-

Really looking forward to spending two days at the 2019 Northeastern University Finance Conference. Thanks so much to @nikir1 and her @NU_Business colleagues for having me. Thread warning; mute if boring. damore-mckim.northeastern.edu/events/finance-conference-2019/ #NUfin2019

-

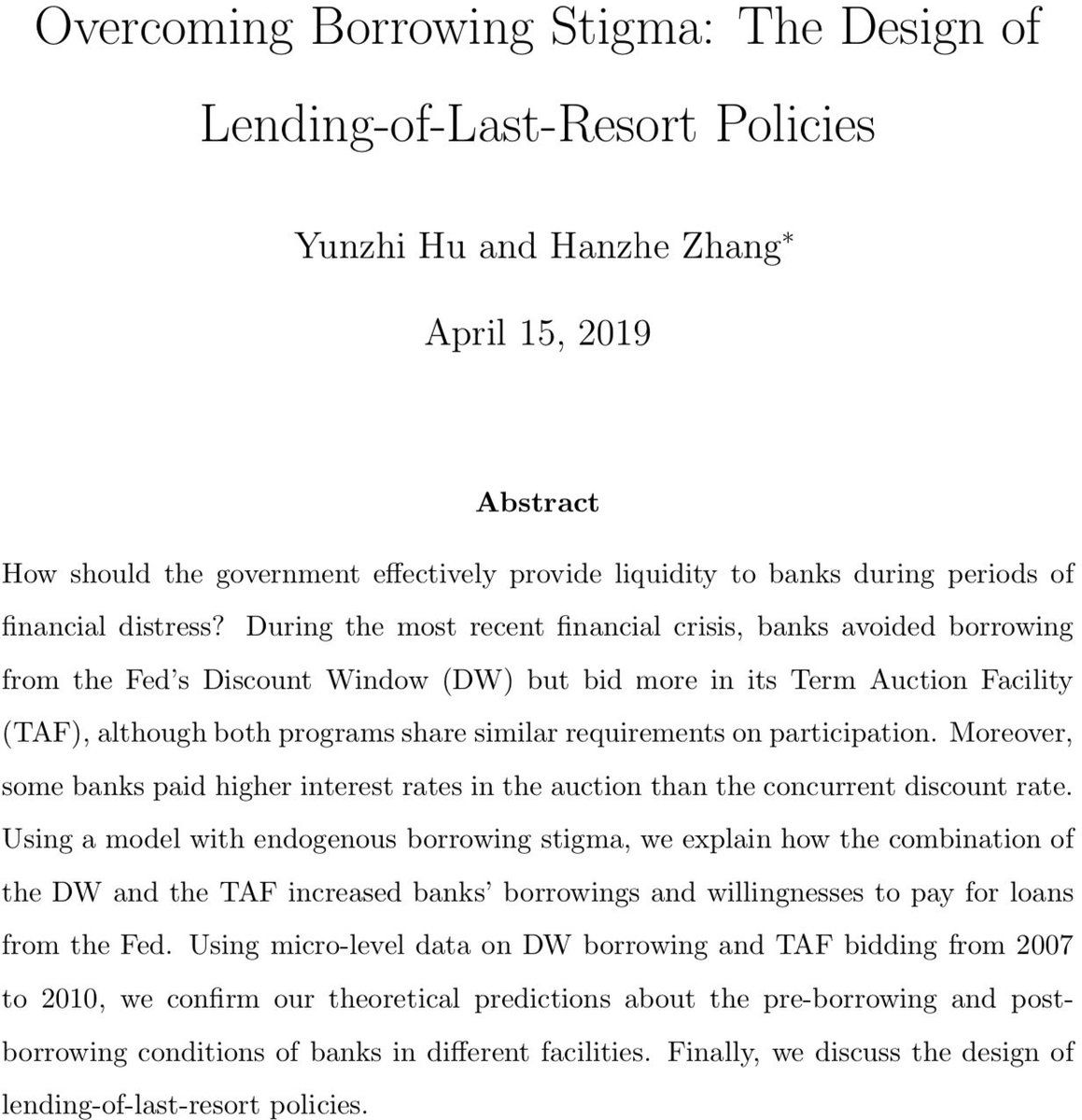

PAPER 1: “Overcoming Borrowing Stigma: The Design of Lending-of-last-resort Policies” by Yunzhi Hu (@kenanflagler) with Hanzhe Zhang (@MSUBroadCollege). Model of discount window stigma and the term-auction facility, with confirmatory empirical evidence. #NUfin2019

-

Endogenous sorting of banks → lower quality use discount window, higher quality use TAF. Robin Greenwood (HBS) discussion asks whether “stigma” = “signal”? And looks like TAF premium right after Lehman was largely large foreign banks. Why? #NUfin2019

