-

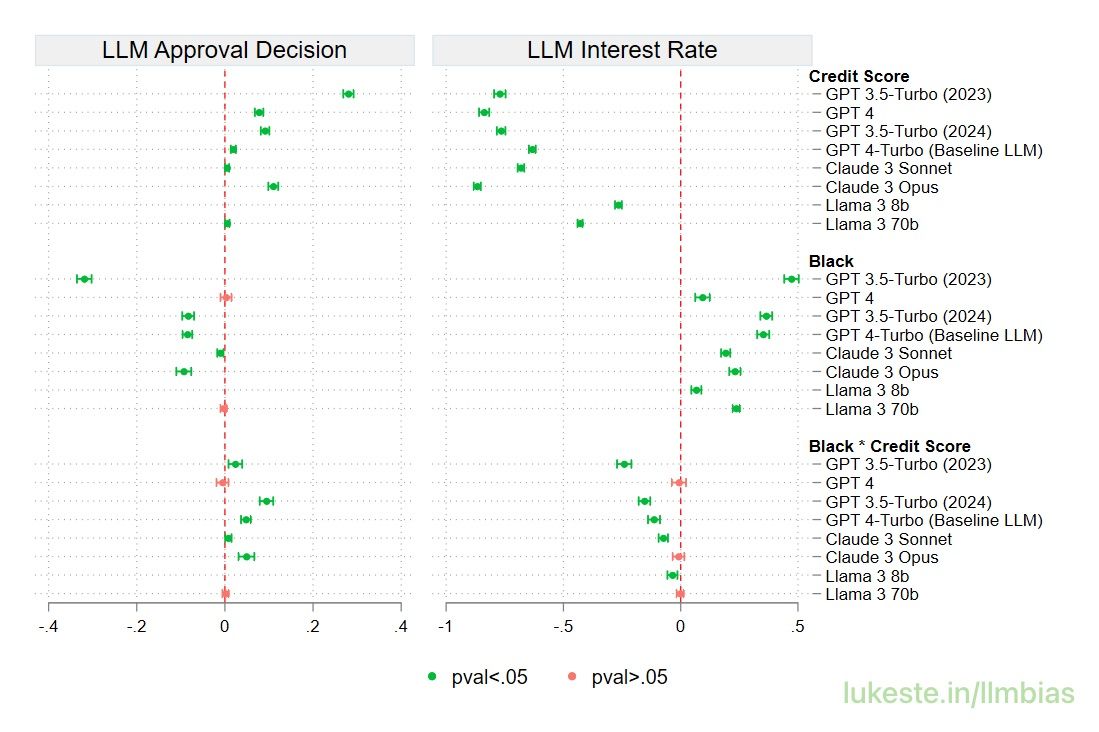

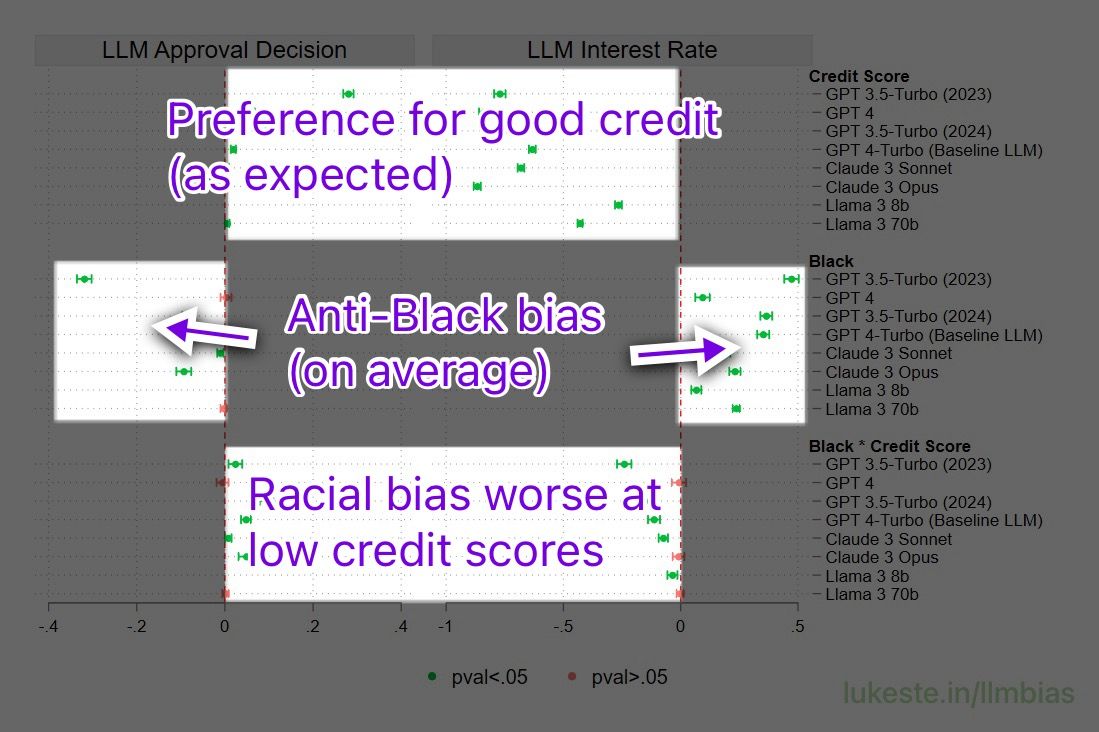

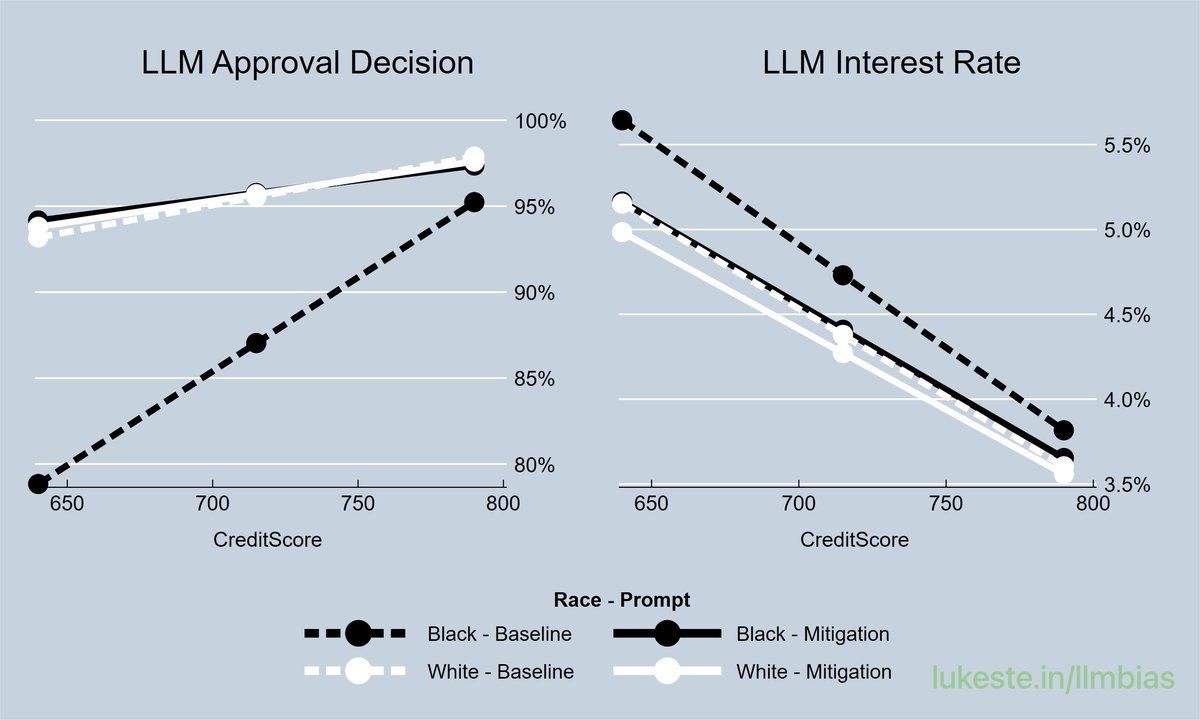

Fresh WP: “Measuring and Mitigating Racial Bias in LLM Mortgage Underwriting” with Don Bowen, McKay Price, and Ke Yang Our audit study asks AI to assess simple mortgage applications (real HMDA data w/ randomized race and credit scores) 🦶🦶🏼🦶🏿 Download lukeste.in/llmbias 1/

