-

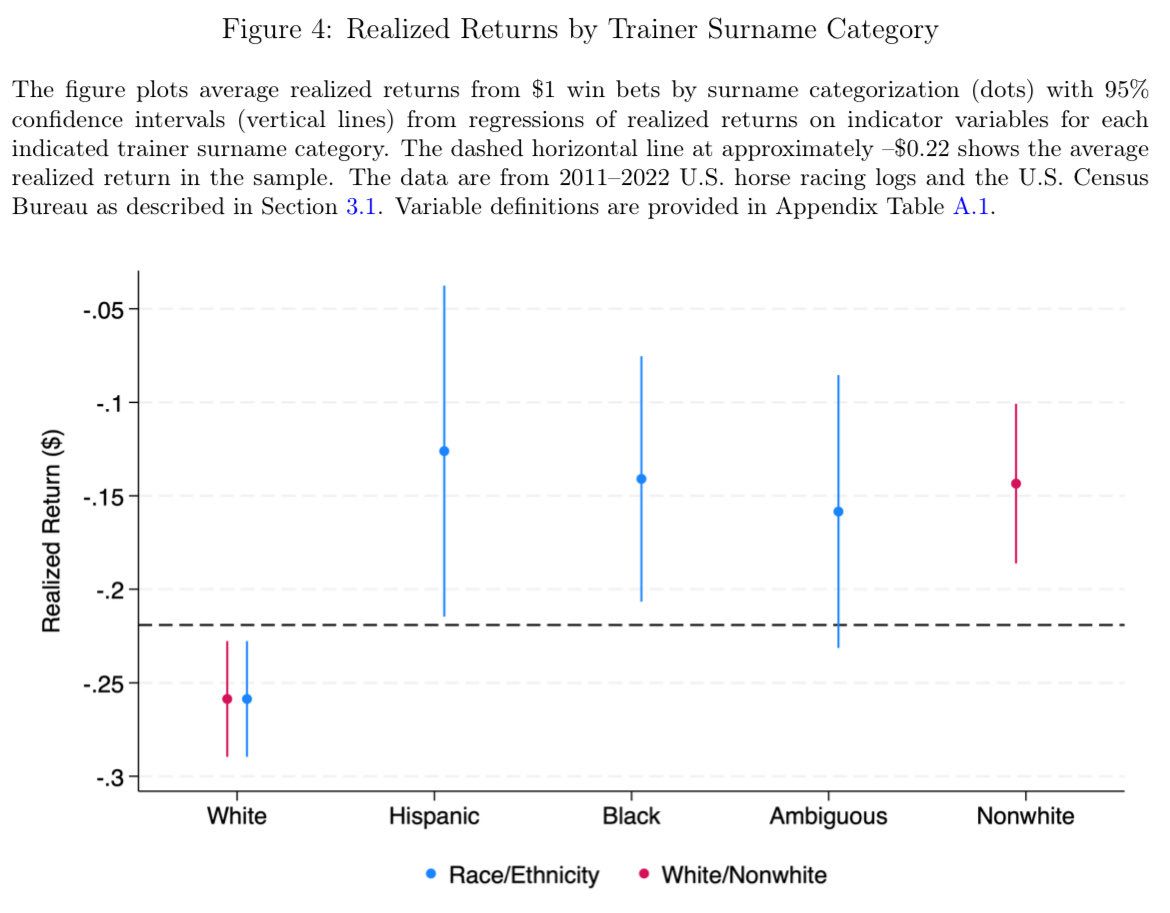

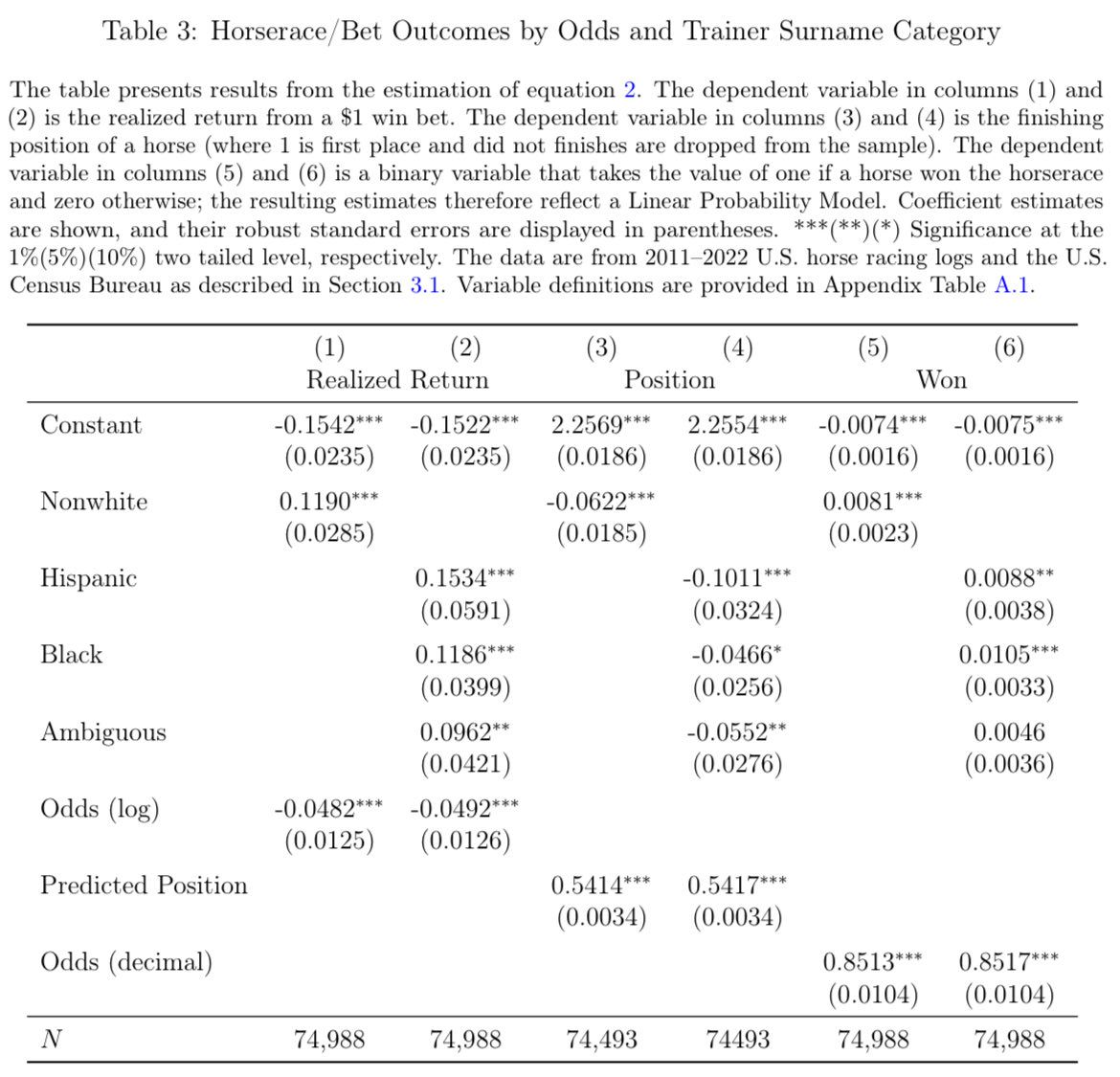

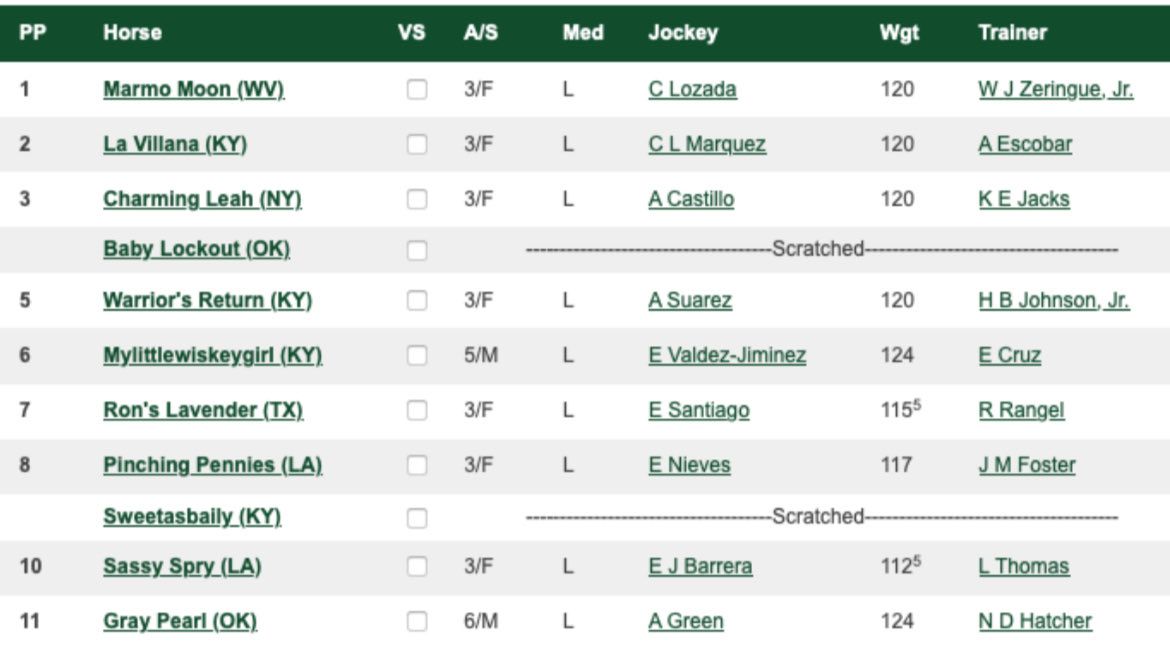

🧑🏾🐎🧑🏽🐎🧑🏼🐎 New: “Racial discrimination in asset prices: Evidence from horse betting” w/ @SpencerBarnes99 If gamblers underestimate minority trainers (or just don’t 𝘭𝘪𝘬𝘦 them), their horses may generate higher risk-adjusted returns! Download WP lukeste.in/horsebetting 1/7