-

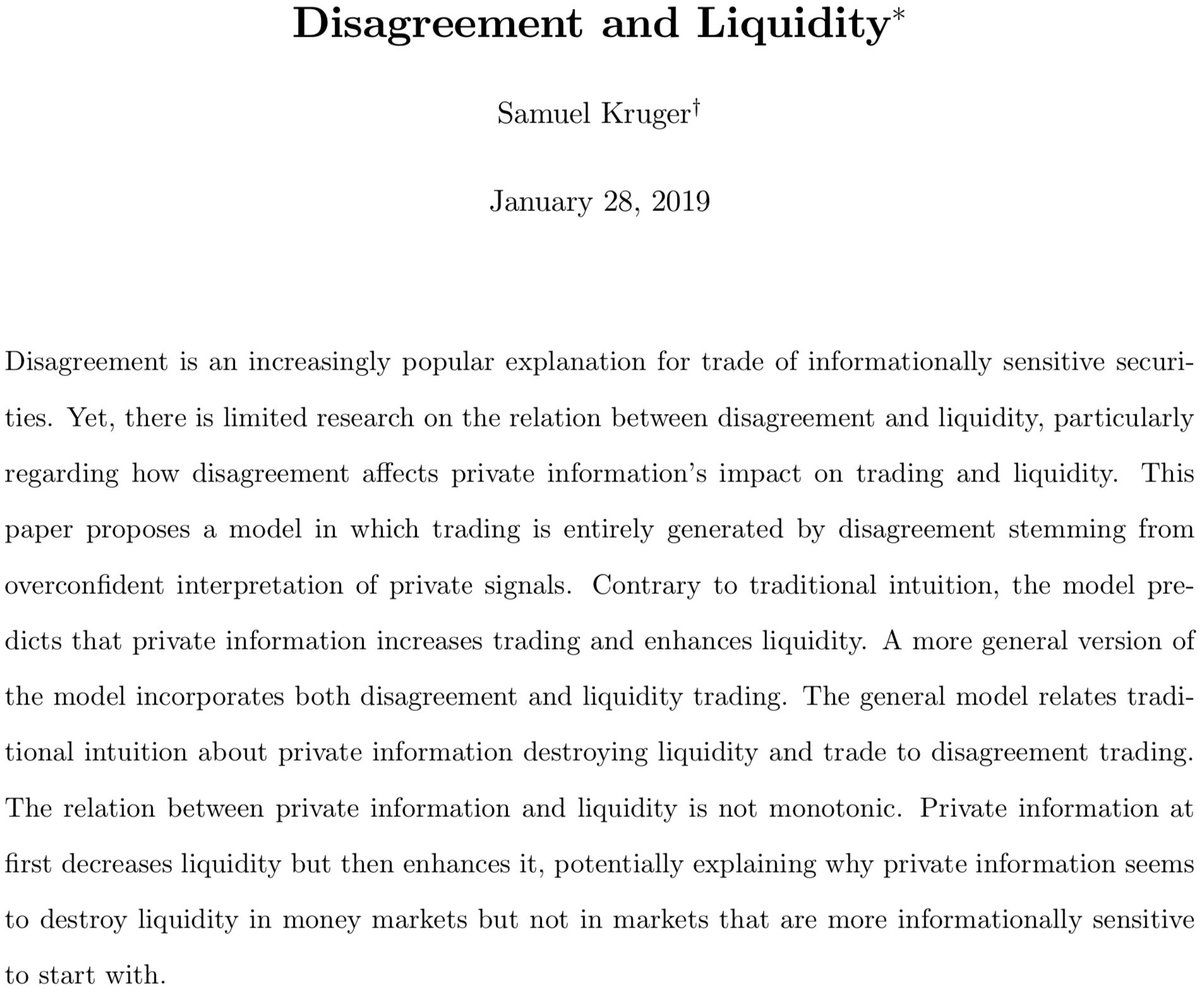

PAPER 2: “Disagreement and Liquidity” by Samuel Kruger @UTexasMcCombs Model (≈Grossman ’76+overconfidence)→ -Trade entirely overconfident disagreement? Private info inc. trade and liquidity. -Some trade from liquidity shocks? Liquidity non-monotone in private info. #NUfin2019

-

Ronnie Sadka @BCCarrollSchool discussion. Runs a cool new analysis: try to precict So and Johnson (Mgmt Sci ’18) market asymetry information measure using analyst dispersion (private) vs. Ravenpack media coverage disagreement (private). doi.org/10.1287/mnsc.2016.2608 #NUfin2019

-

PAPER 3: “Persuasion in Relationship Finance” by Ehsan Azarmsa with Lin William Cong (both @ChicagoBooth) and Uday Rajan (@MichiganRoss). How should entrepreneurs finance experimentation? Model of staged financing with imperfect competition between potential funders. #NUfin2019

-

CORRECTION🤦🏻♂️: Uday Rajan (@MichiganRoss) is discussant not coauthor Azarmsa/Cong model suggests 1. Endogeneous info production matters 2. Outsiders are important 3. Interim competition improves info production 4. Optimality of warrants on convertible securities #NUfin2019

