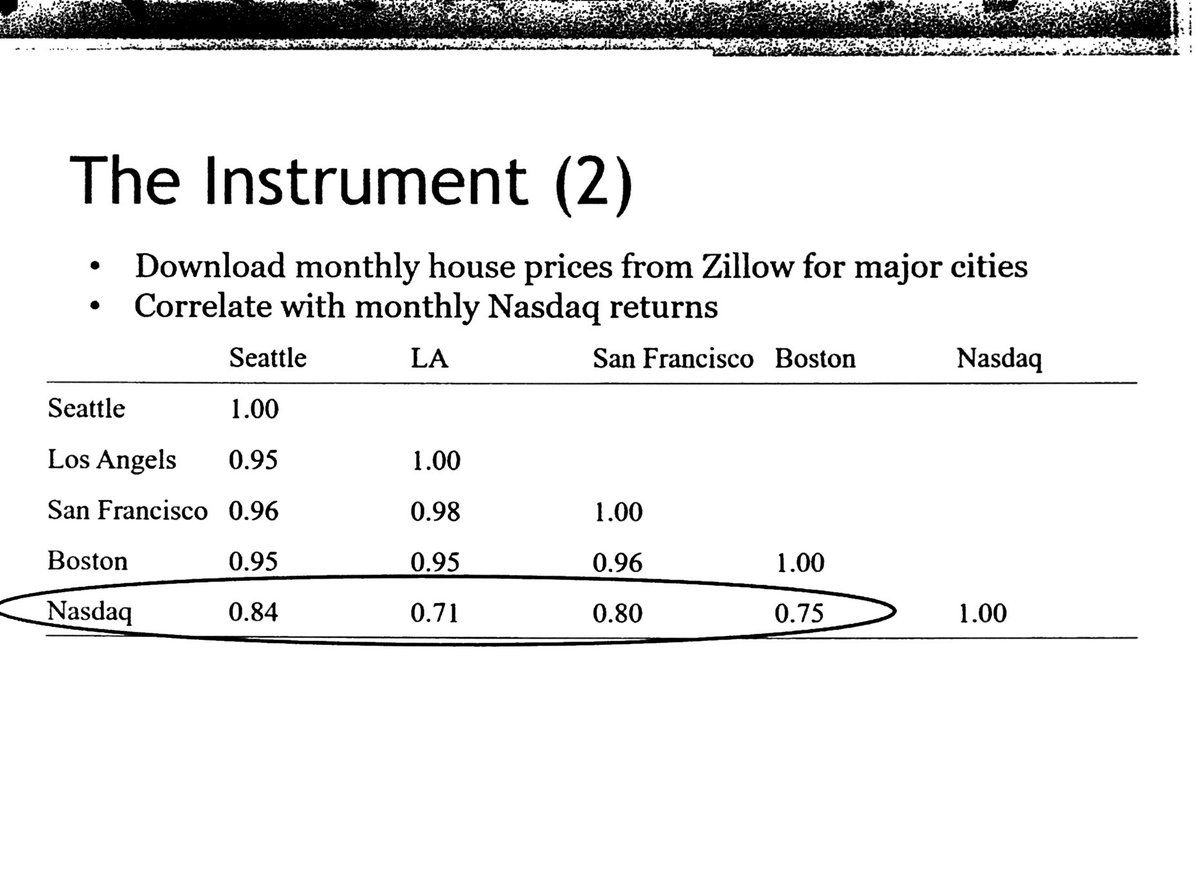

But but but! Duchin worries about CGKP exclusion restriction: Instrument (based on Nasdaq returns) can drive local outcomes in IPO-intensive counties! Also worried that Butler, Fauver, and Spyridopoulos (JFQA cond. accept) seem to find opposite. cc: @JasonKotter #FRA2019

-

We’re back! Just about ready to start day two of the #FRA2019 conference. Caution: If you aren’t looking for financial economics papers, may want to mute me for today. @lukestein/1071502562614865920

