-

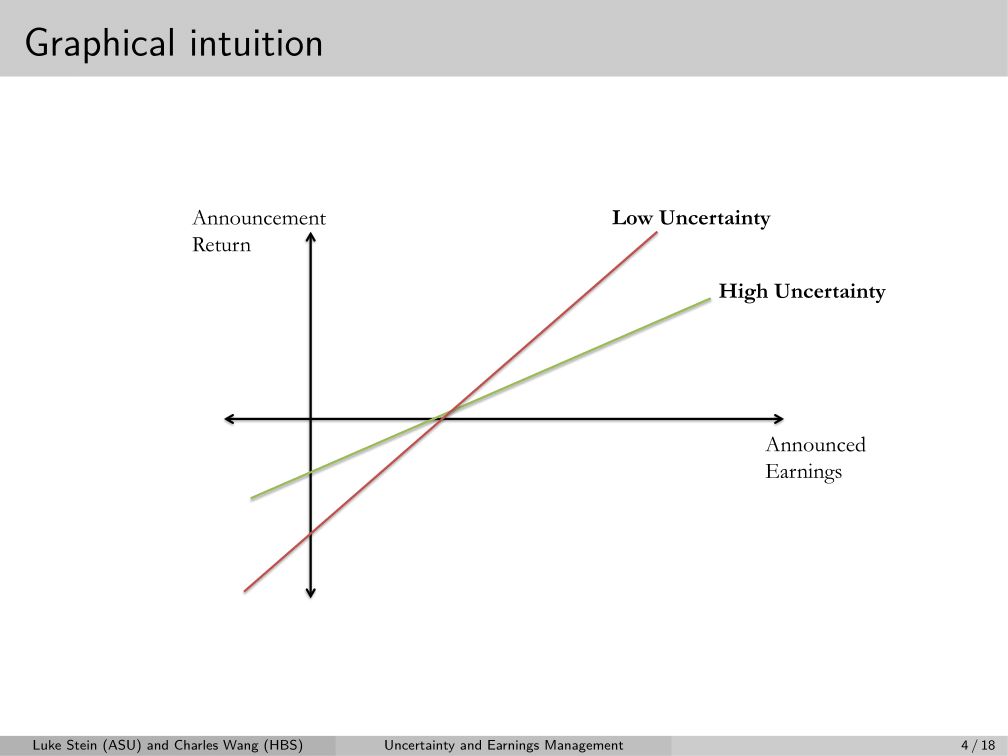

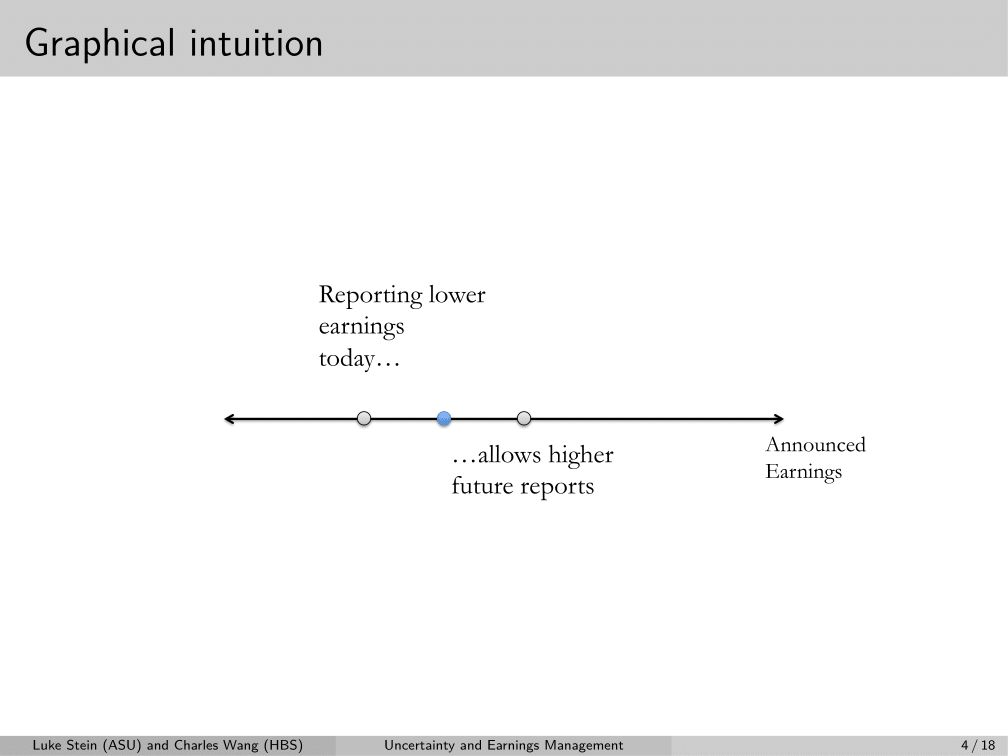

@jnaecker This paper looks very cool (cc: @mikeanton13)! Charlie Wang and I have an empirical corp fin/accounting paper somewhat related to this particular point about strategic timing: if you know when P is more likely to attribute to performance to luck, you shift bad news to then.

