-

1/N: Ten great papers (from 400+ submitted!) at the ASU Finance Conf., but I want to highlight two that show the breadth of financial economics: - The Impact of the Opioid Crisis on Firm Value and Investment - Organized Crime and Firms: Evidence from Italy blogs.wpcarey.asu.edu/financeconference/?page_id=353

-

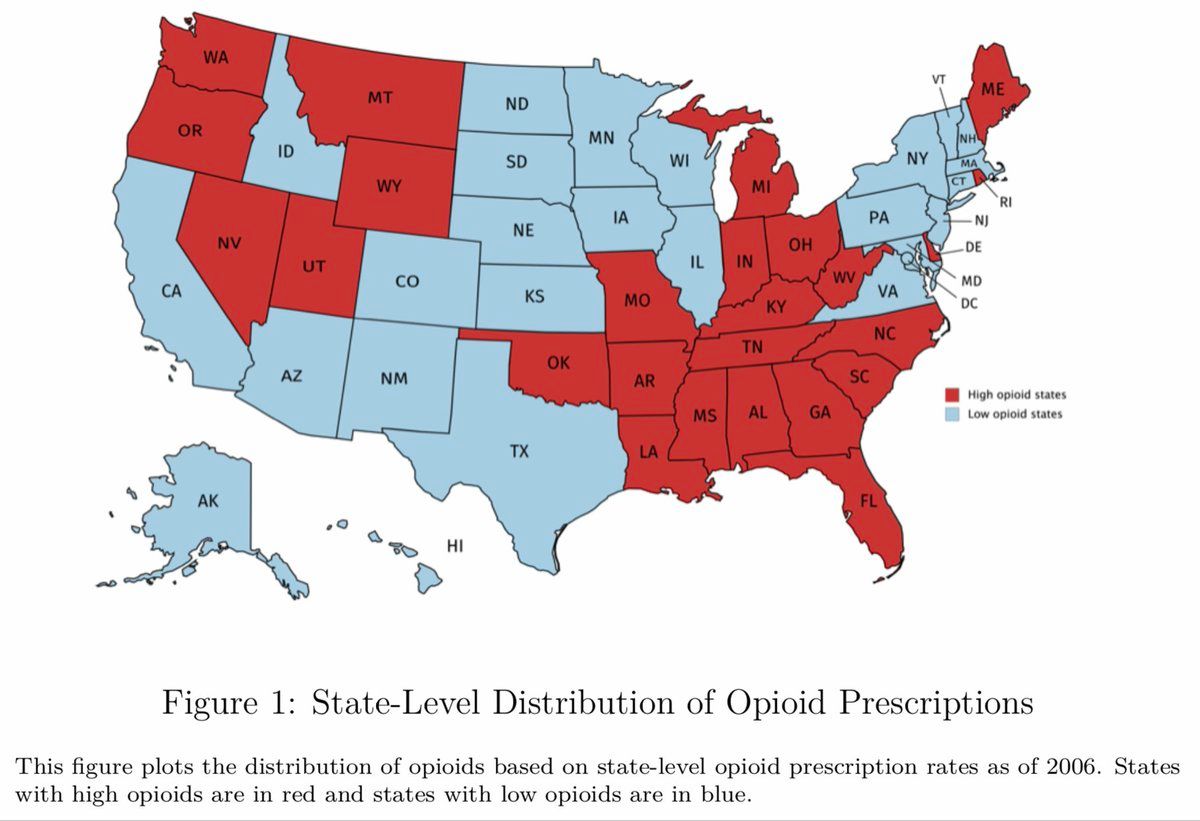

2/ Elena Simintzi presents “The Impact of the Opioid Crisis on Firm Value and Investment” (with Ouimet and Ye). Uses geographic variation in opioid use/legislation to understand their effect on firms. blogs.wpcarey.asu.edu/financeconference/wp-content/uploads/2019/02/Ouimet_Simintzi_Ye_Feb2019.pdf

-

3/ Counties hardest hit by opioid epidemic have falling quantity and quality labor supply. → Local firms have lower performance and value. → Local firms invest in physical capital and automation to substitute away from labor!