-

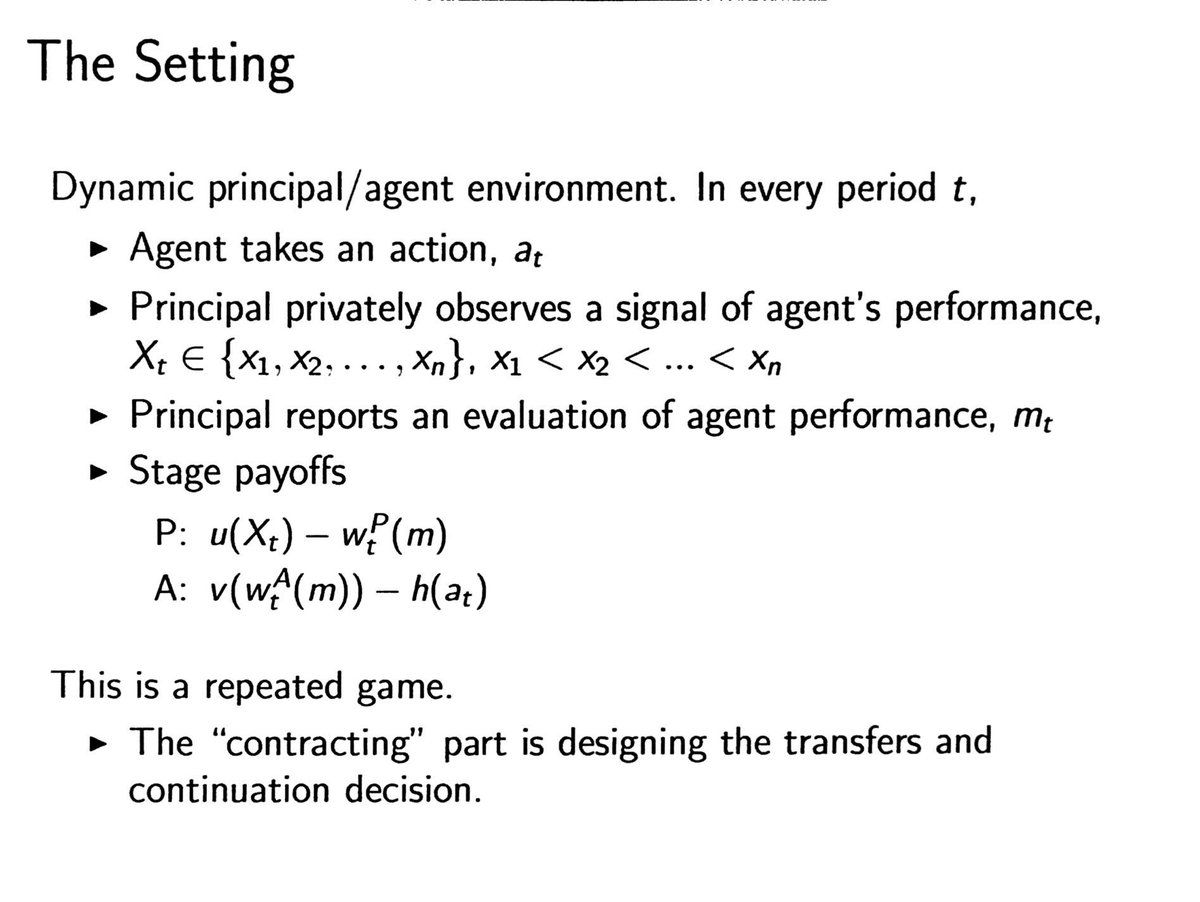

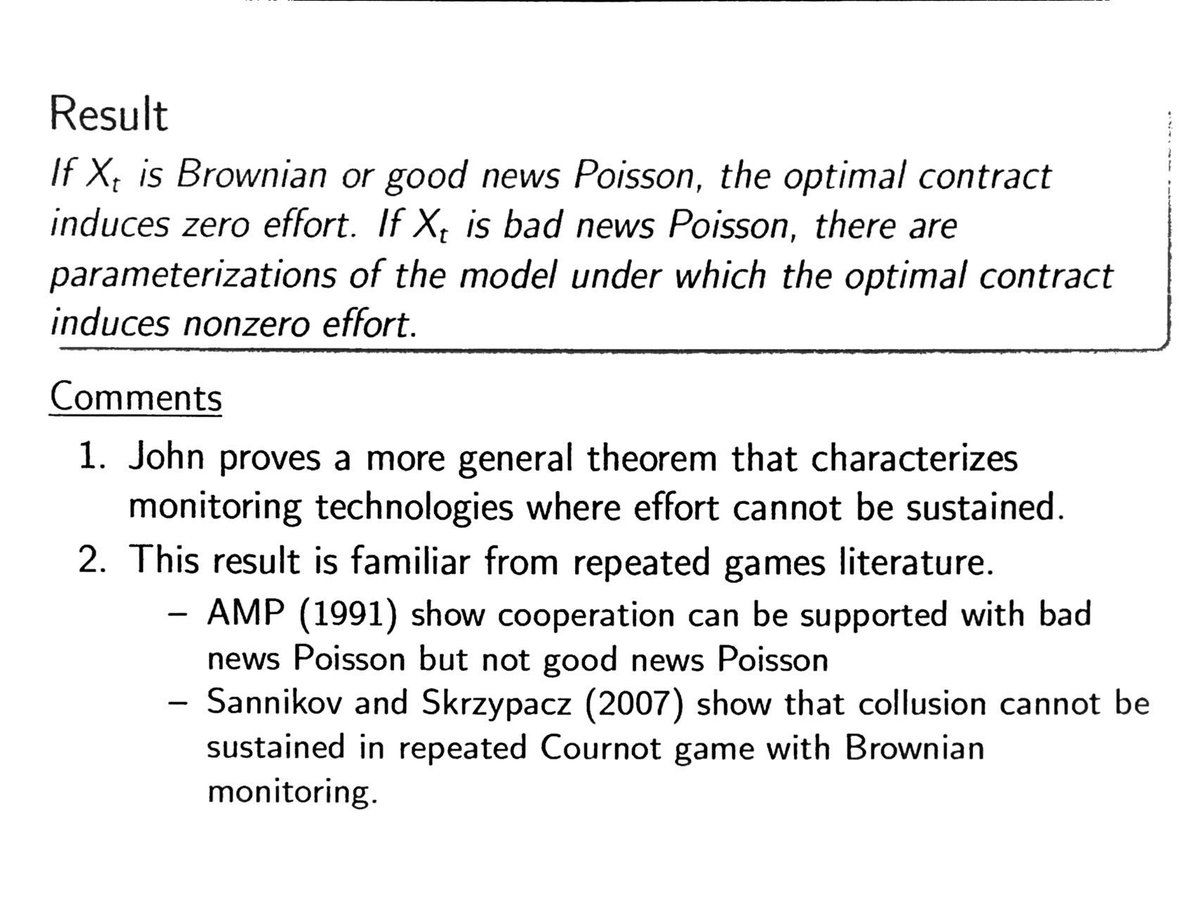

First up today: Brett Green presents/discusses “Better Monitoring... Worse Productivity?” by John Zhu of @Wharton #FRA2019

-

Green’s takeaways: Wouldn’t expect to find in data better monitoring → worse productivity. Instead, in settings where performance measures are subective, (1) formal review periods are critical, (2) firms should limit or discourage informal feedback → compensation/termination

-

Next up: Kelly Shue presents/discusses “Product Proliferation as Price Obfuscation: Evidence From the Mortgage Market” by Lu Liu (a third-year PhD student at Imperial College London, a student of @TRamadorai et al.’s).

-

Picking a mortgage is complex. 3–4× increase in number of products offered in UK. Even within homogeneous product class, many offers are dominated!

-

Substantial dispersion in total cost (driven by more salient interest rates and less salient fees). Liu’s idea: Lenders can use non-salient fees to obfuscate total cost.

