-

[3] Theory of Socially Responsible Investment (@MartinOehmke @realMarcusOpp) Financing constraints+externalities→ -“Broad mandate” necessary for impact -Optimally achieved via increasing scale of clean production -Purely financial and socially responsible capital are complements

-

[4 cont.] Discussion from @drewkoke including great notes that connect institutional reality with model; e.g., trading costs/search frictions, time-to-build, financial constraints.

-

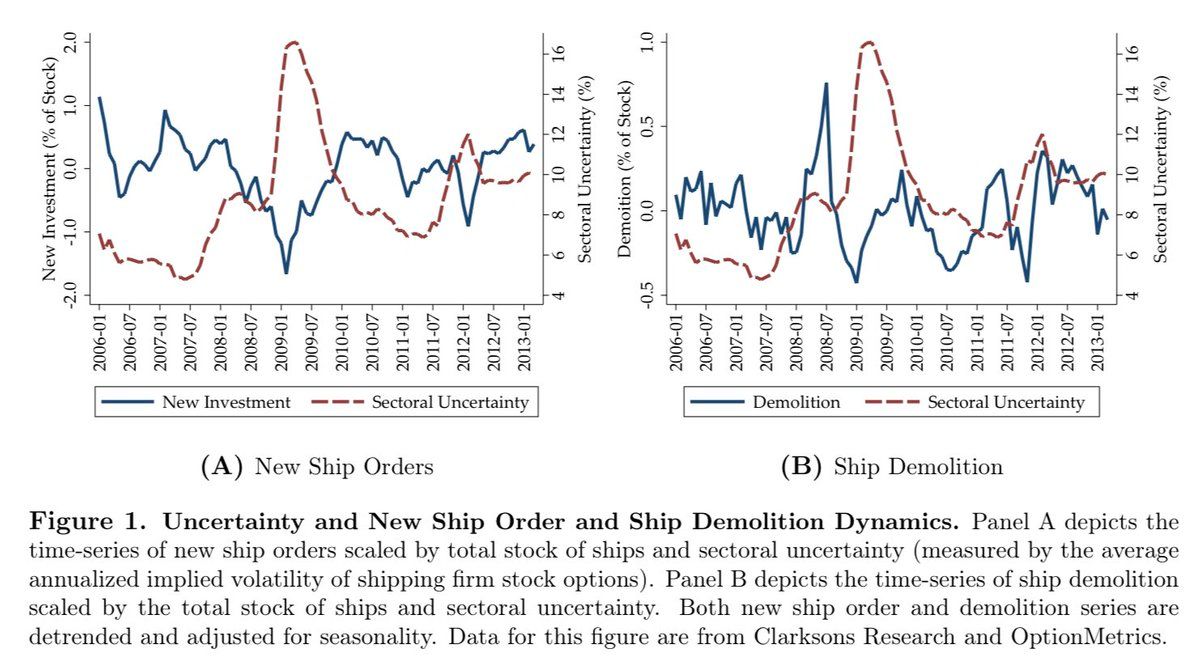

[4 cont] See also (a limited and self-serving list of references): @drewkoke: aeaweb.org/articles?id=10.1257/aer.20160131 Bloom, Bond, @johnvanreenen: academic.oup.com/restud/article-abstract/74/2/391/1574874 @lukestein and Stone: faculty.babson.edu/lcdstein/research/stein-stone-uncertainty.pdf @a_gavazza and @drewkoke: drive.google.com/file/d/0B0zgiGWo8tT2U1RENU5UX21yNm8/view

-

(I realize ☝🏻is unclear. I’M THE ONE being self-serving, not @drewkoke)