-

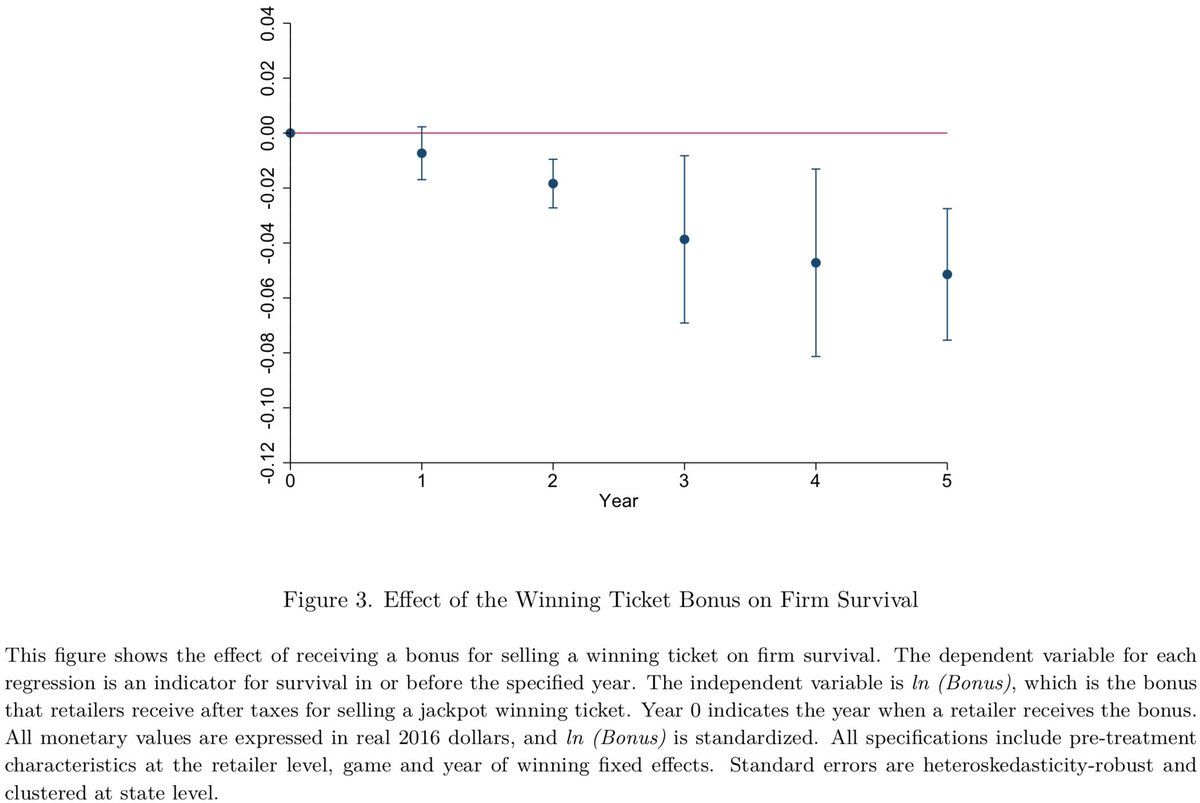

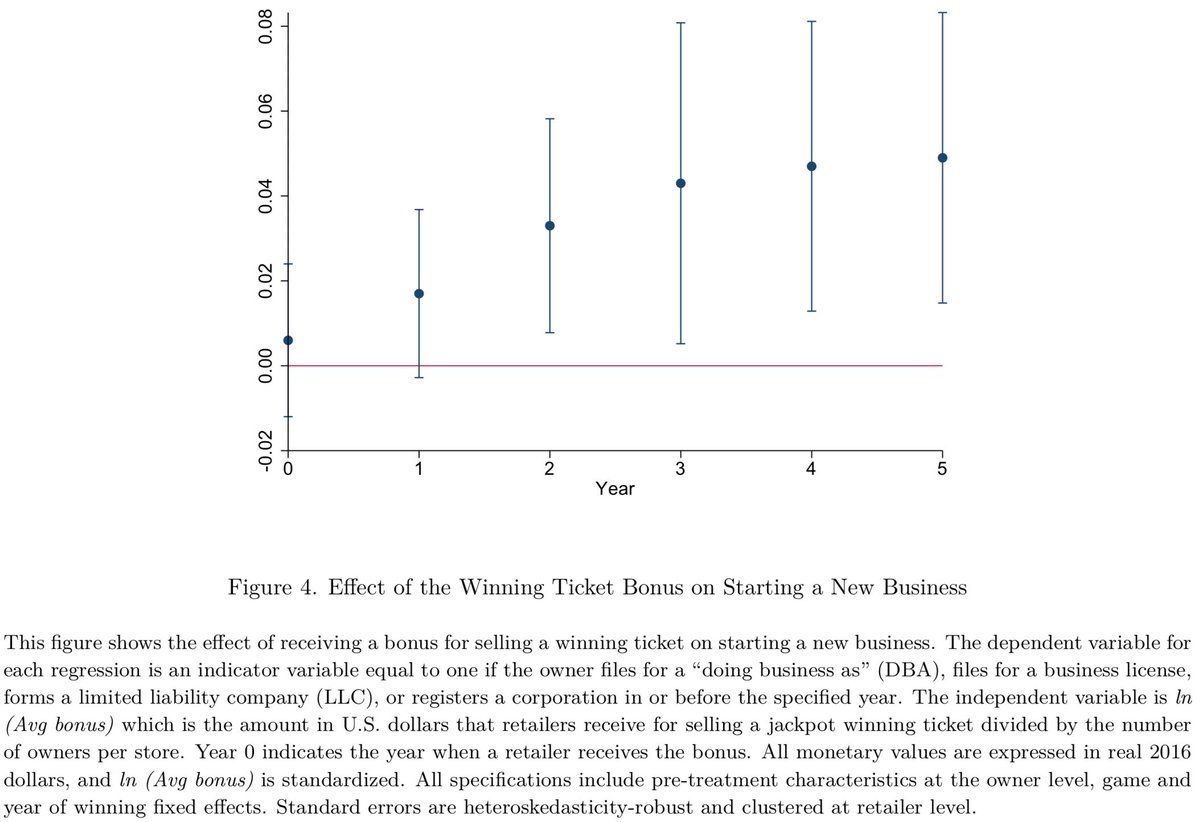

PAPER 4: “More Cash Flows, More Options? The Effect of Cash Windfalls on Small Firms” by Jacelly Cespedes (@CarlsonNews) with Xing Huang (@WUSTLbusiness) and Carlos Parra (@ucatolica) @arpitrage did a nice thread on this paper a few weeks ago. @arpitrage/1121798183640813568 #NUfin2019

-

I’ll get to the paper, but note I met Jacelly when she presented as a PhD student at the Colorado Finance Summit. (At same great conference I met @paulgp, @sgil1122, and @EmilVerner for the first times). She’s a great scholar and presenter. sites.google.com/site/coloradofinancesummit/2017-program #NUfin2019

-

Discussion by Edie Hotchkiss @BCCarrollSchool. Thinks about distinguishing financial illiteracy from credit constraints. Founded business not necessarily capital intensive… #NUfin2019

-

Not enough time for all the great audience questions. One thing I wonder (but couldn’t ask): Given that these bonuses are public—and in fact there’s associated marketing of stores that sold winners—how much is getting captured by stores’ landlords? #NUfin2019

