-

Suppose you had a side hustle catching snails on the weekend and delivering them to a restaurant catering to French tourists. You’d love to get some sense each Saturday of how many tourists are likely to arrive over the next week so you know how much time to spend snailing. 🐌 1/ @paulgp/1236122318730125313

-

You’re in luck: It turns out that there’s an arcane organization (the Coalition of Bakery Oven Examiners, or CBOE) who publish just such a forecast, called the FIX (i.e., the “French visitors IndeX”). Their forecast isn’t perfect, but it’s on their website so 🤷♂️. 2/

-

What does this have to do with baking? Who knows and who cares?! You’ve got your forecast and it helps you with your snailing. But then you get an idea for a new side hustle. The French go on vacation in August. The FIX will go up then. You can predict it in advance! 💰 3/

-

But… you can’t make money predicting the FIX, because: The FIX is not a *price*. It’s a forecast. It’s a number on a website. You can’t buy it or sell it or hold it. So you’re back to snailing. But then you get curious; how does the CBOE come up with their forecast? 4/

-

It turns out the CBOE explains exactly how they do their forecast cboe.com/micro/vix/vixwhite.pdf . It turns out there’s a baker who makes the most amazing croissants 🥐 and baguettes 🥖 and the French tourists love them. 5/

-

It turns out that every weekend this baker prints his menu for the upcoming week. If he expects lots of French tourists, he prices 🥐🥖 high; if he expects few, he prices low. He prices to maximize profit given his demand forecast. And he’s pretty good at forecasting! 6/

-

“Ah ha,” you say. “FIX *is* a price, it’s just the price of a particular bundle of 🥐+🥖. So now I know how to make money from knowing that the French vacation in August! All I have to do is buy lots of baked goods in July when they’re cheap and then hold them for a month!” 8/

-

Of course this doesn’t work. Even though FIX *is* a price, it’s not a price of something durable. *This week’s* FIX is the price of *this week’s* 🥐+🥖. 9/ @lukestein/1233622273246015488