-

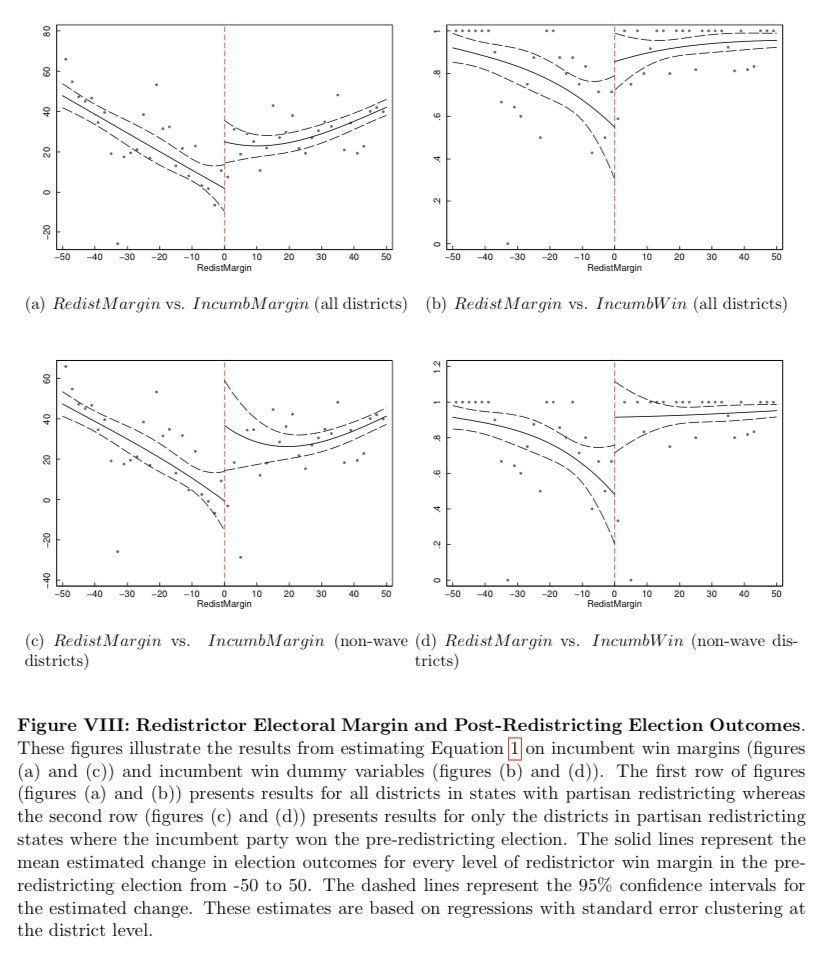

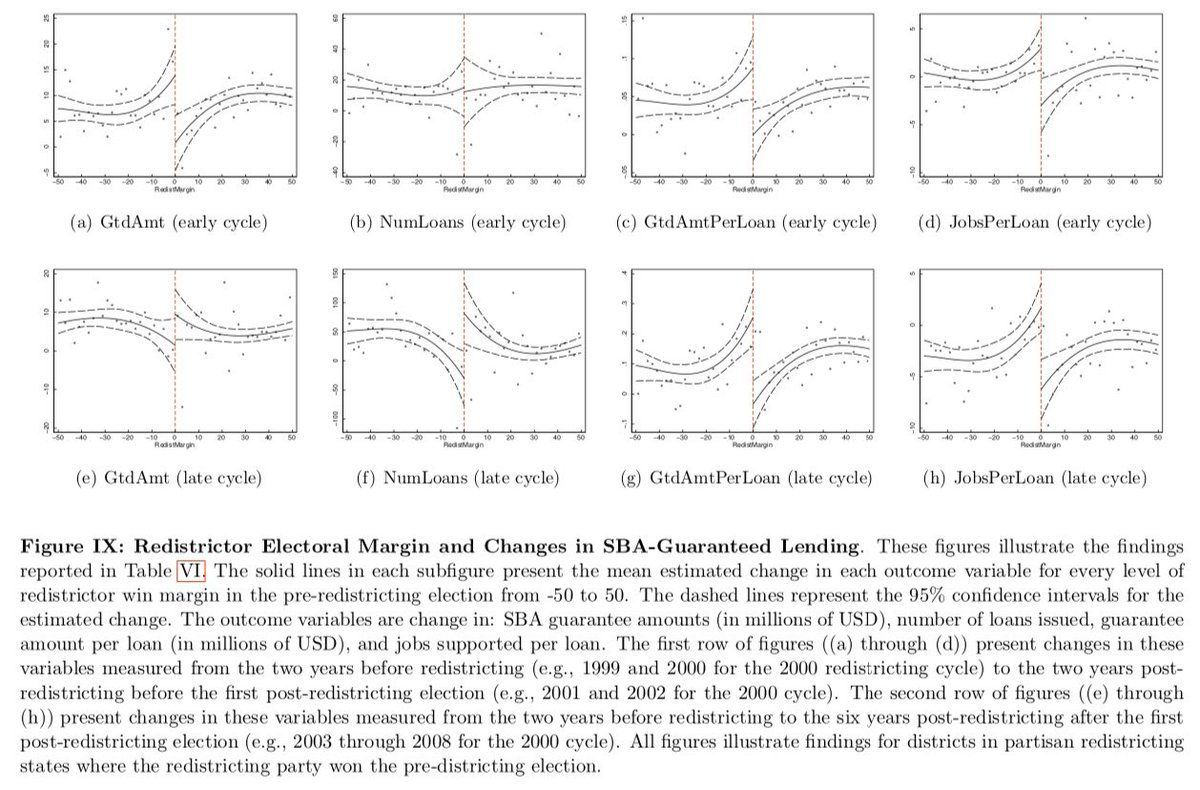

[5] Local Politics and Small Business Lending (@sahilraina and Sheng-Jun Xu): Electorally vulnerable incumbents’ districts 1. Get more SBA lending -Bigger loans, not more -Through banks more sensitive to local politics 2. SR ↑ employment and wages, but LR ↓ establisments

-

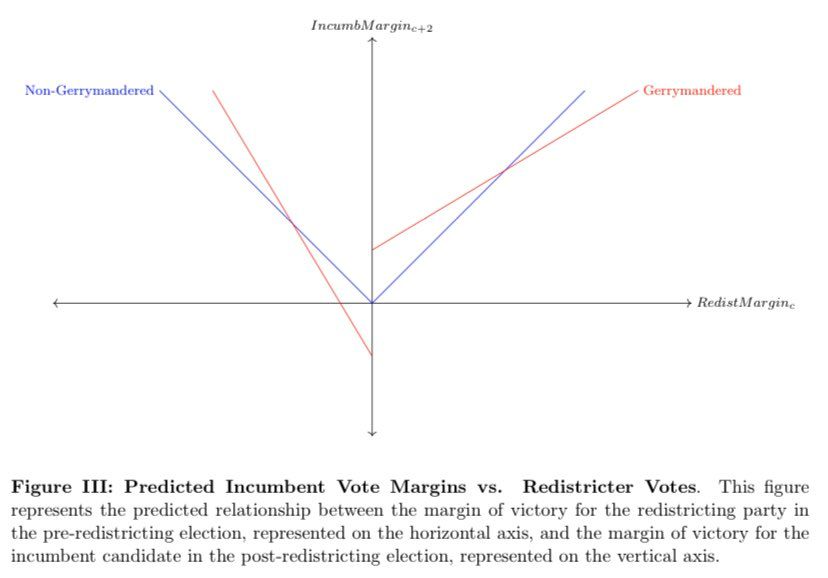

[5 cont] Awesome RDD and diff-in-RDD stragegy using close wins in *previous* elections for partisan-redistrcting and nonpartisan-redistricting states. There is SO much. Check the paper here ssrn.com/abstract=3396699 (and @sahilraina and Sheng-Jun’s other papers, too).

-

[6 cont] Data: Crunchbase, VentureXpert, Form Ds, FOIAed tax credit records Awesome, and *very* different setting from my related paper faculty.babson.edu/lcdstein/research/lindsey-stein-angelsentrepreneurship.pdf 1 Many angels/deals aren’t Crunchbase-style (mostly high-tech) 2 Marginally accredited likely ≠ marginal to tax credit

-

[6 cont] A nice discussion from @filomezza, whose paper with Sabrina Howell kellogg.northwestern.edu/faculty/mezzanotti/documents/tax_credit_hm.pdf finds many similar answers where their questions overlap. Increase in “angel activity,” but inframarginal population may NOT be the “right” ones (for some policy goals)?