-

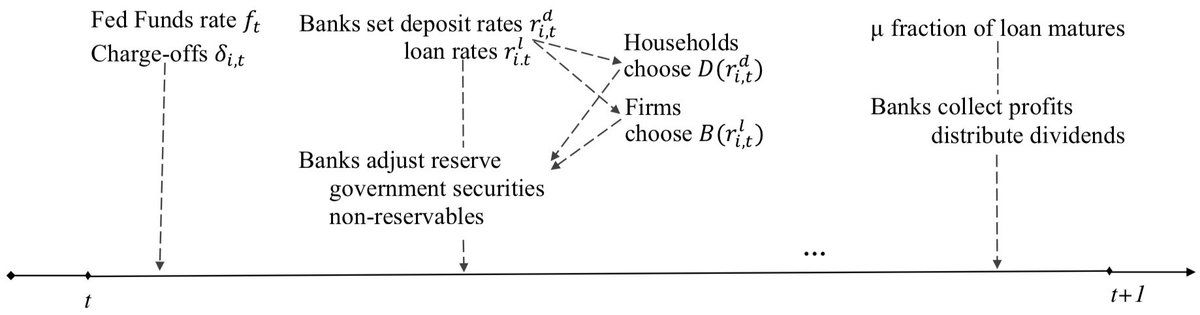

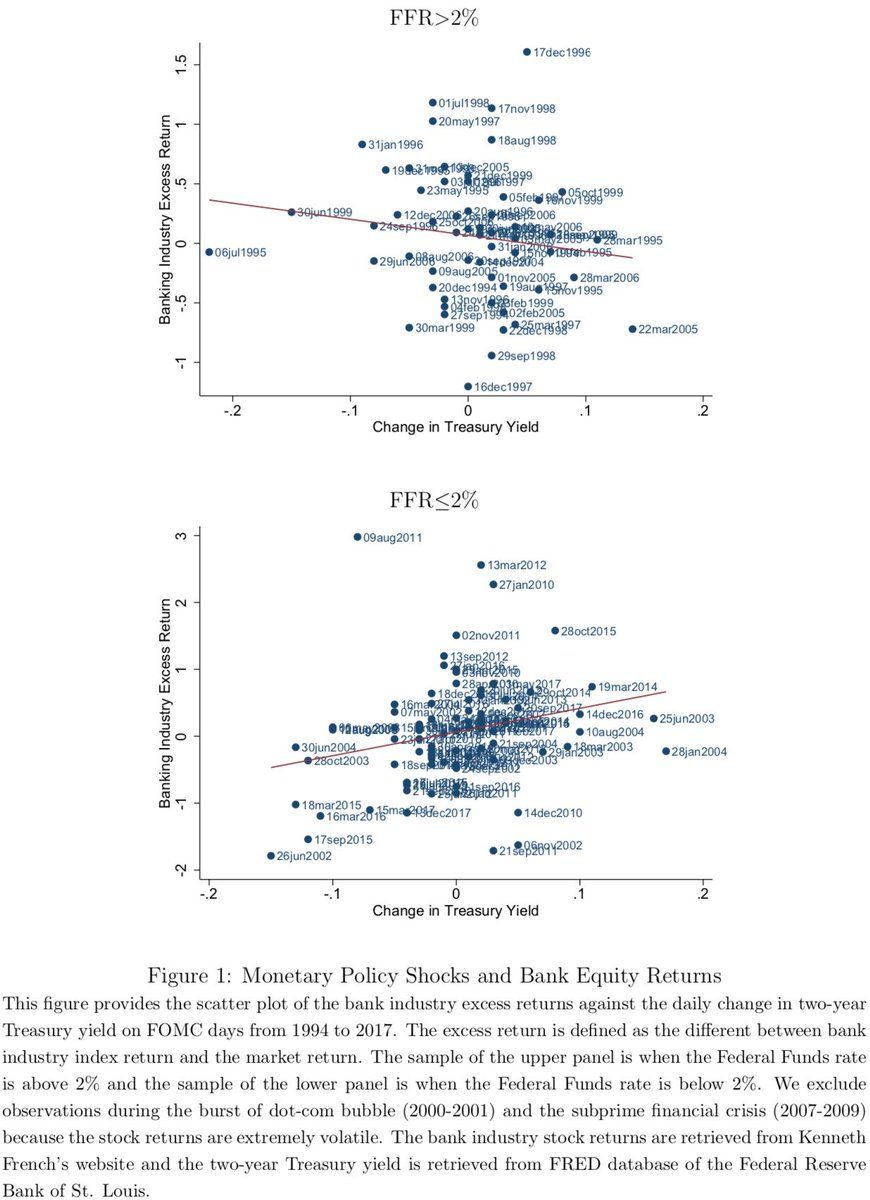

PAPER 5: “Bank Market Power and Monetary Policy Transmission: Evidence from a Structural Estimation” by Yufeng Wu (@giesbusiness) w Yifei Wang (@MichiganRoss), @toniwhited, @kairong_xiao Banks’ market power creates imperfect pass through of rate changes to depositors. #NUfin2019

-

Gregor Matvos (@UTexasMcCombs) discussion helps place paper in broader Monetary Policy × Banking Regulation context. Value of structural approach connecting lots of important pieces (including reserves, which are largely missing from lit). #NUfin2019

-

Gregor gives incredibly clear summary of model. And a wishlist (stipulated: every model is—appropriately—a simplication) -Interest on reserves -Shadow banks/off-balance-sheet lending -Floating rate lending [Last paper of the afternoon🍻; see you here again tomorrow!] #NUfin2019