-

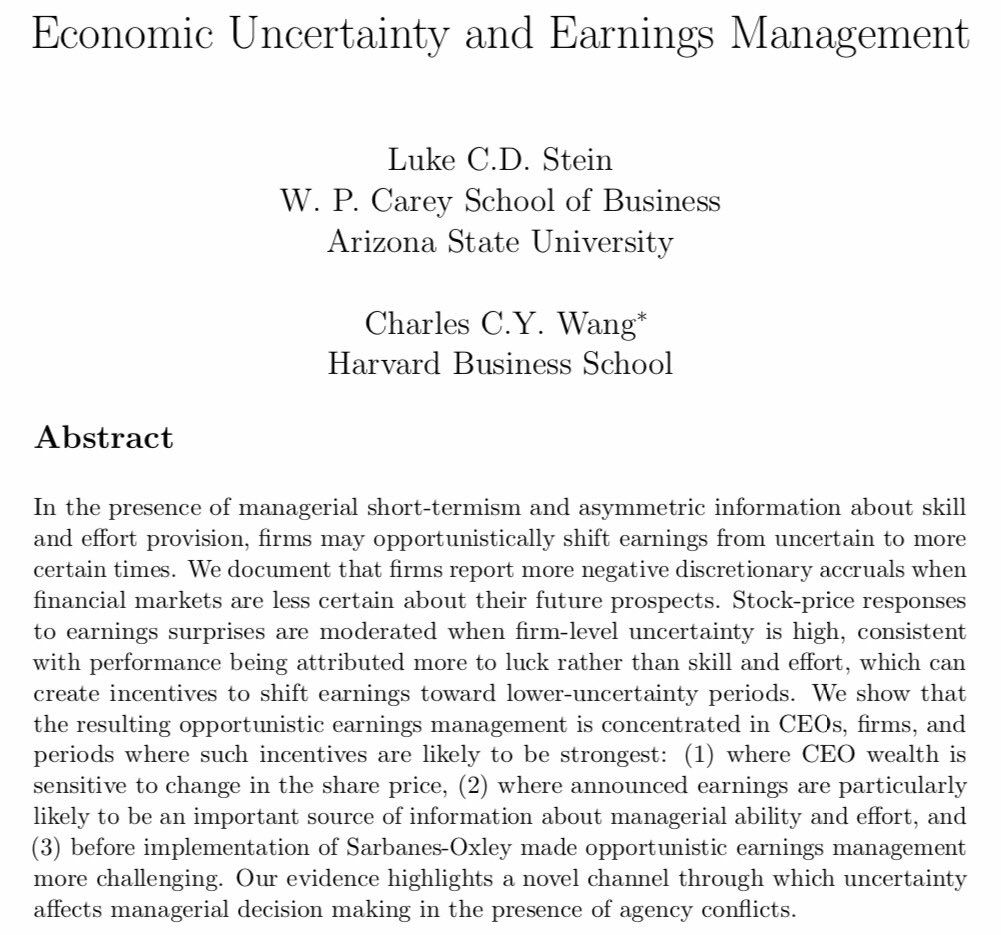

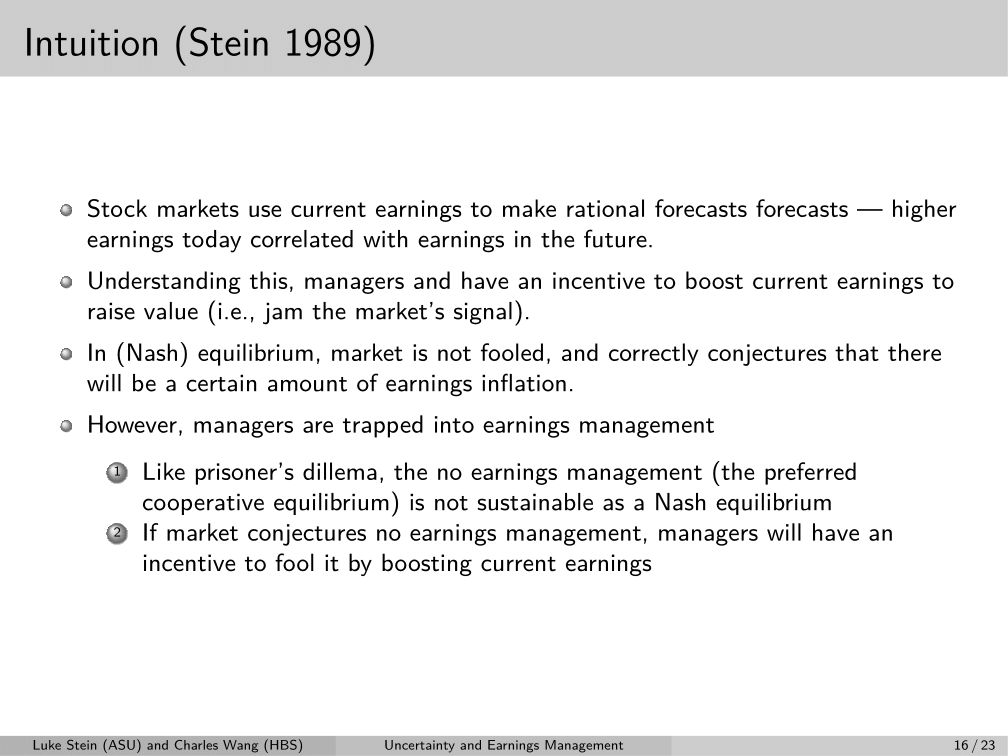

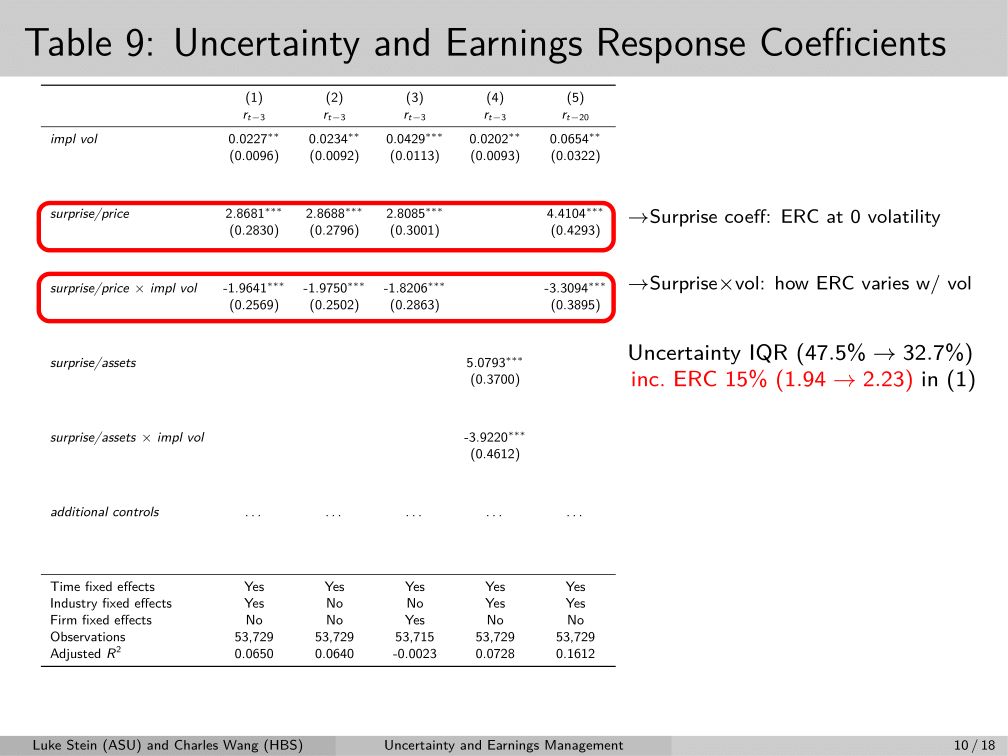