-

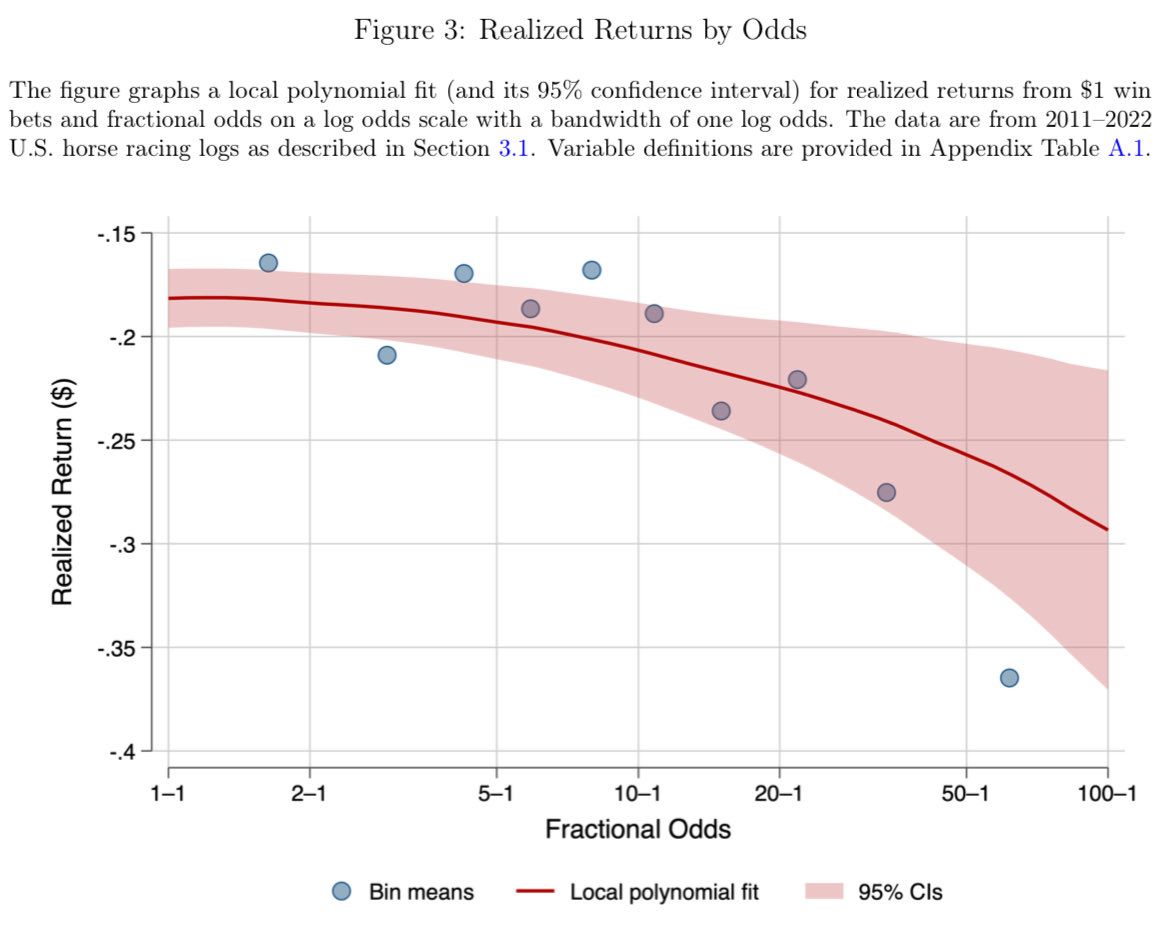

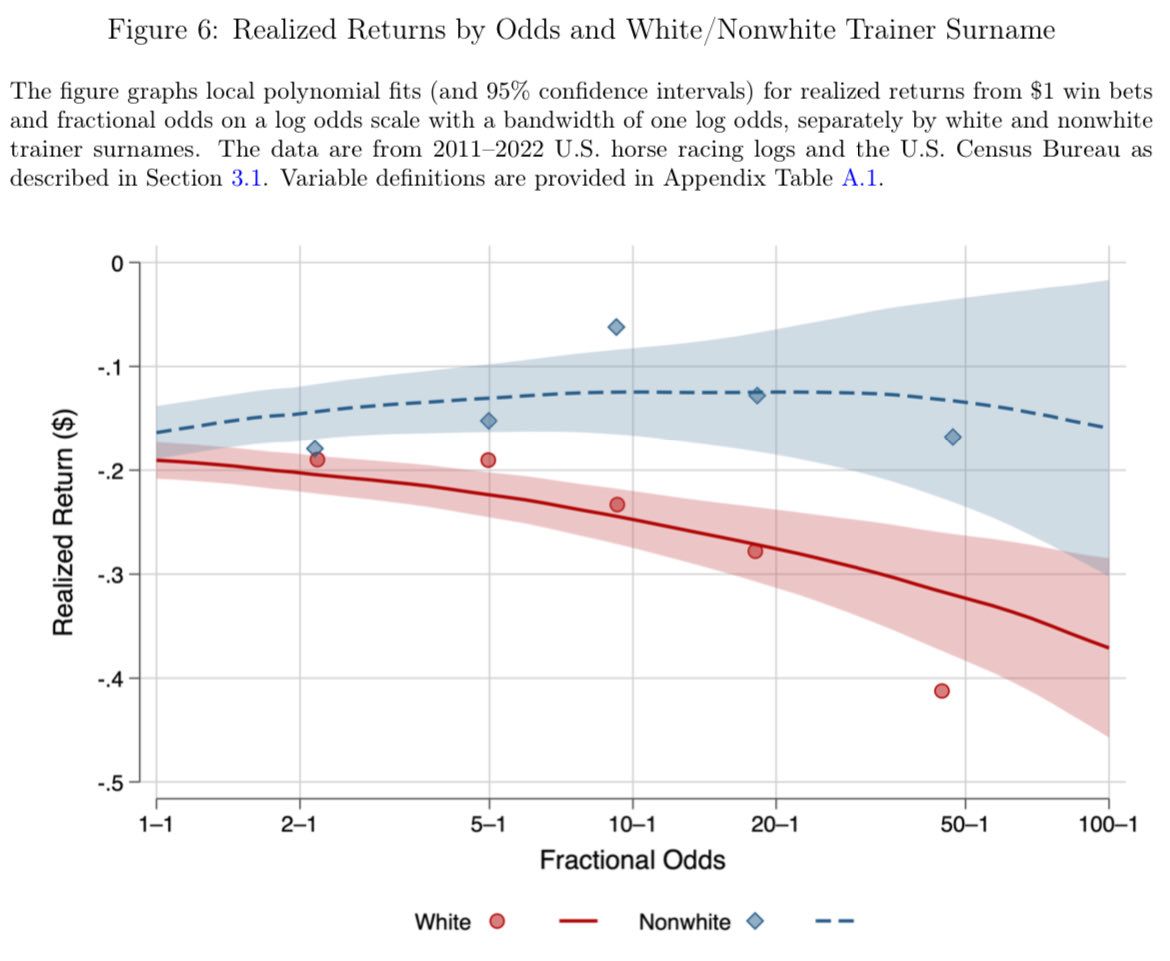

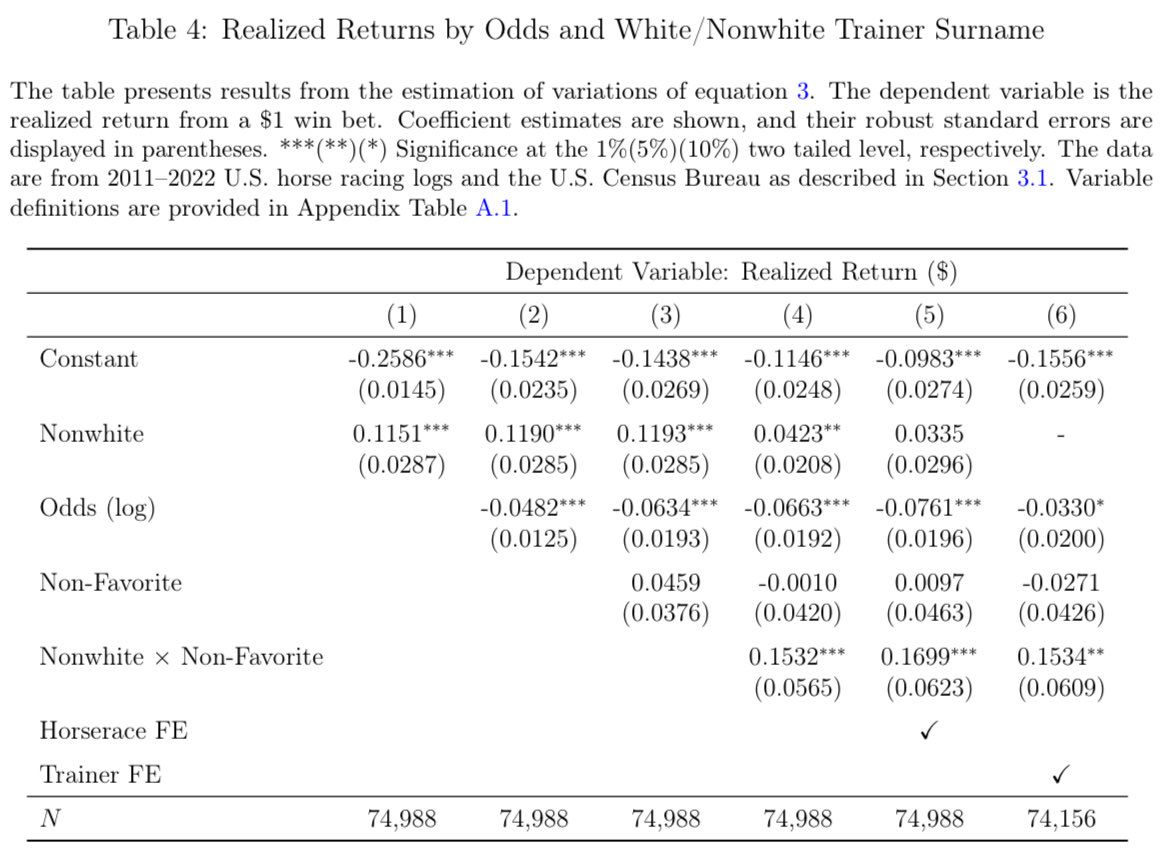