-

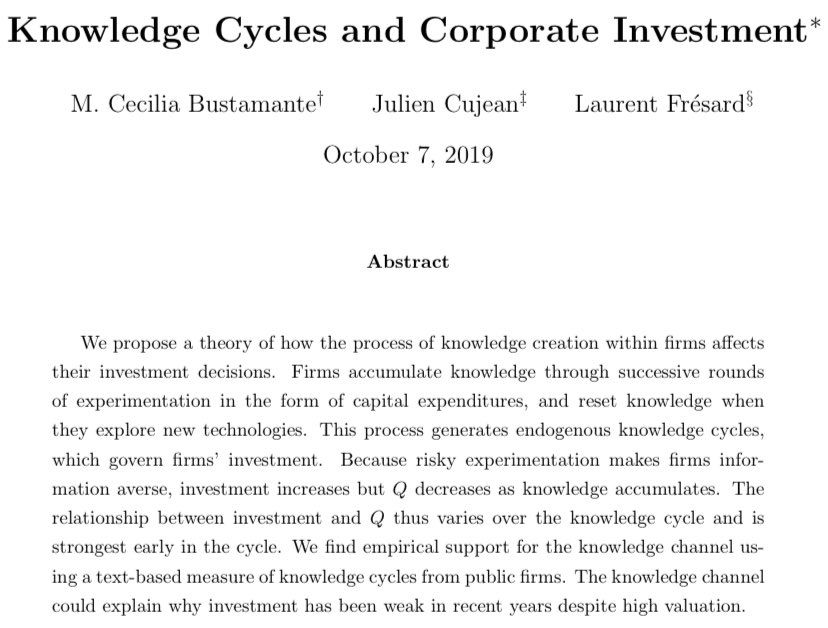

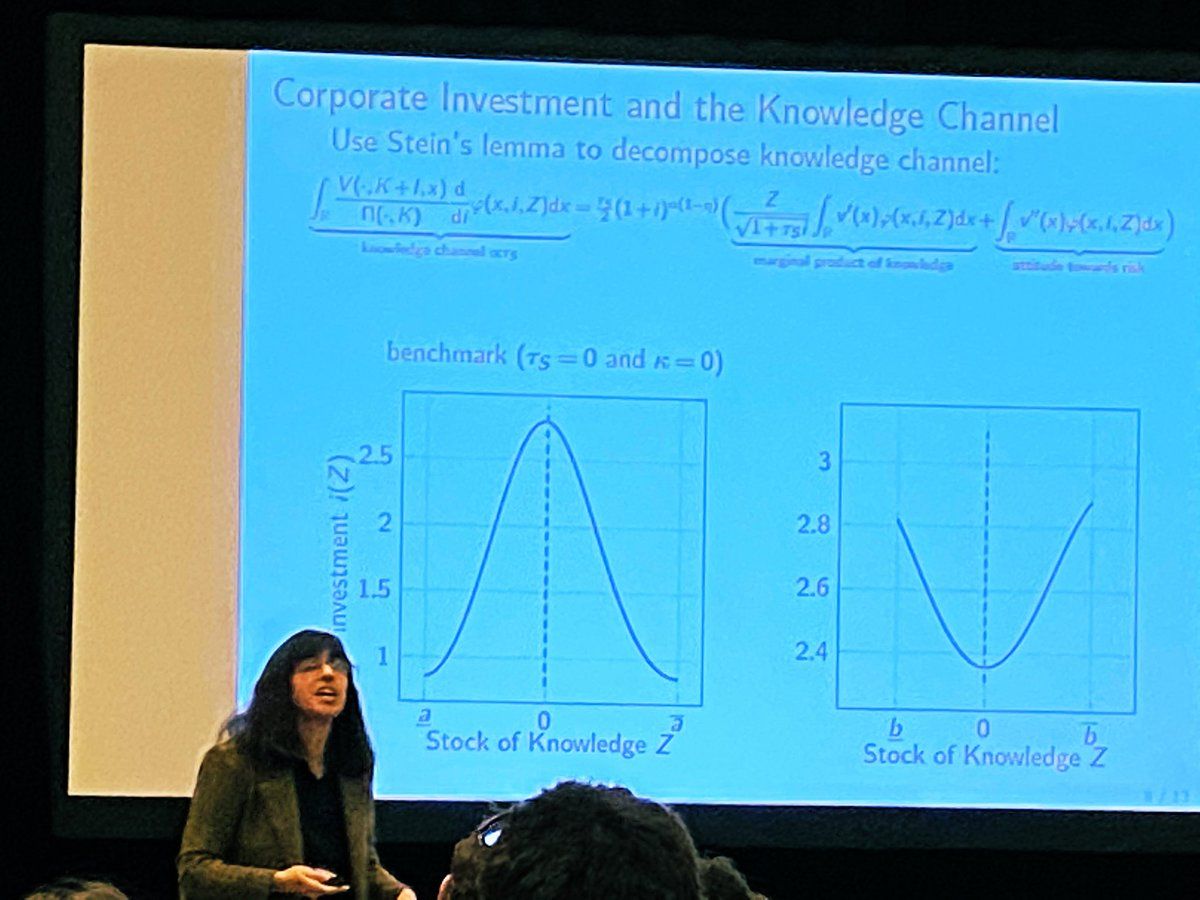

[7] Knowledge Cycles and Corporate Investment (@mcecibustamante et al): How does knowledge (an increasing share of firms’ assets) interact with physical investment? Model where knowledge NOT a typical input to production, but rather an OUTCOME of economic activity (cf Arrow 1969)