-

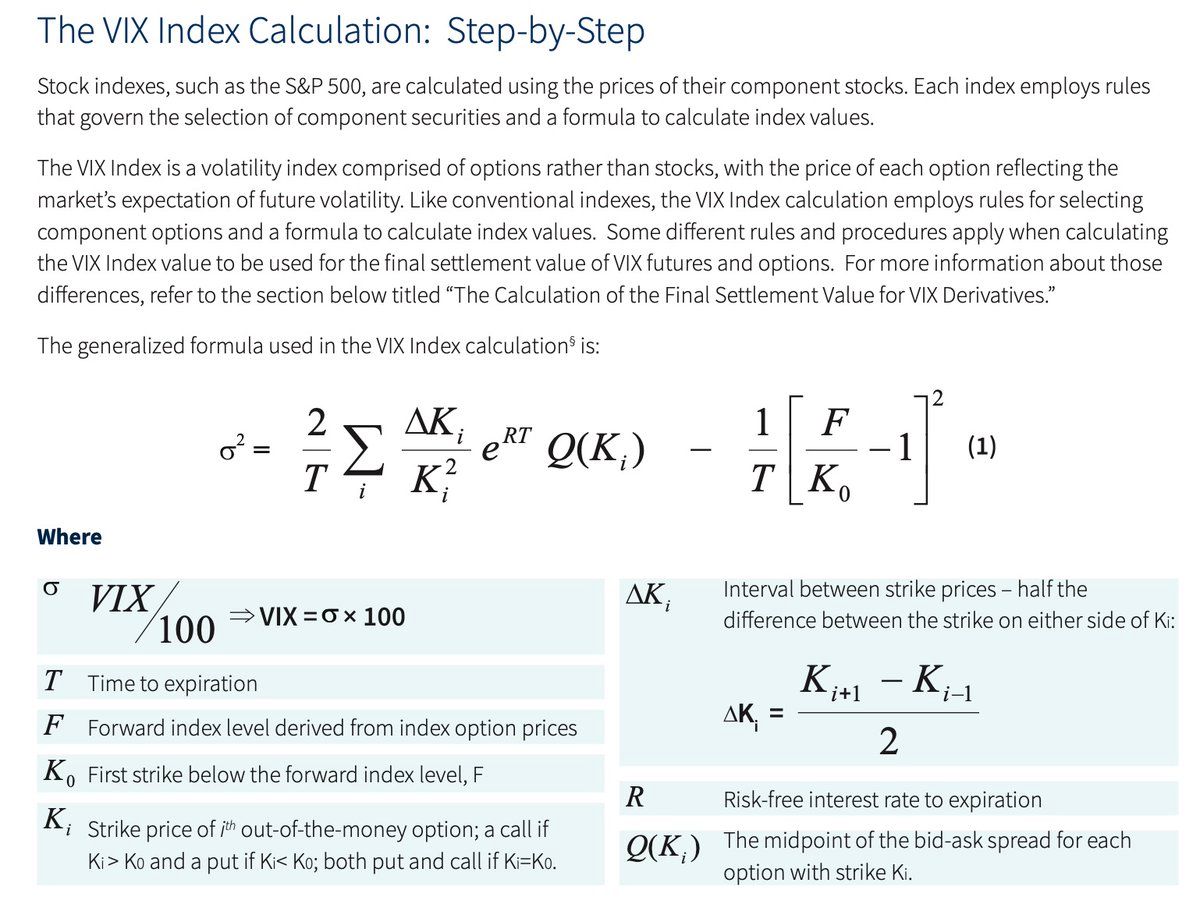

Well, the VIX is (sort of) a forecast of market volatility. But it’s really (the squarerroot of a slightly adjusted) bundle of financial options contracts. Just like 🥐🥖 are expensive when French tourists are anticipated, options are expensive when volatility is expected. 10/

-

For 🥐🥖, this is baker’s profit maximization. For options, this is no-arbitrage/stochastic calculus. And just as the baker might price high/low for reasons unrelated to 🇫🇷 tourist forecasts, option prices aren’t just determined the vol forecasts. @bennpeifert/1235684257881665537 11/

-

And thus ends the weird #econbakingvolatilitytwitter thread that @paulgp gets for posting a weird gif at a time when I’ve been thinking about vol and how to explain it. 12/12

-

A few bonus tweets about the real VIX published by the real CBOE. First off, VIX approximately forecasts the annualized standard deviation of returns on the S&P 500 index over the next 30 days. You can convert to monthly by dividing by √12 or daily… 13/ @lukestein/1053021398963298306

-

The VIX does actually forecast S&P 500 volatility; i.e., the market tends to have bigger swings (up and down) when VIX is high. 14/ @lukestein/1236104906190151680

-

There are vol indices for things other than the S&P 500 over the next 30 days (VIX). @CBOE has other horizons ($VIX9D $VIX3M $VIX6M) and other equities ($VXD $RVX $VXN $VXO). You can get vol indices on oil, or even the volatility of volatility $VVIX! 15/ @lukestein/1071160197958127616

-

Volatility tends to go up when the market is falling. (The timing is tricky, but you can think of this very roughly as “stocks go up slowly and down quickly.”) So investing in volatility can serve as a hedge (i.e, an imperfect insurance policy). BUT… 16/ @lukestein/1236090433974882304

-

…just like trying to “invest in FIX” would involve a portfolio of 🥐🥖 that are constantly going stale, “investing in VIX” involves a portfolio of options that have 30-day maturity today, but only 29-day maturity tomorrow. 17/

-

Much more in threads from @bennpeifert. He seems to write explainers on the train; start here @bennpeifert/1228479496405180416 , and if you want more, just search twitter for “train from:bennpeifert”. You may also recognize Benn’s name from his @QJEHarvard with @aprajitmahajan😉. 19/

-

And if you want to play with daily data in @Stata, you can download from @stlouisfed (which has several vol series fred.stlouisfed.org/categories/32425 ) using eg freduse VIXCLS SP500, clear or from yahoo finance using e.g., getsymbols ^VIX ^GSPC, yahoo fy(2000) frequency(d) 20/

-

So I edited this a bit and posted it (on LinkedIn, but you don’t need an account there to view or print cleanly to PDF) if that’s your jam @lukestein/1237167437490999296

-

Omg omg /26 @seanwestwispy/1700512950258164081

lukestein’s Twitter Archive—№ 6,333

lukestein’s Twitter Archive—№ 6,333