-

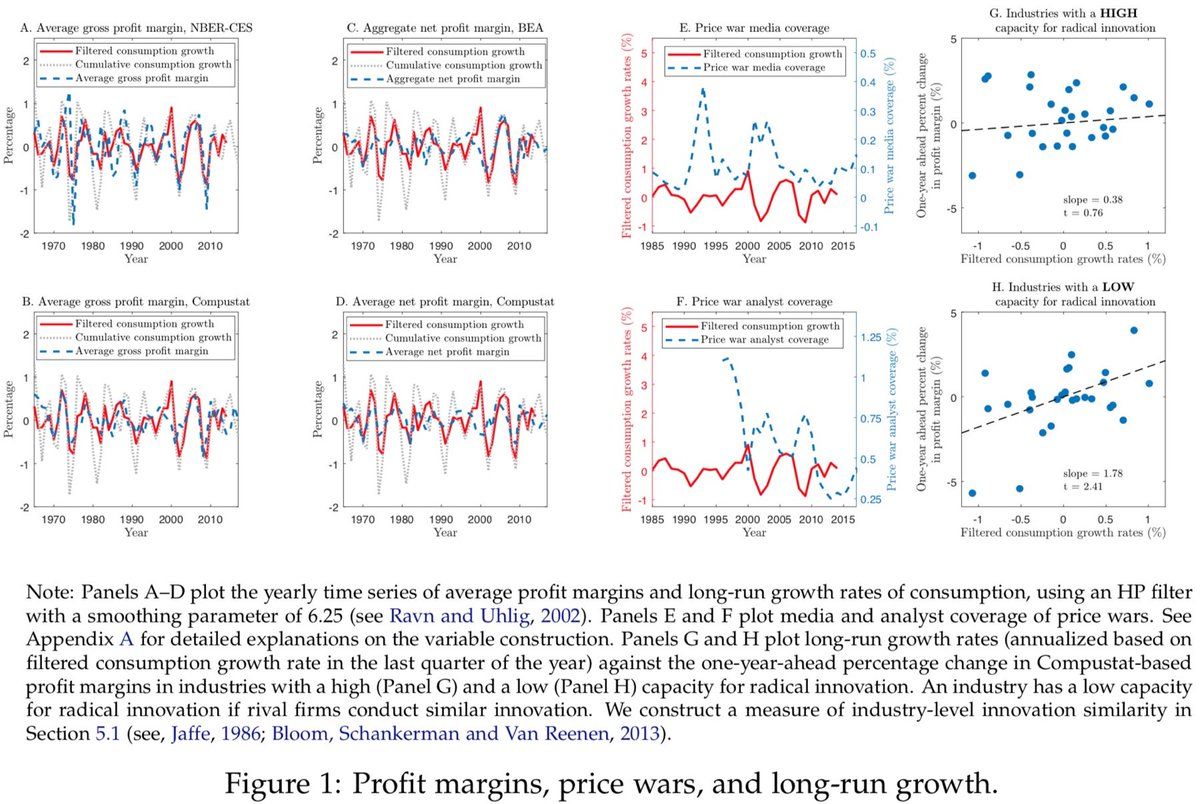

Back at #NUfin2019 for day 2 and PAPER 6: “Endogenous Price War Risks” by Winston Dou (@Wharton) with Yan Ji (@hkust) and Wei Wu (@maysbusiness). I saw this great paper in Kentucky two weeks ago but it’s deep and I’m looking forward to hearing it again. @lukestein/1121768115229143040

-

Discussion from Andrey Malenko @MITSloan Incentives to compete @indsgemodels with asset pricing. Simplest intuition: Lower prices is an investment in persistent market share → collusion easier to sustain if - Market shares of firms are similar - Growth is higher #NUfin2019

-

Great connection to IO literatures: - Theory ambiguous: Price wars in recessions (Green and Porter 84)? In booms (Rotemberg and Saloner 86)? - Empirical evidence seems to be that collusion is procyclical but markups are countercyclical. #NUfin2019

-

…and nice discussion of distinguishing from potential alternative channels - Operating leverage (higher margins in better times because fixed costs less relevant) - Financial leverage (debt can cause equity-maximizing firms to compete aggressively) #NUfin2019