-

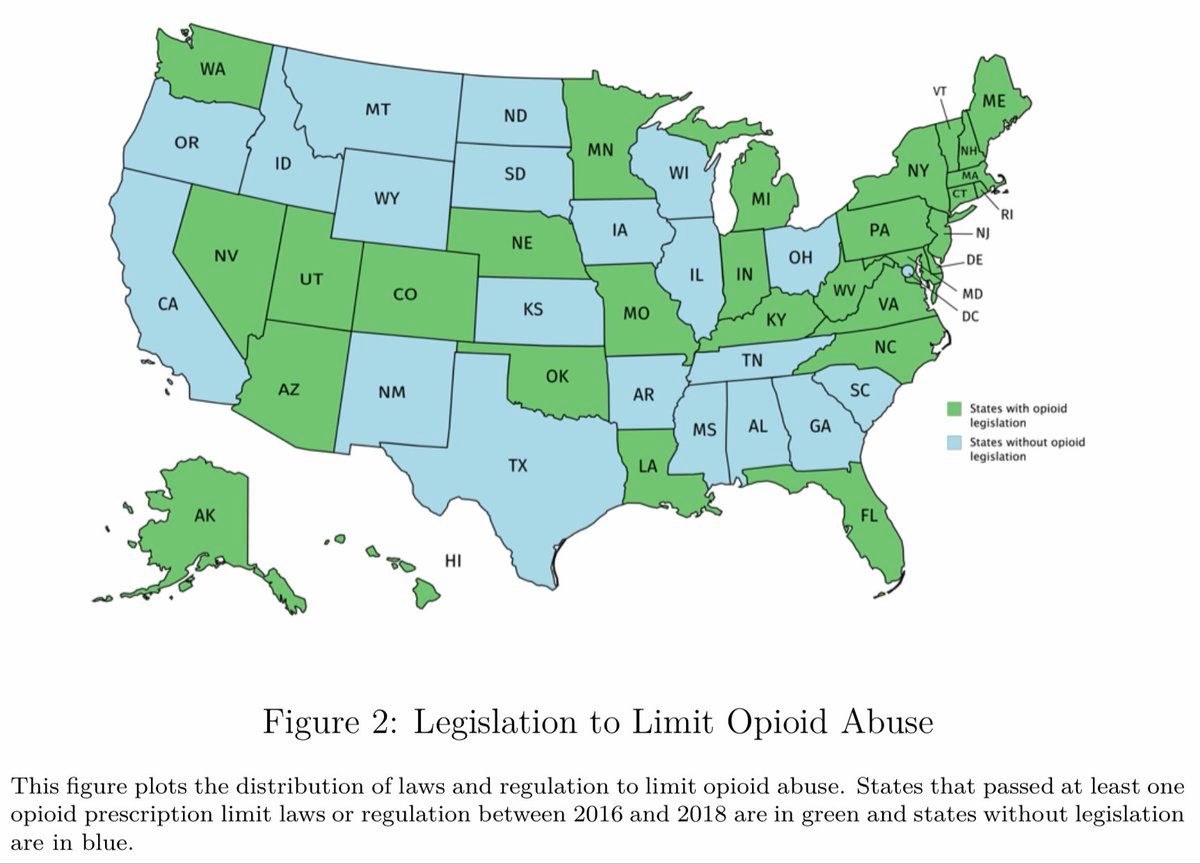

4/ Also, consistent with the suggested mechanism: When states pass opioid-reducing legislation, local firms’ stock prices increase, especially at labor-intensive (/low-IT) firms. This great paper connects evidence from firm behavior and financial markets.