-

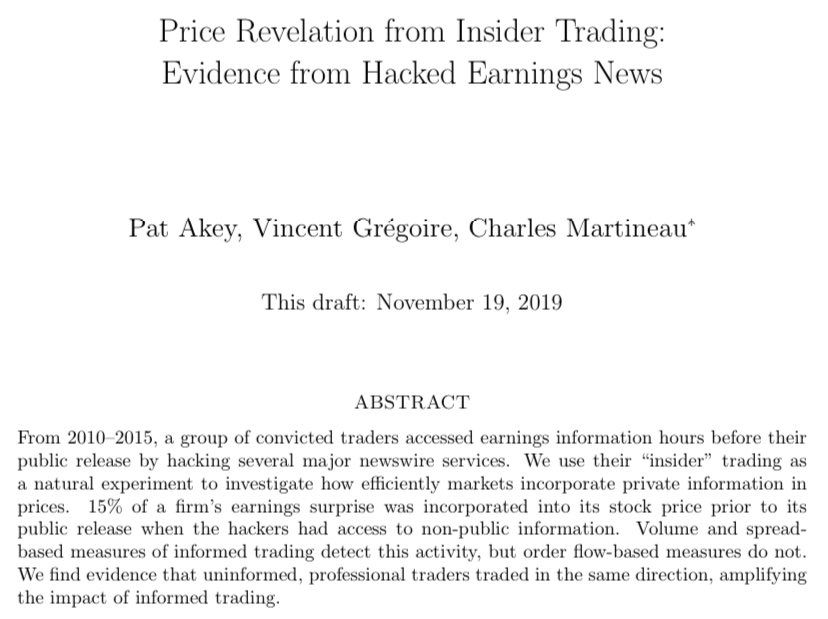

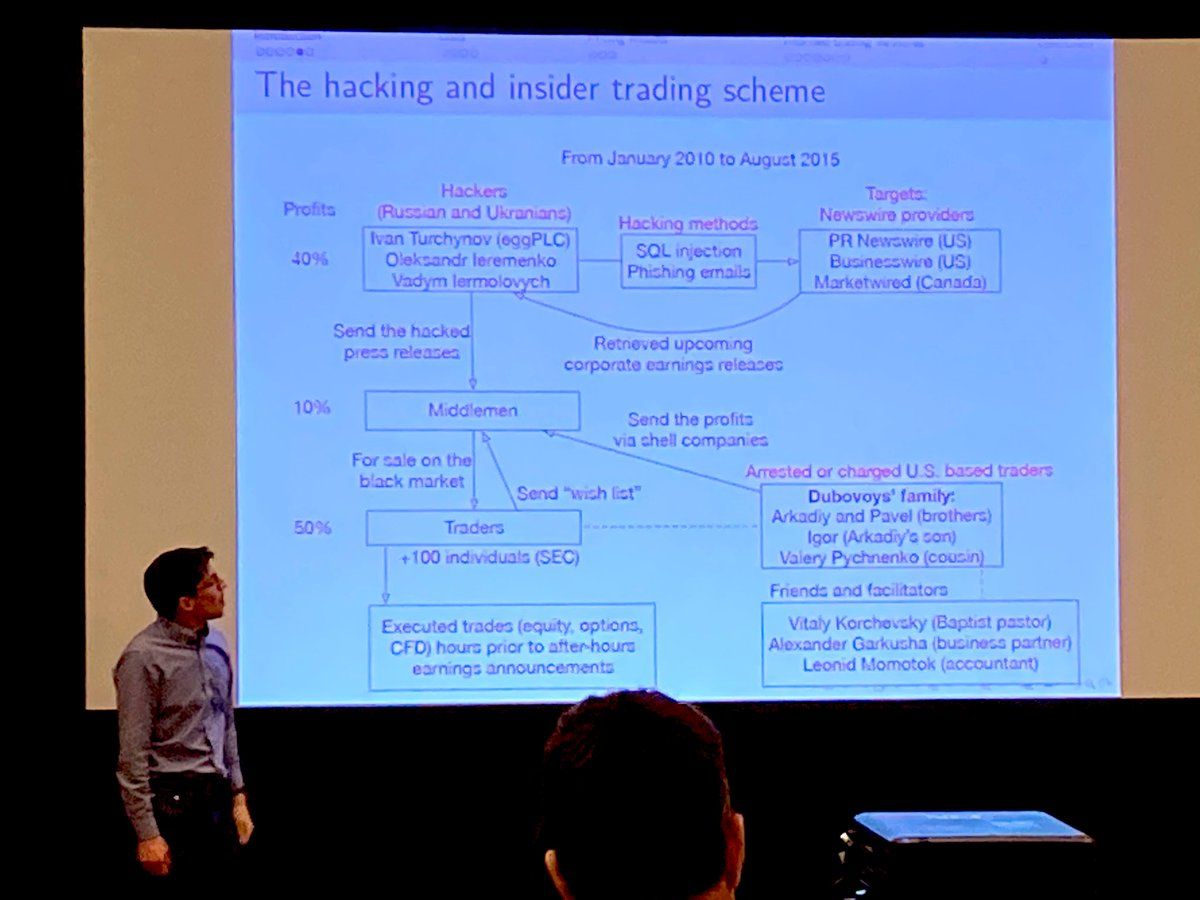

[8 cont] Big effects (price, volume, a million measures of insider trading). Including in put options markets. Hot tip: Don’t do this. Also, looks like professional/algo traders amplify these effects by following informed insiders. cnbc.com/2020/01/27/trump-foe-michael-avenatti-searched-nike-options-insider-trading.html

-

[8 cont] @FosVyacheslav with a nice discussion that connects explicitly to recent work on race bias in policing! @jonmummolo/1219694149424861184 Unlike many papers on insider trading, there’s data here on a number of *potentially* hacked announcements.👍

-

[9] Horizon Bias and the Term Structure of Equity Returns: Extend @MarkusEconomist and Parker (2005) in multi-period model. Intuition: You get utility from anticipated consumption, and have more time to enjoy anticipation for long term.

-

[9 cont] Consistent with model - More optimistic predictions over long-horizon than short- (several contexts, incl equty analyst forecasts) - Especially w. positive skewness Helps explain equity returns’ down-sloping term structure! (Beliefs; cf most discount-rate explanations).

-

[10 cont] Last up is @sophieshive (the second great discussion I’ve seen her give in the last few months @lukestein/1203448614434947072 ), incl. - Connecting factor and dividend-strip evidence - Discussing microstructure of dividend strip, which may really matter!

-

And... we’re done! If you didn’t get *quite* enough Sonoran Winter Finance Conference twitter, here’s a short thread I did last year: @lukestein/1099353776706613248

-

(Also, I apparently lied when I said I wasn’t going to live tweet the whole conference 🤷🏻♂️) @lukestein/1228346128929718272

lukestein’s Twitter Archive—№ 5,942

lukestein’s Twitter Archive—№ 5,942