-

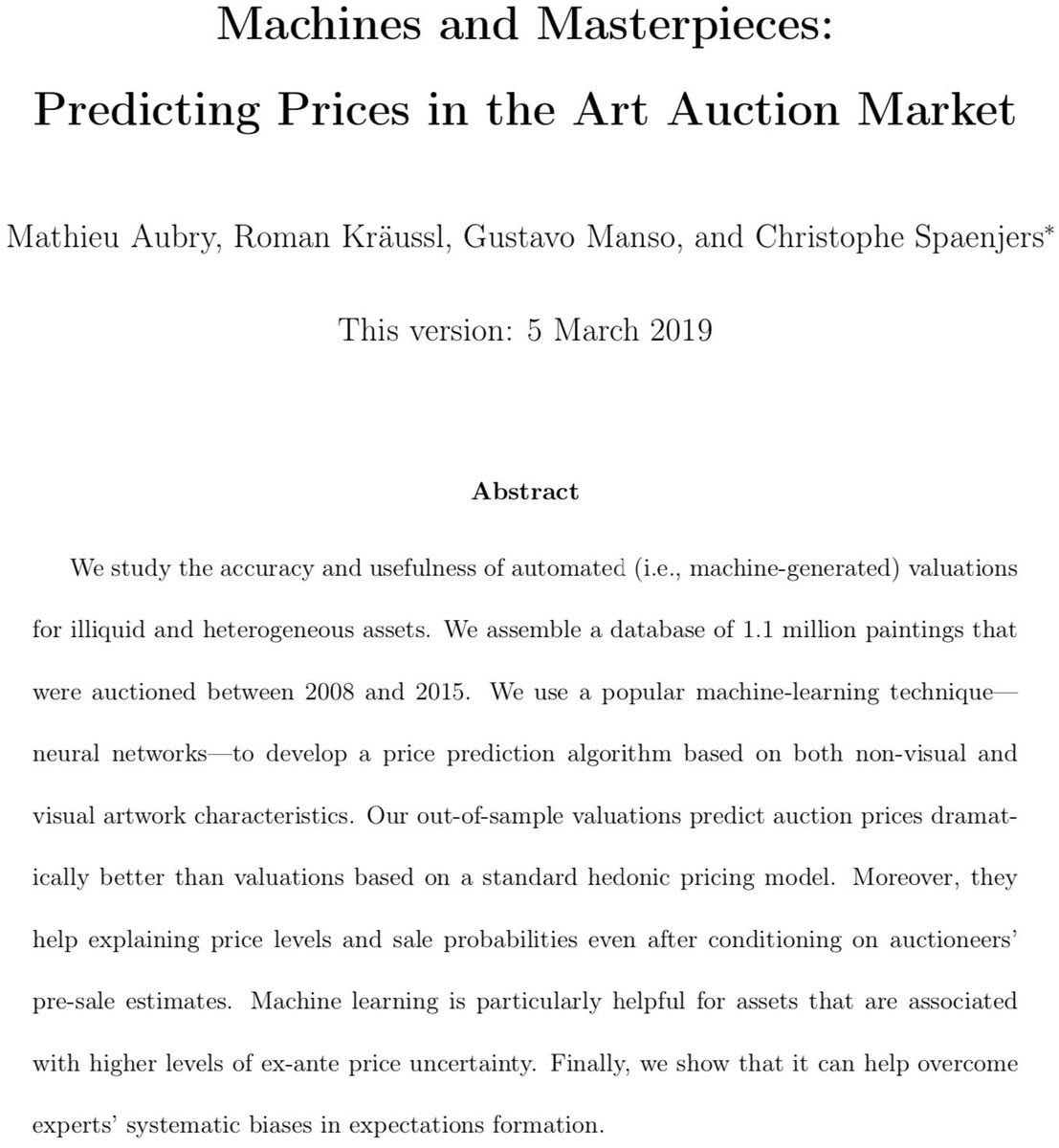

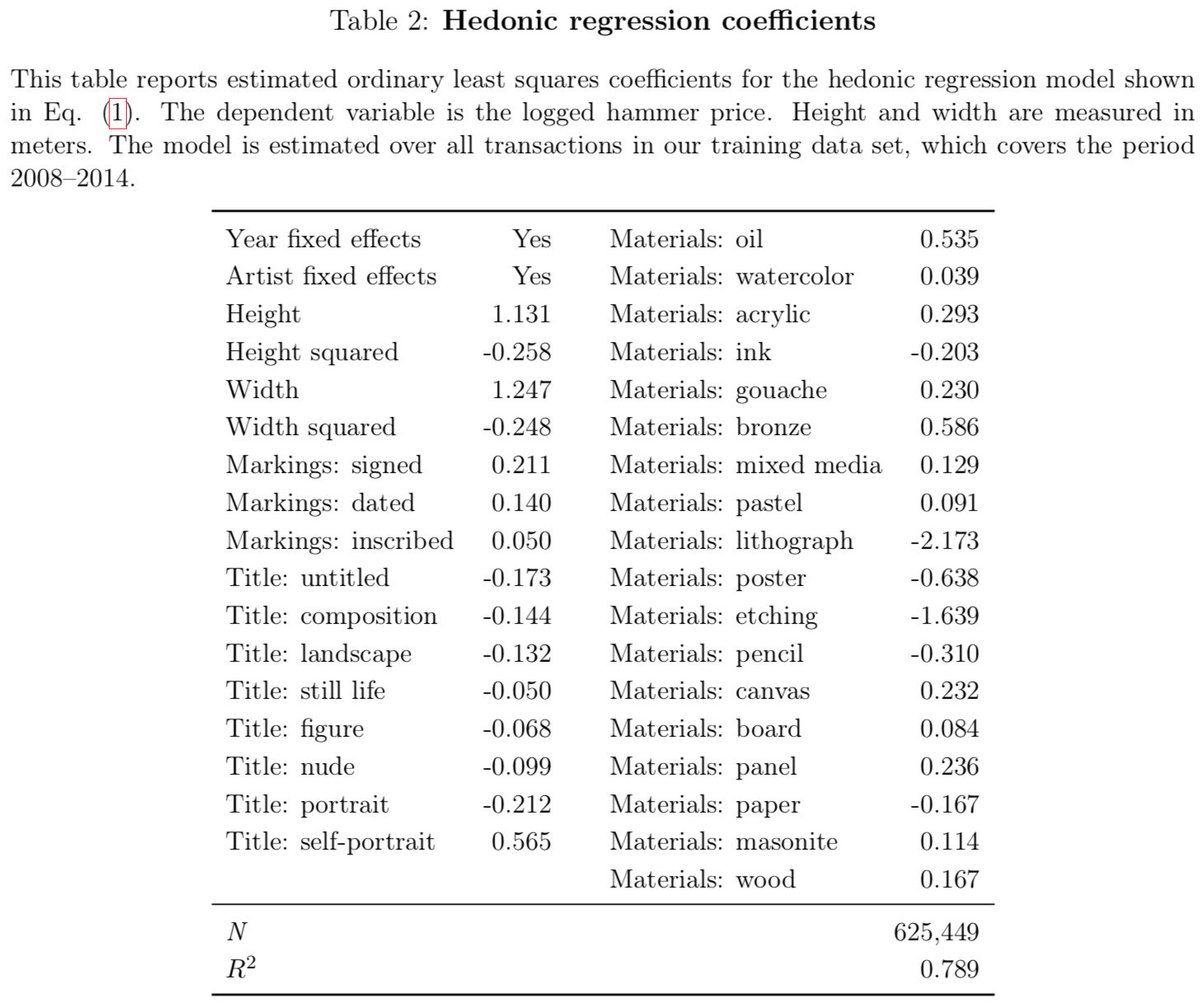

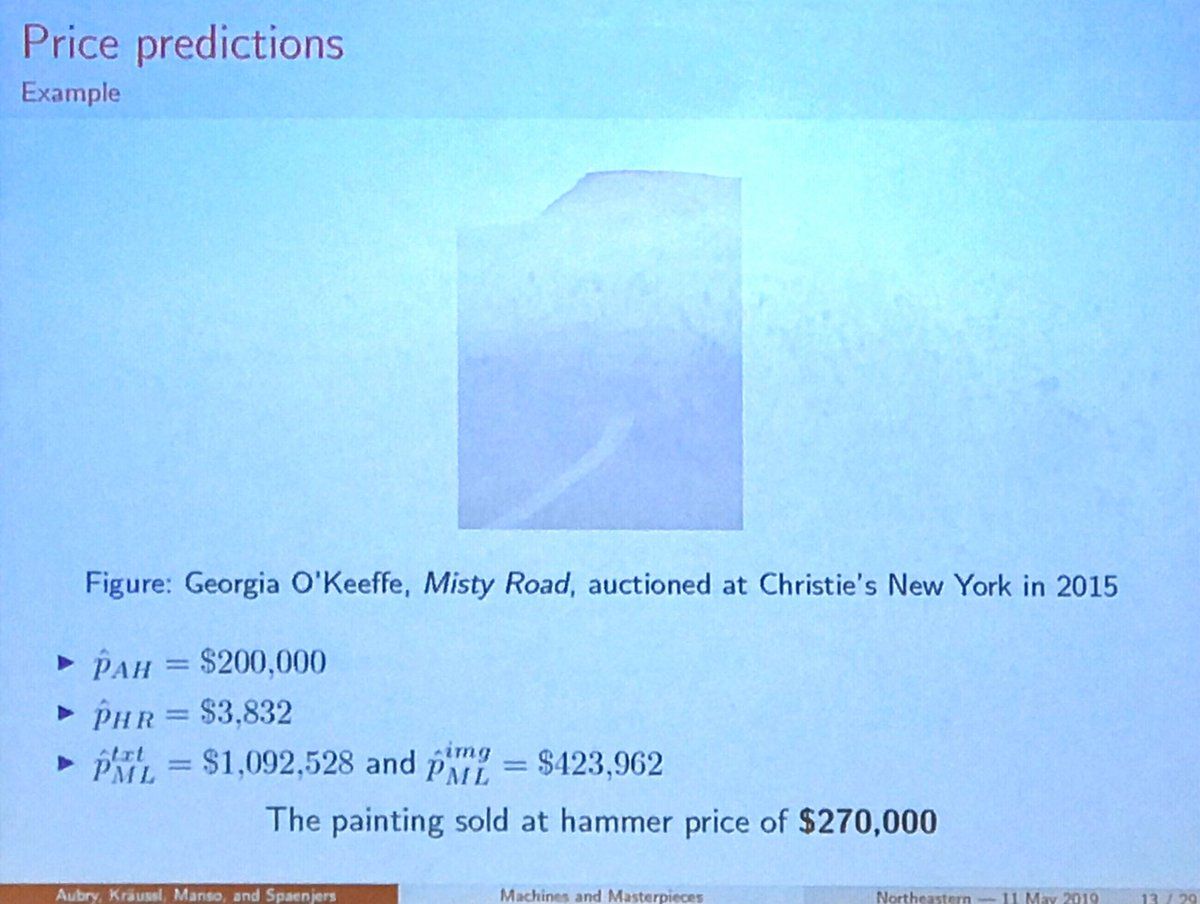

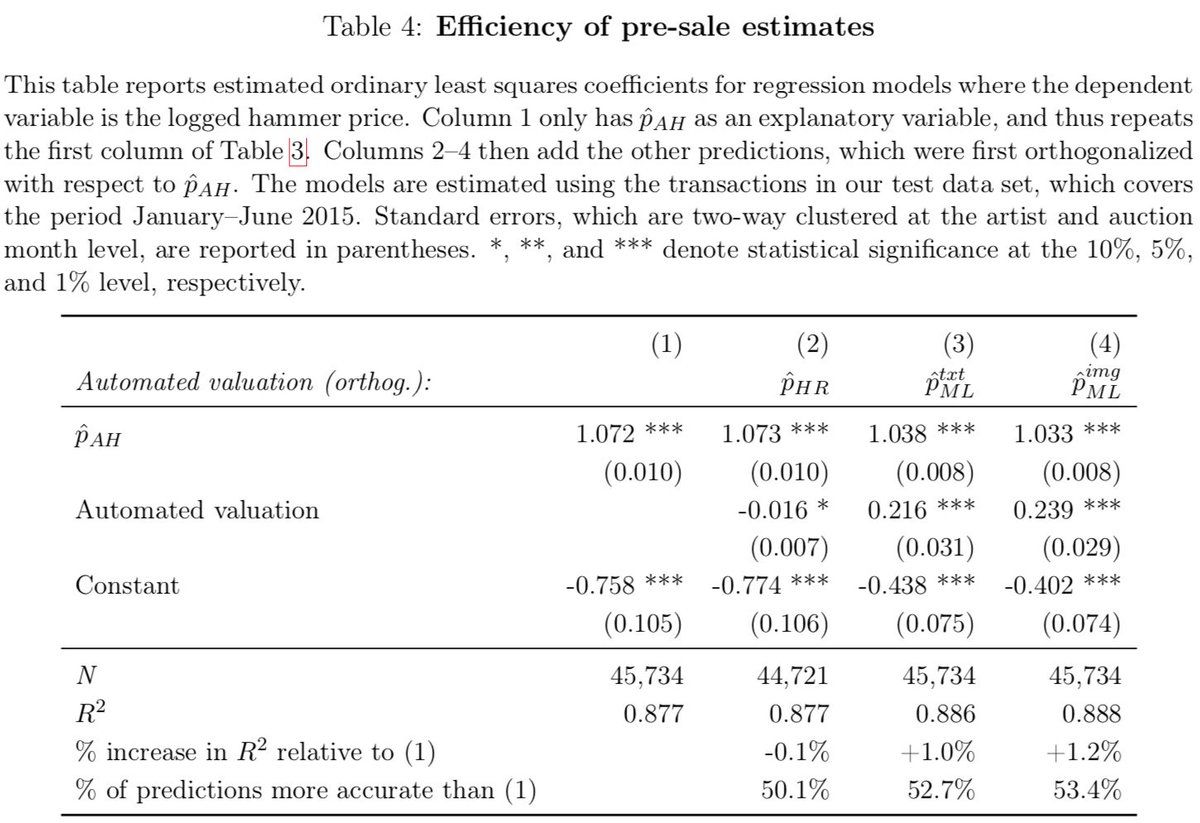

PAPER 7: “Machines and Masterpieces: Predicting Prices in the Art Auction Market” by @CSpaenjers with Mathieu Aubry (@EcoledesPonts computer vision scientist), @RomanKraussl, and Gustavo Manso (@BerkeleyHaas) Looks at machine learning and automated valuation methods #NUfin2019

-

Lots of idiosyncratic “valuation” problems where automated models can help. Lots are asset valuation questions, but more generally this is (part of) what all recommendation algorithms are trying to do. @lukestein/1099524337361551360 #NUfin2019

-

Use ~1M art auction lots 08-14 to train neural networks; test out of sample using 2015 auctions Assess - Auctioneers’ pre-sale estimates¹ - ML based on artwork-related text data - ML with text and images - Hedonic predictions ¹May be strategic, not just predictions! #NUfin2019

-

Always excited for a discussion by Ramana Nanda @HarvardHBS (who has cool work on ML evaluation of startup pitches with @ccatalini and Chris Foster). tuck.dartmouth.edu/uploads/centers/files/Paper_11_Machine_Intelligence_vs._Human_Judgement_in_New_Venture_Finance.pdf Goal - Nonlinear models vs. linear? - Help auctioneers? - Understand limitations of humans? #NUfin2019