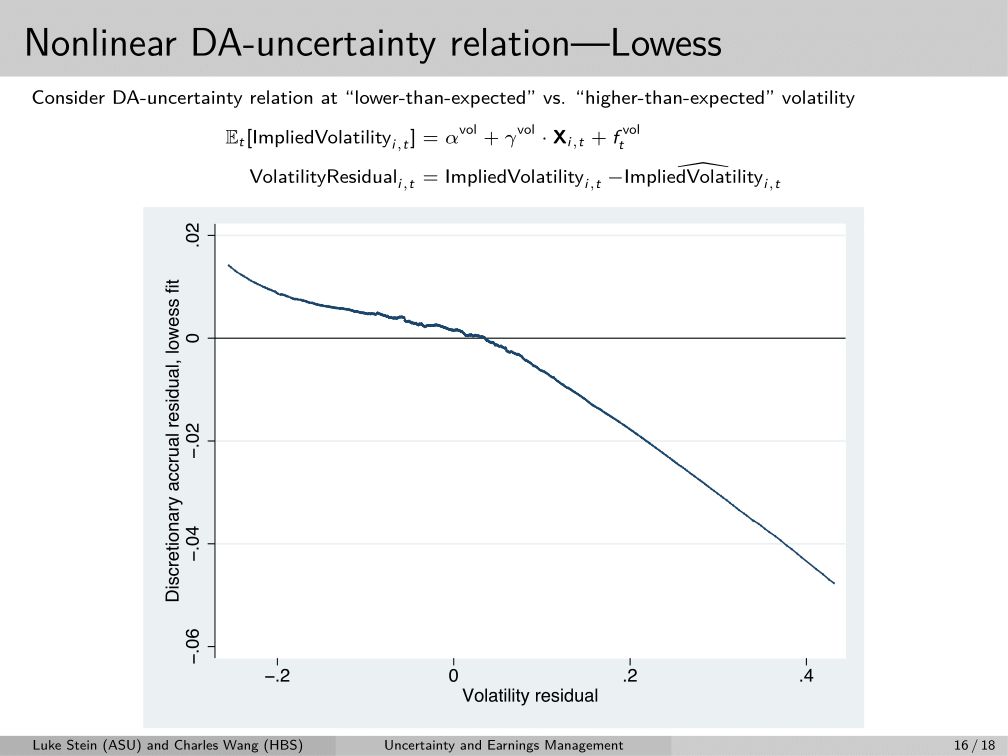

@jnaecker @mikeanton13 Will tweet a fuller thread on it some time, but the key intuition is that financial market uncertainty about firms’ value is tied to persistence of shocks (e.g., skill), consistent with empirical regularities in earnings shifting.

