-

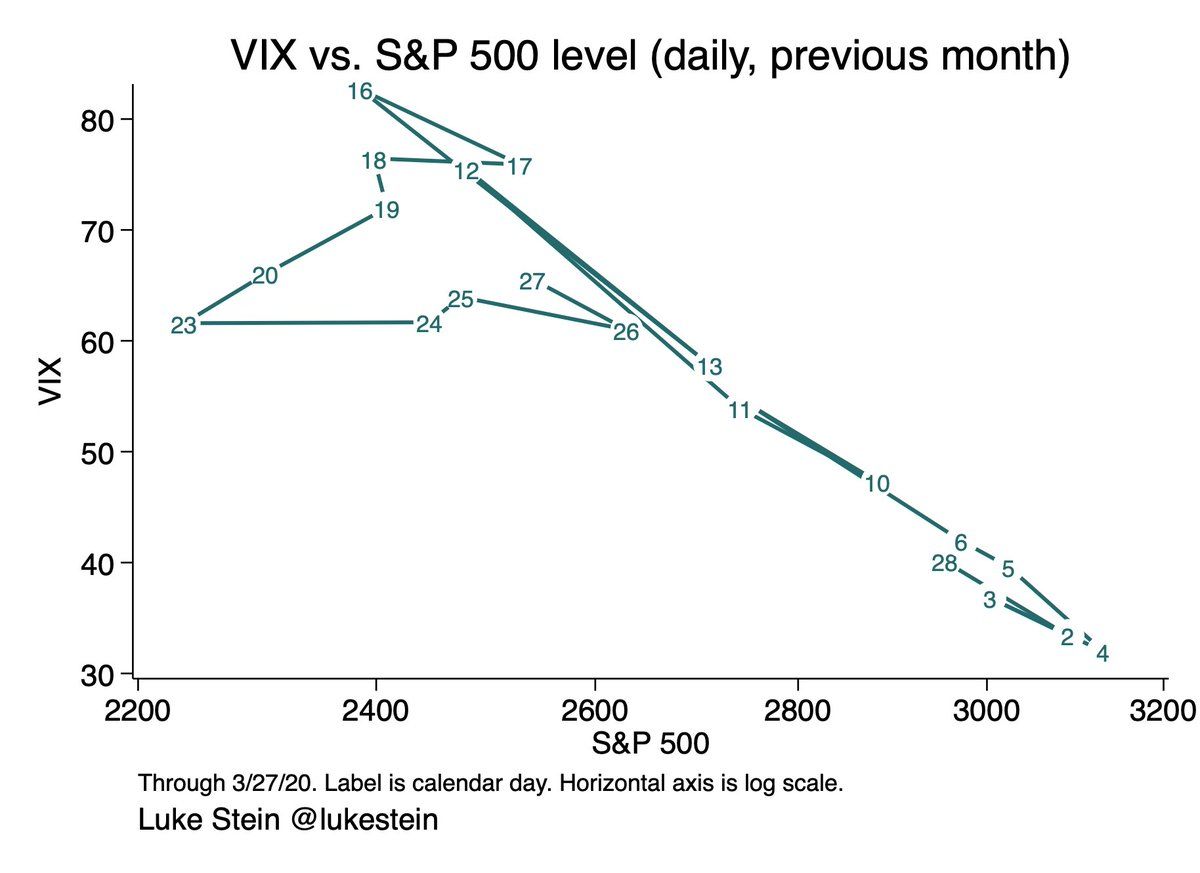

As usual, a great volatility explainer thread from Benn👇. It’s true that the market and VIX *usually* have a negative relationship. (The market tends to fall faster than it rises, there may be more hedging demand during downturns, …) But… 1/4 @bennpeifert/1243675911578193921

-

… markets *can* rise quickly, and volatility—both realized and implied—can be high during rallies. As it is now! The relationship between VIX and the market is NOT always linear. Not even close. @lukestein/1240293950394531840 However, if you started paying attention recently… 2/4

-

…the (negative) VIX–market relationship probably looked *very* linear. In fact, as of ten days ago, the linearity was arguably the strongest it had *ever* been in the VIX’s 30-year history! @lukestein/1240291827791482880 But that was ten days ago. Things change, and… 3/4

-

…it’s been… different. From a VIX near historic highs, it fell at the same time markets did. We had three of the ten largest ever “weird” VIX declines (relative to market returns). @lukestein/1242206581967609857 And with markets *rising* unusually quickly, vol remains high. 4/4

lukestein’s Twitter Archive—№ 7,080

lukestein’s Twitter Archive—№ 7,080