-

Liu offers model of mortgage pricing. To get interior solution for optimal fee, need to assume consumers are somewhat elastic to fees. Estimate model using @TimBartik-style shocks to lender-specific funding cost shocks: use of wholesale funding loans × LIBOR. #FRA2018

-

Liu finds that as wholesale funding costs rise, total fees rise and products proliferate. Magnitude: ~1 sd increase in funding costs → GBP 60 increase in total fees. #FRA2018

-

Interesting note from Shue: US has long-term mortgages and rates quoted in 1/8 %s. UK has shorter terms and more granular rates → more flexibility to adjust total cost through interest rates (vs. fees). #FRA2018

-

Shue also notes lenders may have different preference for short-term revenue (fees) vs. long-term (rates). #FRA2018

-

Liu also shows that lenders tend to specialize in low-fee or high-fee products. #FRA2018

-

Shue suggests Liu’s data—with additional tests—may really be able to show: (1) Increase in relative costs causes lenders to increase prices through fees rather than interest rates (2) Borrow demand is more elastic wrt interest rates than fees #FRA2018

-

Last full paper of the #FRA2018: Terry Odean presents/discusses “What Do Investors Really Care About?” by Itzhak Ben-David, Jiacui Li, Andrea Rossi, and Yang Song

-

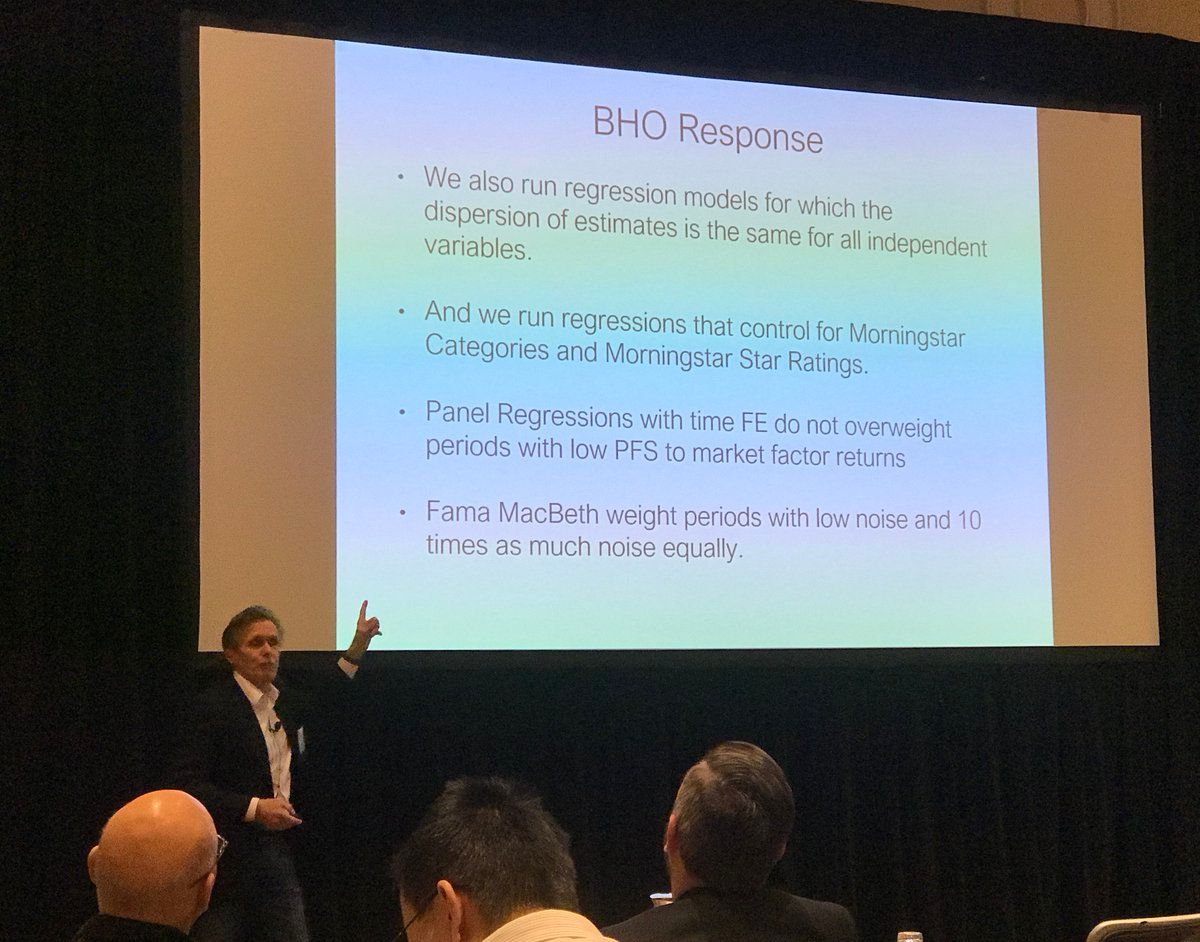

