-

@AnthonyLeeZhang @ben_golub I'm not really the expert on this (🏷@bennpeifert) but there are at least a few things going on—some, but not all, in the spirit of what you wrote Anthony. 1/

-

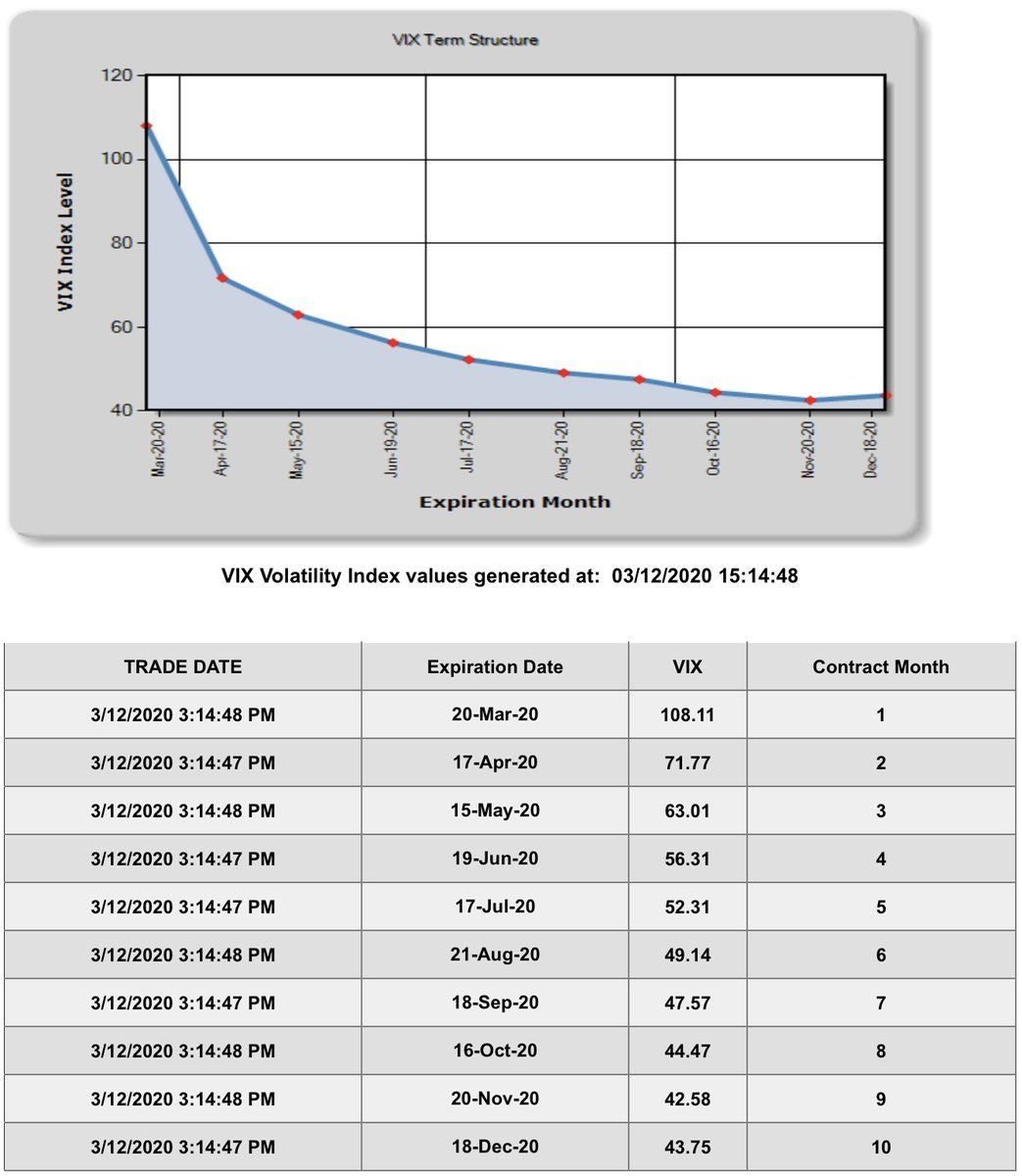

@AnthonyLeeZhang @ben_golub @bennpeifert One thing is that the VIX's 30 day horizon is actually an interpolation (and sometimes extrapolation, I think!) from a sloped volatility term structure. Definitely can't just take the VIX as an annualized vol forecast. 2/ cboe.com/trading-tools/strategy-planning-tools/term-structure-data

-

@AnthonyLeeZhang @ben_golub @bennpeifert Another is that the VIX isn't really (just) a vol forecast, since e.g. demand for "volatility" as a hedge creates a vol risk premium. 3/

-

@AnthonyLeeZhang @ben_golub @bennpeifert Also, the VIX model only "forecasts" the standard deviation of the underlying if returns were expected to be log-normal, which they aren't. (cf smile ≈ fat-tailedness and smirk ≈ asymmetry). 4/4 N.B., world: This isn't me *correcting* Anthony, just trying to add some nuance.

lukestein’s Twitter Archive—№ 6,529

lukestein’s Twitter Archive—№ 6,529