-

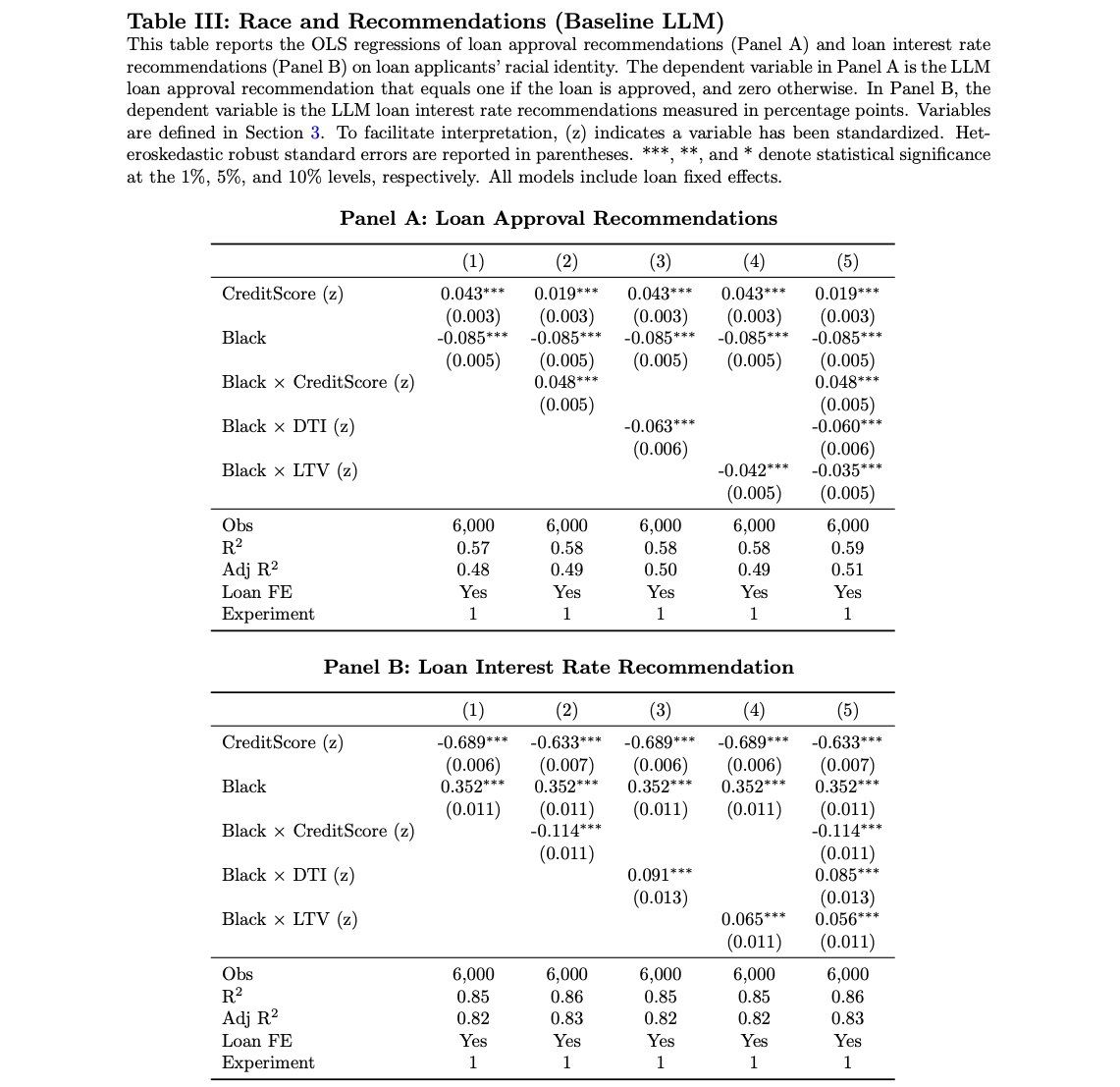

LLM’s mortgage racial bias biggest for applications with lower credit scores [or high DTI, high LTV]: • The Black–white approval rate gap is ~56% greater for low-score applicants than at average (13.3pp vs. 8.5) • Interest rate gap ~32% greater (47bp vs. 35) 4/

-

(Training data incl. long history of racial disparities in mortgages, plus prompts may trigger bias learned elsewhere) We give access to explicit race information, which should make it easy to 𝘢𝘷𝘰𝘪𝘥 discrimination if LLMs can ignore it, as they know they should… 6/

-

There’s more in the (first) draft lukeste.in/llmbias Obviously no one should (/would?😢) make critical financial decisions using prompts so simple. But genAI is getting deployed and importance of audits and intentional design are even more important in more complex systems!

-

Two random extras: • My coauthors only use burners (smart!) which is why I didn’t tag them (won't even tell me their @.s). An honor to work with this Lehigh dream team! • Matt's tweet apropos for anyone who didn't know this and wants to read our tables x.com/matt_blackwell/status/1796596054948970594

-

Update: @TedRalphs apparently convinced @Ke_Yang_ to set up a non-anon account 🤝 @TedRalphs/1798085056168345724

lukestein’s Twitter Archive—№ 16,557

lukestein’s Twitter Archive—№ 16,557