-

5/ An amazing discussion. Miao (Ben) Zhang does *new analysis* to suggest that exposure to import competition (using Autor 🇨🇳🇺🇸 and Bustos 🇧🇷🇦🇷 shocks) might play a role, affecting opioids, workers, firm values, and automation.

-

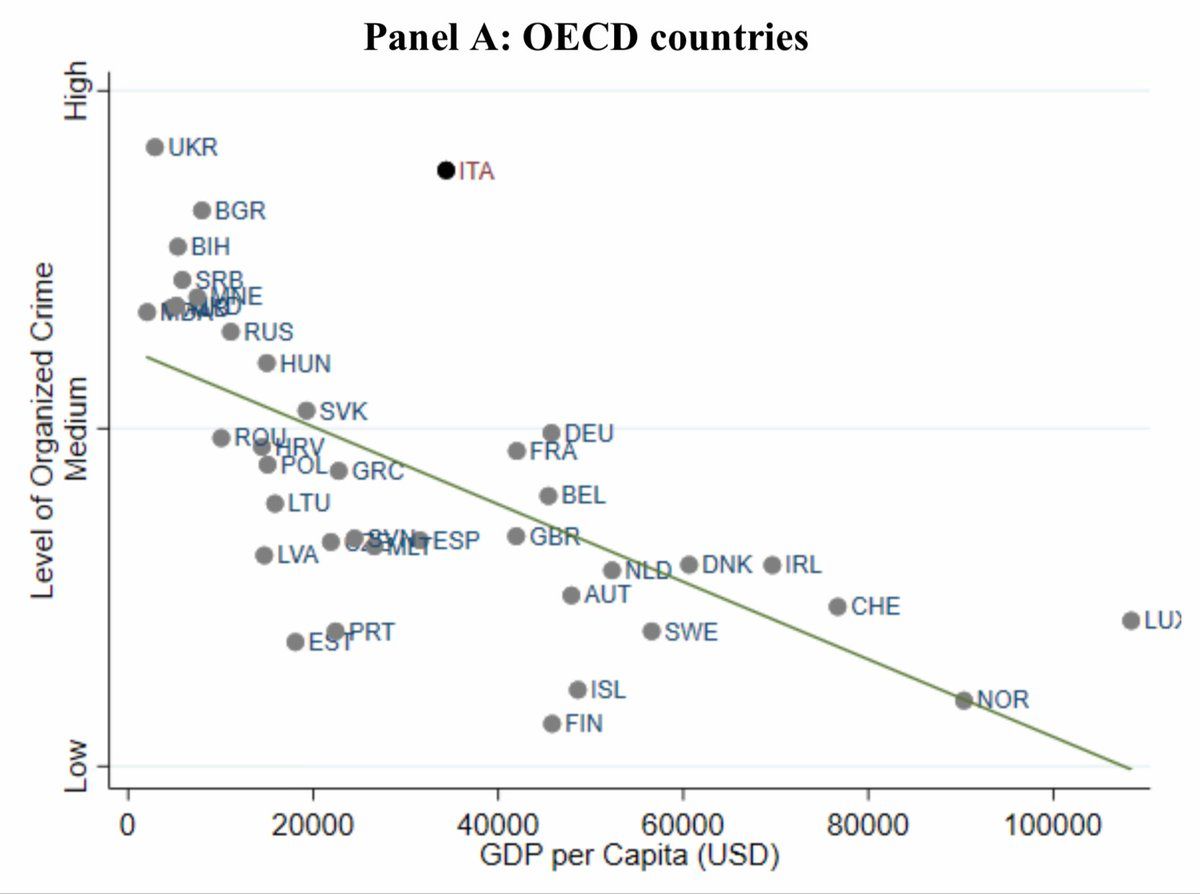

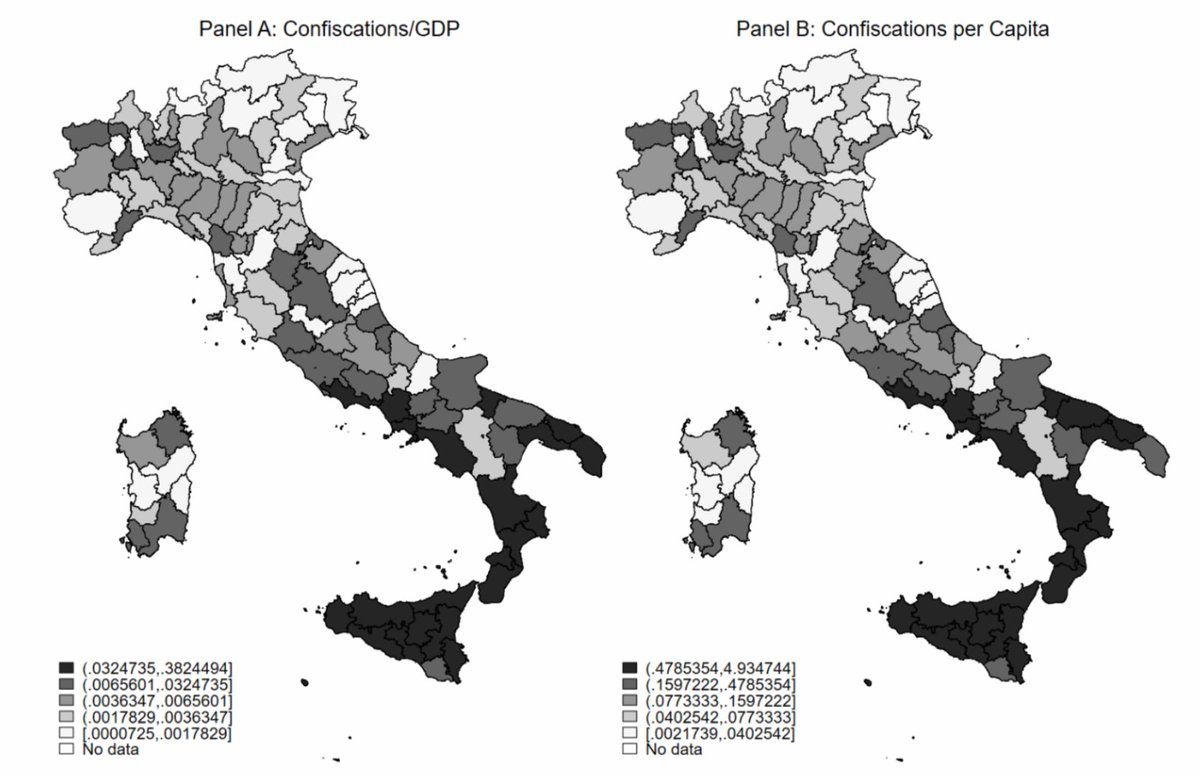

6/ Pablo Slutzky presents “Organized Crime and Firms: Evidence from Italy” (with Stefan Zeume) OC has revenue ≈1.5% of world GDP [!], and OC associated with poor economic growth. Why? In particular, how does OC affect firms? blogs.wpcarey.asu.edu/financeconference/wp-content/uploads/2019/01/Organized-Crime-Slutzky-Zeume.pdf

-

8/ Anti-mafia enforcement → Much higher firm turnover (more entry and more exit) → More innovation → More competition in public procurement auctions Mafia seems to protect firms in non-tradable sectors from competition Firms founded when local mafia powerful more affected

-

9/ We saw eight great presentations on the cross section of expected returns, multi-horizon risk-return tradeoffs, delegated asset management, business groups, investment manager compensation, sovereign debt, managerial decision-making, human capital in financial markets. So…

-

10/10 Financial economists work on the “traditional” topics you might have in mind, and I love and do that kind of research. (E.g., corporate governance, banking/intermediation, asset pricing.) But we work on all kinds of other stuff too! — fin —

lukestein’s Twitter Archive—№ 1,598

lukestein’s Twitter Archive—№ 1,598