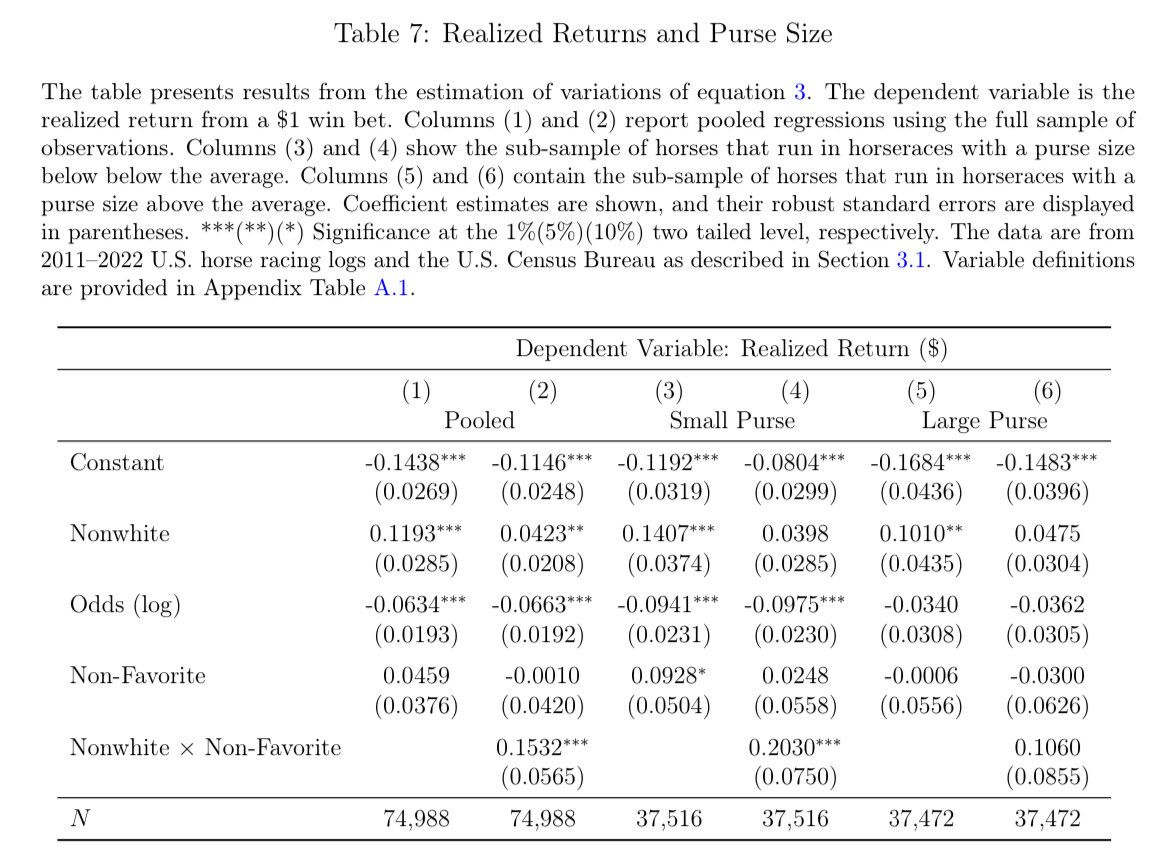

As usual with finance, we have to think about 𝙧𝙞𝙨𝙠 as well as returns Among the best-known 🐎 regularities is the “favorite-longshot bias” (FLB) where risky bets generate very negative returns—big lit incl. @JustinWolfers and Snowberg journals.uchicago.edu/doi/10.1086/655844 3/