-

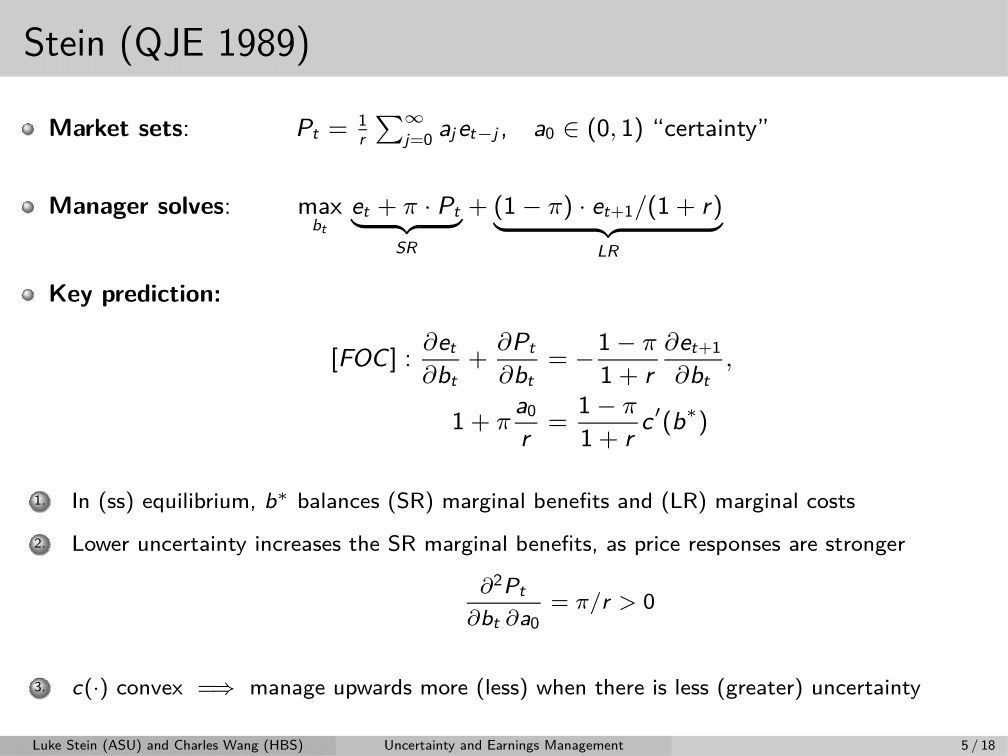

@jnaecker @mikeanton13 The theory that underlies our predictions is basically Stein, QJE 1989 (no relation).

-

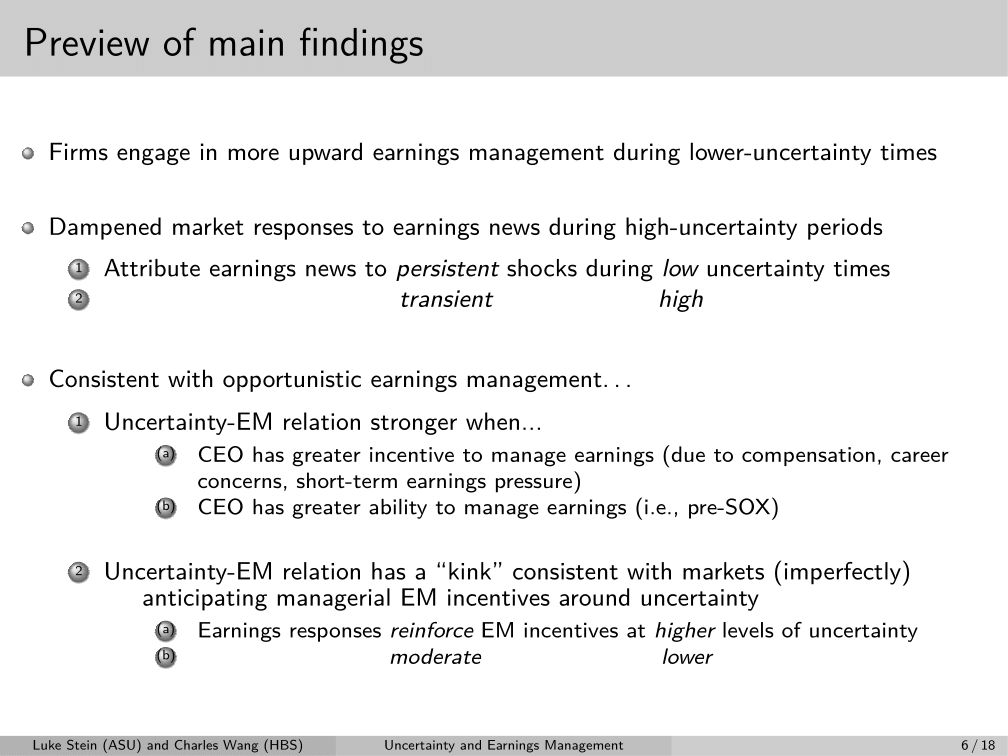

@jnaecker @mikeanton13 Our evidence on both financial market responses and firms’ behavior—incl. some heterogeneous and non-linear effects—seems consistent with what the model predicts. And the economic magnitudes are significant in terms of how much earnings management we see!! ssrn.com/abstract=2746091

lukestein’s Twitter Archive—№ 2,003

lukestein’s Twitter Archive—№ 2,003