-

PAPER 8: “Organized Crime and Firms: Evidence from Italy” by Pablo Slutzky @SmithSchool with Stefan Zeume @MichiganRoss Another paper I've seen before, have tweeted before, and love. Authors have a broader set of cool crime+finance papers, too. #NUfin2019 @lukestein/1099365700701835264

-

In addition to baseline results👇, work/working on new stuff on - “Recycling” firms - Shifts in/out of organized economy (night lights, electricity/water usage 🤯) #NUfin2019 @lukestein/1099368639642230784

-

Great discussion by Carola Schenone @UVAMcIntire If cost of not paying protection fee ≈∞, why would mafia “protect” firm’s monopoly? Intermafia competition? Maybe mafia serves as alt govt→“protection fee” is just tax. We have lots of relevant models! #NUfin2019

-

Dear Conference Organizers Everywhere, Two days in a row, we’ve had *really* good food for conference lunch here at @NU_Business #NUfin2019. [Thank you!] The sandwiches were really good sandwiches. Participants notice. Love, Luke

-

PAPER 9: My presentation (can’t tweet): “Financial Inclusion, Human Capital, and Wealth Accumulation: Evidence from the Freedman’s Savings Bank” (w Constantine Yannelis @ChicagoBooth) Excited for discussion from Charles Hadlock @MSUBroadCollege #NUfin2019 ssrn.com/abstract=3302996

-