BLRS ask: What informatin do mutual fund investors pay attention to? 1. Morningstar ratings 2. Do not discount market factor returns 3. BHO’s results are driven by methodological error Odean (i.e., the “O” in BHO) doesn’t seem to agree with 2 or 3 #FRA2018

-

BHO asks whether premia associated with size, value, momentum, beta due to risk? Or behavioral biases, regulations, market frictions, etc.? Argues if - Investors ignore factor → not risk factor - Investors attend to factor → may or may not be risk factor #FRA2018

-

BHO estimate flow-performance sensitivities and argue that investors behave as if they are attending to market risk. But discount size, value, ..., much less. Cf. BvB test looks at fraction of fund-month observations where sign(model alpha) = sign(flow). #FRA2018

-

First up: Shaun Davies on an idea about whether ETF flows provide exogenous variation in stock prices? Lots of papers rely on asset market externalities to identify causation (e.g., in CF). ETF flows generate price distortions in underlyings. (More $ in ETFs than HF!) #FRA2018

-

Looks like there is non-linearity in relation between value-weights and price impact of ETF flows. What questions (perhaps in empirical corp finance?) could use this shock to share prices? #FRA2018

-

A couple of audience questions for Davies et al. about exogeneity of ETF flows. (Seems like it should depend on the outcome?!) #FRA2018