-

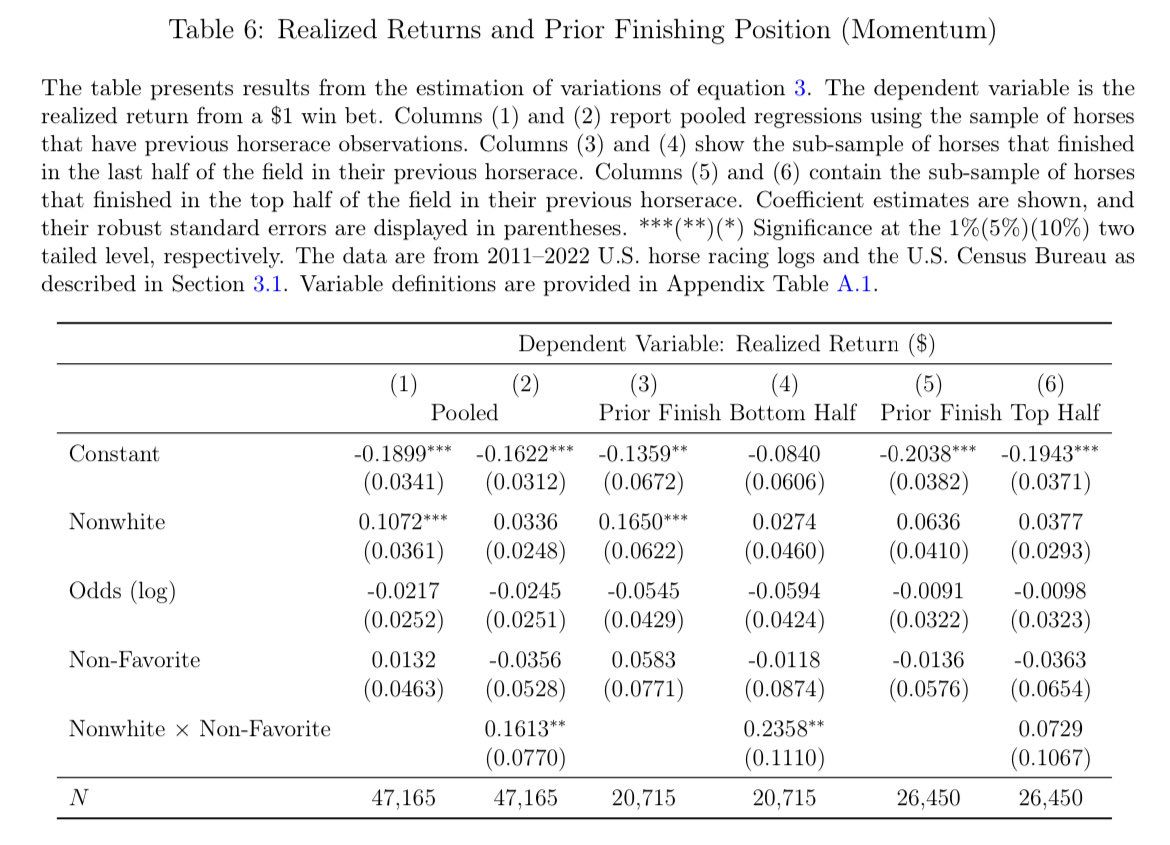

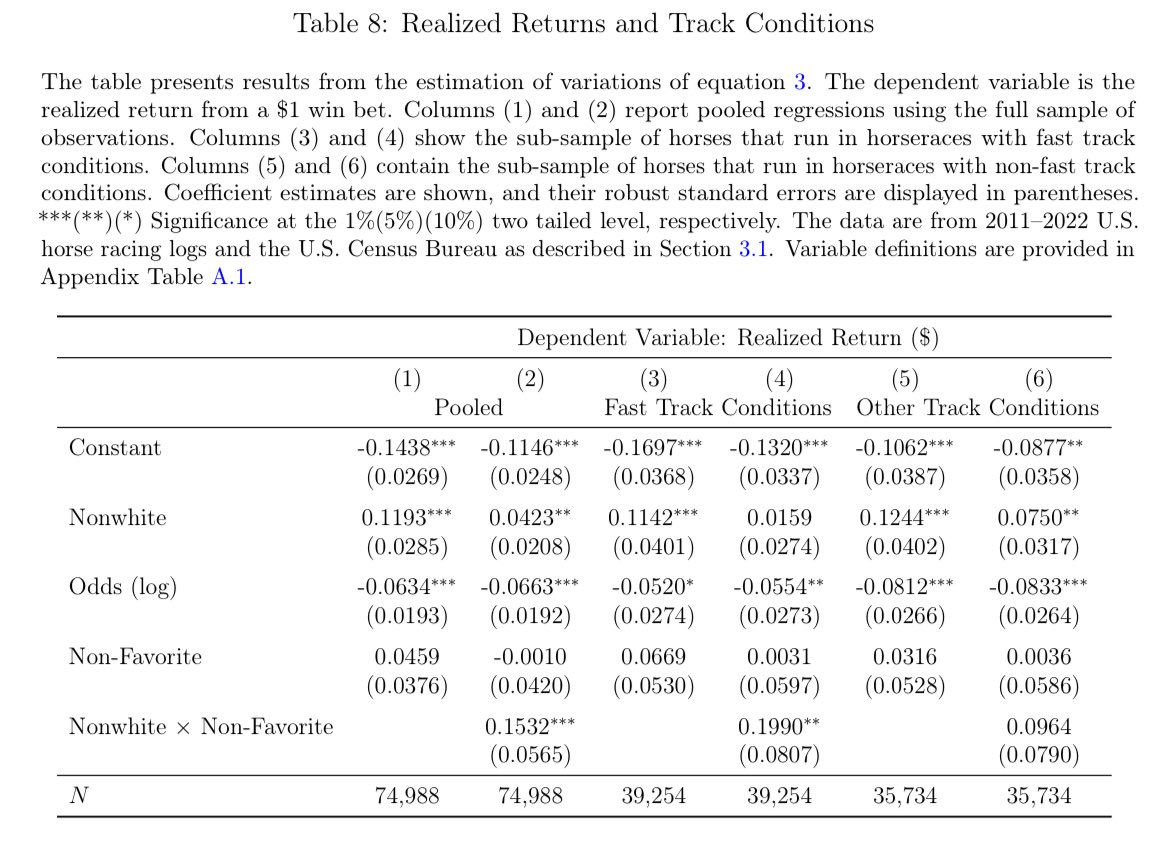

@JustinWolfers Because longshots lose more money, they should attract unsophisticated and less informed bettors And that’s exactly where racial/ethnic bias has big pricing impacts! tl;dr: Looks like unsophisticated discriminators drive down returns on long shots with white-named trainers 4/