Thanks @nikir1 for tweeting my presentation! And Charlie’s discussion was *amazingly* thoughtful and very useful. #NUfin2019 @nikir1/1127250267945230336

-

PAPER 10/10: “Mobility Constraints and Labor Market Outcomes: Evidence from Credit Lotteries” @JanisSkrastins with Bernardus Van Doornik (Banco Central do Brasil), Armando Gomes (@WUSTLbusiness), and David Schoenherr (Princeton) 💰🇧🇷 🏍🛵🏍🛵 🇧🇷💰 #NUfin2019

-

.@JanisSkrastins uses randomized timing of access to a ~$3,500 motorcycle loan (𝘤𝘰𝘯𝘴𝘰𝘳𝘤𝘪𝘰𝘴) in Brazil. Mobility matters! - Formal employment ↑ - Wages ↑ - Business ownership ↑ - Appears to reduce spatial mismatch #NUfin2019

-

This nicely complements @alexandraroulet’s work on randomized (financial) support for commuters in France. #NUfin2019 @lukestein/1048635807358181376

-

Final discussion from Joan Farre-Mensa (@NU_Business → @thisisUIC) Paper is finance + labor + urban economics Consorcio (cf. ROSCA): everyone gets a motorcycle, but early winners get high-NPV transfer from late winners. Shock isn't just mobility, it's financial! #NUfin2019

-

Cool to think about potential channels, e.g., - 🛵 especially useful for job search? - 🛵 allows investment in education? - 🛵 allows buffering business cycle shocks? - Mobility works very differently for business owners? #NUfin2019

lukestein’s Twitter Archive—№ 2,627

lukestein’s Twitter Archive—№ 2,627