-

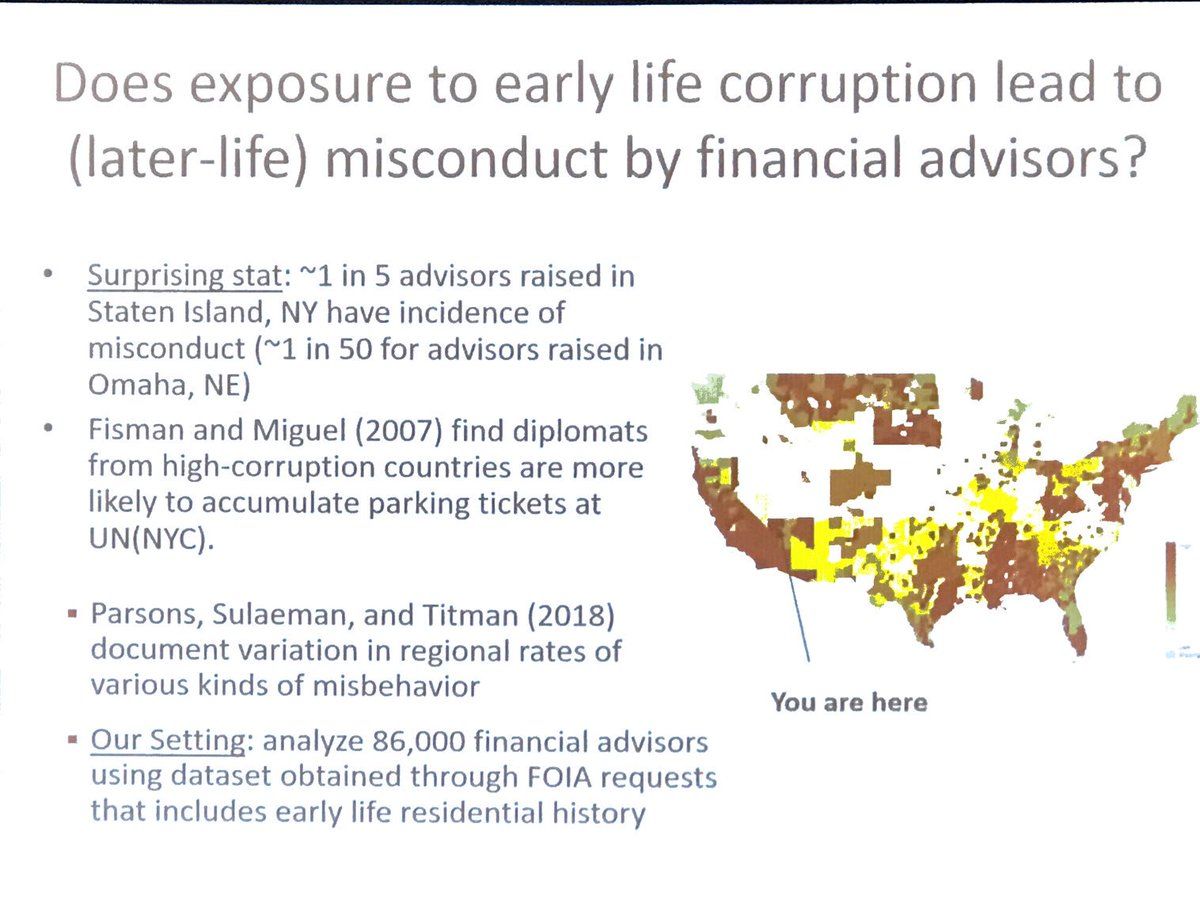

Next up, Will Gerken (@universityofky) and coauthors with an idea titled “Born to be Bad.” Turns out that where a financial advisor grew up is highly associated with subsequent rates of misconduct. See pic for a summary stat about Staten Island! #FRA2018

-

Micah Officer (@LoyolaMarymount) pitches an idea (with Tingting Liu at @IowaStateU) about trying to get “inside the ‘black box’ of private merger negotiations.” Puzzle about M&A market after 1990: Big premiums despite lack of competing offers, hostile offers, etc. #FRA2018

-

Officer wants to build on Boone and Mulherin (2007 JF) using hand-collected SEC filings details about bidding during private M&A negotiation period. E.g., finds that despite few bid revisions during public process, lots of (positive) revisions during private process. #FRA2018