-

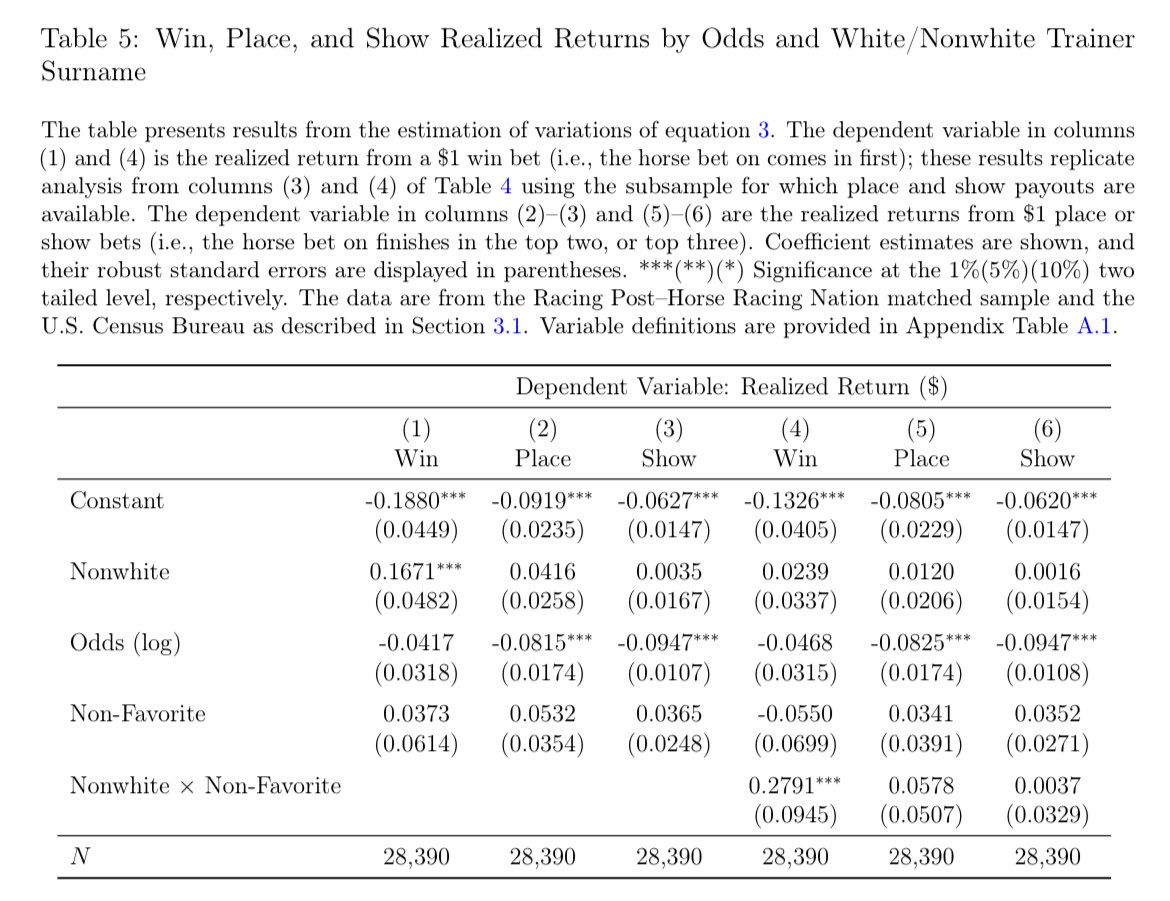

@JustinWolfers Racial/ethnic return differences are stronger— overall and especially among longshots where bettors may be less informed/sophisticated or limits to arbitrage stronger: • “Win” vs. “place” and “show” bets • Horses w/ poor prior performance • Low-stakes • “Fast” conditions 5/

-

The whole paper’s about horse racing, but we think there are some lessons about where else bias may affect asset prices: markets with unsophisticated or poorly-informed investors and limits to arbitrage 6/

-

Thanks for reading 🙌 @SpencerBarnes99 and I have had a ton of fun on this and I’ve learned a lot working with him Download link🔗 and retweet button🤌 in the first post quoted here for your convenience👇 @lukestein/1824244024699457716

lukestein’s Twitter Archive—№ 16,798

lukestein’s Twitter Archive—№ 16,798