-

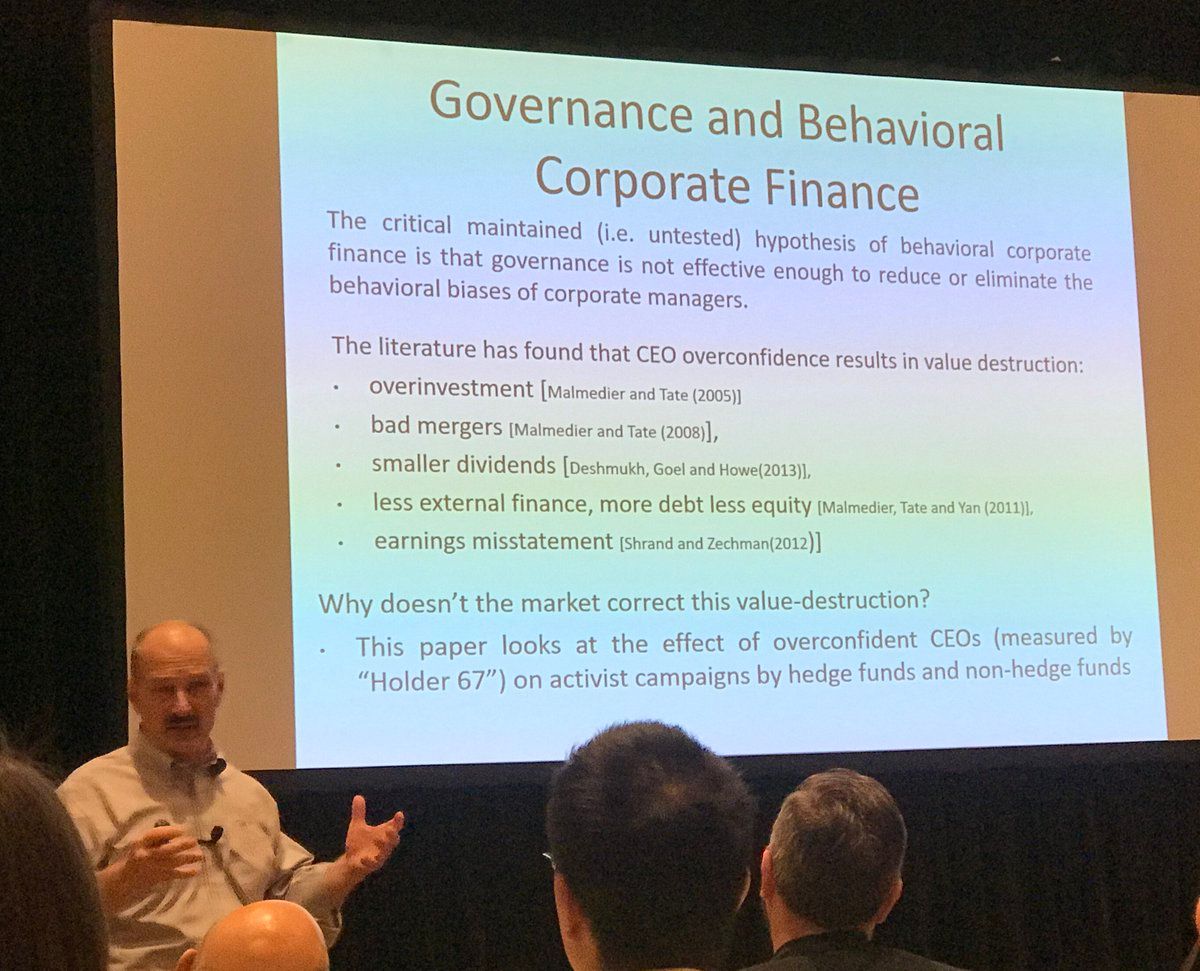

#FRA2018 “Early Ideas” session number four: @ctrzcinka (with Abhi Ganguli) asks “Do Activist Hedge Funds Avoid Overconfident Managers?” Why doesn’t market correct value destruction from overconfident CEOs?

-

#FRA2018 “early idea” from Eitan Goldman (@IndianaUniv) et al. asking “Is Financial News Politically Biased?” Analyze articles in @WSJ and @nytimes 1990–2016 about public companies. Also measure co.s’ alignment based on political donations.

-

LAST PRESENTATION! Jeff Pontiff presents an early idea with Caitlin Dannhauser about “Flows.” (Not sure what @SayWhatYouFound would approve of this awesome, pithy title, but this is an “early ideas” session.) #FRA2018

-

Pontiff: Want to provide “apples-to-apples comparisons of flows” to - Active mutual funds - Passive mutual funds - ETFs Preliminary: 1. Passives’ flows are 2× as volatilie as actives’ 2. Flow-performance sensitivity: ETF > Active > Index 3. MF have smart money flows, ETFs don’t

-

Pontiff preliminary findings (cont.): 4. Convexity: ETF > Active > Index 5. Flows chase expense ratios: ETF ≫ Active > Index 6. Flow/trading relation: ETF and active > Index 7. Fire sales: ETF stocks experience fire sales (more than index or active) #FRA2018

-

And that’s a wrap! Well deserved awards announced at dinner: Worst poker player in finance: Will Gerkin Best poker player: Chris Clifford Best PhD paper: Li Liu Best discussant: Daniel Andrei Best paper (tie): Elizabeth Kempf/Margarita Tsoutsoura, Alex Chinco #FRA2018

lukestein’s Twitter Archive—№ 945

lukestein’s Twitter Archive—№ 945